Over the course of the last year and a half, the Fed has engaged in the fastest rate-hiking campaign in its history, with rate increases in 2022-23 doubling the pace of increases in the 1988-89 cycle. Those rate increases have come in response to the highest inflation we’ve seen in 40 years and translate to higher borrowing costs across the board.

We’ll dive into whether that makes it a good time to invest in CDs shortly, but first, let’s see the impact of these rate hikes elsewhere.

For consumers, that means that on top of the rising costs of goods, they’ll also face higher costs to finance those purchases. Borrowing costs for things like mortgages (average rates over 7%), auto loans (6.5%) and credit cards (average rate over 20%) are the highest they’ve been in decades.

The silver lining to higher borrowing costs should be higher yields on your cash deposits. Although, for now at least, the competitive landscape for bank deposits is marred by concerns about the health of the banking system, which lets the too-big-to-fail banks continue to offer low rates (average savings account yield is currently 0.43%) because they know that depositors are more interested in the safety of deposits than yields.

So, with cash account yields failing to keep pace with the Fed or inflation, is it time to look at an alternative banking product and invest in CDs?

[text_ad]

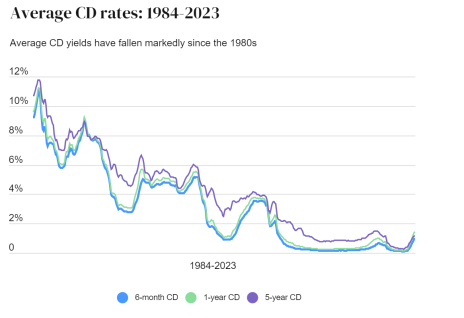

CDs (or certificates of deposits) were a popular saving option in the ‘80s and ‘90s and they remained popular with conservative investors until after the dotcom meltdown of the early aughts. However (as you can see from the chart below, courtesy of bankrate.com), CDs (across a range of maturities) have not been particularly compelling for about the last decade.

The average yield for a five-year CD has been below 2% since May of 2010. And that number has continued to fall, from 1.5% in February 2019 to a measly 0.4% just one year ago.

But rates have begun to climb of late, which begs the question, is it time to invest in CDs again?

What Are CDs?

Although CDs pay a fixed rate like a bond, they’re not a debt instrument. Rather, they’re a term deposit with your bank. CDs are FDIC-insured like a bank account (and subject to the same limits) but offer a higher yield than your bank may offer on a savings account because you’re essentially agreeing to a pre-determined length of deposit.

As a general rule, CDs with a longer term to maturity offer a higher yield. You can see that in the gap between the return on a six-month or one-year CD and a five-year CD in the chart above.

Whether you invest in a one-year or five-year CD, the interest on your deposit is paid at maturity. At maturity, you’ll typically be offered options to roll your deposit into another CD at prevailing rates, close the CD and move the funds to another account at your bank, or withdraw them from that bank entirely.

Unlike buying a bond, there’s no secondary market for CDs, so you can’t sell a CD to access cash early. Instead, the terms of the CD will dictate the early withdrawal provisions. Typically, you’ll simply surrender some percentage of the yield in order to withdraw the funds early, and that amount declines as you approach maturity. But make sure to familiarize yourself with the early withdrawal terms before committing.

CDs have minimum deposit amounts that can range from as little as $100 or $500 to as much as $25,000 or $50,000.

You can treat CDs like you’d treat most fixed-income investments, although they have no default risk and you can’t use the yield on CDs for monthly/quarterly income. You can build a CD ladder in the same way you’d build a bond ladder and money tied up in a CD has the same interest rate risk (the risk that rates could rise while you’re stuck in a lower-yielding CD) as a bond or Treasury.

Because you’re not incurring default risk, CD yields are usually lower than that of bonds with comparable maturities.

Who Should Invest in CDs?

Since CDs have a fixed term, they’re best suited for investors (or savers in this case) with money that has a shelf life, so to speak. If you have large, anticipated expenses at a fixed date down the road, like the down payment on a house, money for a wedding, tuition, a big vacation, or a new vehicle, a CD may allow you to earn more money over a specific term than parking the funds in a savings account without incurring additional risk.

As noted above, you can ladder CDs like you would bonds, which can allow them to serve as a portion of your fixed-income portfolio. But the lower prevailing rates mean you’re trading long-term returns for safety of principal.

Is Investing in CDs Worth It?

The answer to this question will be dependent largely on a) your bank, b) the amount you’re investing, and c) your willingness to shop around.

If you have deposits with the too-big-to-fail banks you’ll find that CD yields there are better than savings accounts, but at sub-2% (on average) are still not particularly high. Other banks offer CDs with yields as high as 4% or 5% for CDs maturing in less than a year, which is where points b & c come into play. If you’re considering a CD near account minimums (say, $1,000) earning $50 for a one-year deposit is probably not worth taking the time to shop around and fill out the paperwork for a new account.

But if, for example, you’ve set aside $20,000 to put toward a new vehicle when a lease expires a year down the road, you could confidently put that money in a one-year CD and walk away with an extra $1,000 at maturity, all while taking advantage of the FDIC-insured status of your CD.

[author_ad]