Dividend Reinvestment Plans (DRIPs)

Why DRIPs Are Worth It:

Benefit 1: Increase your position with no fees

Benefit 2: Automatically invest, without having to think about it

Benefit 3: The power of compounding adds up fast.

Why DRIPs Are Not Worth It:

Drawback 1: You may need the dividend income

Drawback 2: You may need to reallocate your positions

Drawback 3: You may not want to buy that stock at that time.

Dividend reinvestment is one of the most powerful weapons in the income investor’s toolbox. You’ve probably heard it said that compound interest is the most powerful force in the universe (a quote attributed to Einstein, almost certainly erroneously), and Dividend Reinvestment Plans (i.e., DRIPs, or DRIP plans, as many redundantly refer to them) take advantage of some of the same forces—namely time and compounding.

When you choose to reinvest your dividends, each stock’s dividend payment is used to buy new shares of that same stock, at the market rate (we’ll call these DRIP stocks). You then start earning dividends on those new shares, and those dividends get turned into more shares, and so on and so forth. Over time, the number of shares you own and the size of the dividend checks you receive every quarter will both gradually increase, without you doing a thing.

People frequently ask, are DRIPs worth it? Here is the answer:

[text_ad]

The Benefits of DRIP Plans and DRIP Stocks

DRIPs Pro 1: Increase your position with no fees

Most brokers will reinvest your dividends for you for free, and the purchases will be completed without fees (although you will owe income taxes on the dividend amount). Alternatively, you can often sign up for a Dividend Reinvestment Plan, or DRIP, directly with the dividend-paying company.

DRIPs Pro 2: Automatically invest, without having to think about it

Company-operated DRIP plans allow investors to buy shares directly from the company, and in exchange, dividends are automatically reinvested in the company’s stock, sometimes at below-market prices.

Those are the two most obvious benefits of dividend reinvesting: You can increase your position for free, without fees, and it’s automatic, so you don’t have to think about it. If a stock is high quality and you plan to own it for a long time, dividend reinvestment is a great passive way to increase your exposure over time. Sure, you could collect the dividends and then manually invest them in something else, but a good habit that takes no effort is easier to keep up than one that takes a little effort.

DRIPs Pro 3: The power of compounding adds up fast

However, the third big reason to reinvest dividends, and the less obvious one, is actually the most powerful. It’s the power of compounding, the same action that makes compound interest so powerful.

When you reinvest dividends, you increase the size of your investment, thus also increasing the dividends you’ll receive next time. So each reinvestment will be slightly larger than the last (assuming dividend payments don’t decrease). Just as with compound interest, you’ll be surprised how quickly those little additions can add up!

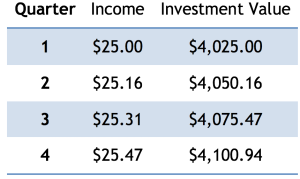

For example, let’s say you own 100 shares of a $40 stock with a 2.5% yield. That means the company pays $1.00 per share in dividends each year, or 25 cents per quarter. This table shows how your dividend income and the size of your investment will change over the first year.

As you can see, reinvesting that first $25 increases your second dividend payment by 16 cents, because you now own another $25 worth of dividend-paying stock. By the end of the year, your quarterly dividends have increased to $25.47, and the value of your investment has increased by $100.94—that $100 is simply the dividend payments, which you would have earned whether or not you chose to reinvest. But the extra 94 cents is “dividends on dividends,” which you earned thanks to reinvesting.

Ninety-four cents may not seem like a lot, which is why the second important force at work here is time. After 10 years, your annual dividend income from this same position will be $126.31, up from $100.94 the first year. (That’s a yield on cost of 3.16%, based on your initial investment.) The value of your investment will be $5,132.11, without any appreciation in the stock price. One-hundred thirty-two dollars and eleven cents of that is thanks to your dividends on dividends. (If you hadn’t reinvested, the value of your investment would still be $4,000, and you would have collected $1,000 in dividends, for a total return of $5,000. The difference between that and $5,132.11 is what we’re calling dividends on dividends.)

After 30 years, your investment will be worth $8,448.26, and you’ll be earning $207.95 per year in dividends—you’ve more than doubled your original income, and are earning a yield on cost of 5.2%.

And that’s all without a single increase in the stock price, or the dividend. If you buy a Dividend Aristocrat that increases its dividend every year, your returns improve at every step. If the company in the example above increases its dividend by 5% per year, your annual income will reach $200 at the end of 10 years, instead of 30. After 30 years, your annual income will be a whopping $2,218.83, and your investment will be worth $22,022.24. Not bad for a stock that doesn’t go up!

Of course, if you buy a stock that does goes up over 30 years (as most of them do!) you’ll be even happier. While your reinvestments will occur at higher prices, the capital appreciation on those new shares more than makes up for it. (If you’re intrigued, try punching some numbers in an online dividend reinvestment calculator like this one)

The Case Against DRIP Plans

While dividend reinvestment is powerful, there are a couple reasons why you might not want to reinvest your dividends.

DRIPs Con 1: You may need the dividend income

The most obvious reason is that you need the income. If you’re in the “distribution” phase of your investing life, dividends are a perfect source of passive income. Income from qualified dividends is taxed at the long-term capital gains rate (currently 15% for investors who are in the 25% to 35% tax bracket for ordinary income, 0% for taxpayers in a lower bracket and 20% for those in the highest bracket). So if you’re going to be looking to your portfolio for income every month anyway, it makes sense to have that cash deposited in your account.

DRIPs Con 2: You may need to reallocate your positions

You might also choose to stop reinvesting your dividends for allocation reasons. Reinvesting your dividends, through DRIP plans or otherwise, will cause your stock positions to grow over time, and if you’ve owned a particular issue for a long time, it may already be a large enough percentage of your portfolio. Higher-yielding positions will grow faster, which can throw your allocations out of whack pretty quickly. So once a stock position is as big as you want it to get (for now) feel free to turn off dividend reinvestment for that position, and either enjoy the extra income or save up the cash to invest in other stocks.

DRIPs Con 3: You may not want to buy that stock at that time

Finally, you may also have stock-specific reasons not to reinvest dividends—if a stock is temporarily overvalued, or you simply don’t want to buy any more of it at current prices.

But bottom line, reinvesting dividends through a broker or by signing up for DRIP plans directly through dividend-paying companies, is a surprisingly powerful tool to passively improve your investment returns. So yes, DRIP plans are worth it, as long as they fit with your investing goals.

[author_ad]

*This post is periodically updated to reflect market conditions.