Taking its cues from an improving U.S. economy, the Federal Reserve has accelerated its interest rate hikes of late, with another rate increase expected in June. Higher interest rates have resulted in higher Treasury yields, but high-yield utility stocks have been a clear casualty.

[text_ad use_post='129633']

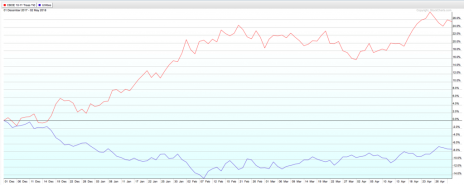

The Utilities Select Sector SPDR ETF (XLU), which tracks the price of some of the more prominent utility stocks on the market, is down 4% this year and a whopping 10% in the last six months, during which time the Fed has raised short-term interest rates twice, from 1.25% to 1.75%. Here’s what the inverse relationship between the Federal Funds Rate and utility stocks looks like on a chart (the 10-year Treasury yield is in red, the XLU is in blue):

It’s no real surprise that utility stocks are falling while interest rates are rising. Utility stocks, after all, are known for their high yields, and until recently had little competition for income investors’ hearts with interest rates at near zero for the better part of a decade. Now that interest rates are rapidly rising, Treasury yields have become a viable alternative again, making high-yield utility stocks less coveted.

Digging deeper into some of the holdings in the XLU ETF, the higher a utility yields, the worse its performance has been of late. Duke Energy (DUK) is a perfect example. It yields 4.8%, and the share price is down -13.8% in the last six months, worse than the -10.3% dip in the XLU.

Here are a few other examples:

The Southern Company (SO): 5.2% yield, -13.4% return in the last six months

Dominion Energy (D): 5.1% yield, -23% return

American Electric Power Company (AEP): 3.8% yield, -12% return

You get the point. High-yield utility stocks have had a rough six months, coinciding with two increases in the Federal Funds Rate. With another rate hike likely next month, and one more expected before year’s end, the next six months for utility stocks might not be much better. But that doesn’t mean there aren’t plenty of strong high-yield alternatives out there.

If you need help finding them, I highly recommend subscribing to our Cabot Dividend Investor advisory. Run by our income investing expert Chloe Lutts Jensen, the advisory’s portfolio has an average total return (dividends included) of 20%, with nary a losing position among its 20 holdings. And the average yield is 3.4%, better than the 2.8% current yield on the 10-year Treasury note.

As Chloe will tell you, high-yield utility stocks may be struggling, but that doesn’t mean there aren’t more than enough solid high-yield investments out there—even in a rising-interest rate environment. If you want Chloe to help you find them, click here.

[author_ad]