Investing in REITs can be a great way to earn high income, but every REIT has some unique features that investors should be aware of.

All About Real Estate Investment Trusts (REITs)

To start with the basics, real estate investment trusts are special purpose entities, with special tax status, that own real estate and pass along most of the income from the real estate (rents or mortgage payments) to shareholders. They can own any type of real estate, and many specialize in one type.

[text_ad]

Welltower (WELL), for instance, owns health care facilities. It’s what’s known as an equity REIT, because it owns property directly and gets most of its income from rents. There are also mortgage REITs, which own mortgages and mortgage-backed securities—they’re much more leveraged to credit conditions and interest rates, and I don’t recommend any at this time.

Both types of REITs are exempt from taxation at the trust level, as long as they pay out at least 90% of their income to investors. That means that while any retained income will be subject to regular corporate-rate taxes, the REIT doesn’t have to pay taxes on current income (rents or interest payments from the current period) that is distributed to shareholders. Essentially, the REIT is treated as a “pass through” entity, collecting the rents or interest payments and then passing them on to investors. It’s as if you own a sliver of the properties or mortgages themselves.

That’s why we analyze REIT earnings a little differently. As income investors, we don’t really care about the REIT’s retained income or EPS. The important number to us is how much cash the REIT generates and can distribute to investors. You can get an idea of this by looking at a REIT’s net income, a GAAP number reported with quarterly earnings which equals revenues minus expenses. However, NAREIT (the National Association of REITs) has developed an industry-standard but non-GAAP measure that can give us an even better idea of how the REIT is really doing.

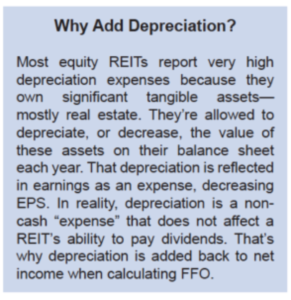

That number is Funds From Operations, or FFO. FFO is calculated by adding real estate depreciation back to net income (see box), and then subtracting gains from the sale of real estate (which generate non-recurring revenue). The result is a good indication of how much cash the REIT’s regular income sources—leases or mortgages—generate on an ongoing basis.

Most REITs also report Adjusted Funds From Operations, or AFFO, which is not industry-standard (it varies from company to company), but can be an even purer measure of distributable cash flow. Usually REITs calculate AFFO by subtracting certain recurring capital expenses, like repairs and maintenance, from FFO.

AFFO will generally give you the best idea of how easily a REIT can afford its distributions. Investors who want a margin of safety in their REIT investments should focus on REITs whose AFFO per share consistently covers their distribution per share. In the most recent quarter, Welltower generated AFFO of $.80 per share, and paid a dividend of $0.61 per share.

The remainder of the REIT’s revenue can be used to improve its properties, acquire new properties, or for operating expenses. Most REITs also borrow heavily to make new acquisitions or improve properties. REITs are usually highly leveraged as a result, so high debt is not in itself a reason to stop investing in REITs, but you do want to make sure your REIT’s debt is manageable.

You can do this by looking at a measure like the debt-to-equity-ratio and comparing it to the industry average and the REIT’s typical historical level, or by looking directly at the REIT’s outstanding debt obligations and maturities. Welltower’s debt to equity ratio is currently 0.75, which is lower than both its own historical average of 1.0 (past 10 years) and the current industry average of 1.0.

REIT performance tends to be more correlated to the real estate market than the overall stock market, and both equity and mortgage REITs can be affected by changes in interest rates and credit conditions. Better-capitalized REITs should be more insulated from rising interest rates, but all REITs are susceptible to interest rate-related shocks. In September, interest rates spiked briefly, and the Real Estate SPDR (XLRE), which holds mostly REITs, declined almost 9% (but has since recouped most of that).

What Investing in REITs Means for Your Tax Bill

Lastly, investing in REITs does have some tax consequences. Most of your REIT distributions will be classified as ordinary income because you are treated as a part owner of the assets the REIT owns, and thus income from those assets is treated as your income.

However, when some portion of a REIT’s distribution did not come directly from that quarter’s real estate ownership activities—for example, if it sold a building and distributed part of the proceeds to investors—you may be taxed differently on that portion of the distribution.

The REIT will tell you after the year-end how that year’s dividends should be treated. Options include ordinary income, qualified dividend income, long-term capital gains and return of capital. Any portion of the distribution that is treated as return of capital will reduce your cost basis in the REIT, and then you’ll be taxed on the difference between your purchase price and your adjusted cost basis when you sell the REIT.

On average though, about 70% of REIT distributions are taxable as ordinary income. This makes investing in REITs a good choice for tax-advantaged accounts like IRAs and 401(k)s and for investors with a low income tax rate.

Do you regularly invest in REITs to generate income in your portfolio?

[author_ad]

*This post has been updated from a previously published version.