While earnings season will be providing the biggest headlines over the next few weeks, there is one additional market move that growth investors should be paying attention to. That story is the remarkable performance of Chinese ADRs since the beginning of the year in general (+24.5%) and their surge since April 19 in particular (+6.3%).

ADRs are American Depositary Receipts, a way for U.S. investors to own dollar-denominated shares in foreign companies. An ADR will typically be the equivalent of five or 10 native shares, but they trade on U.S. exchanges and offer the same SEC protections that a U.S. company gets from its pre-listing due diligence by regulators.

[text_ad]

Buying ADRs can give you access to non-U.S. stocks with excellent stories in markets with enormous potential. The risk is higher too, of course, but that’s always the case with any investment that offers the potential for higher returns.

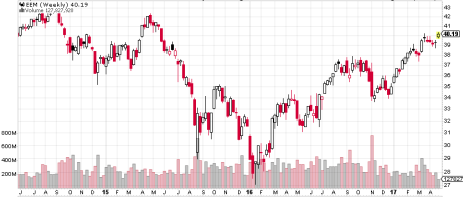

In recent years, iShares MSCI Emerging Markets (EEM), the ETF that tracks the performance of all ADRs, has shown plenty of volatility. From April 2015 until early 2016, EEM dipped from 42 to 27, reflecting both the weakness in the U.S. stock markets in general and the additional risk avoidance that always kicks in when investors get worried. Here’s a weekly chart that shows both the decline in EEM and its subsequent choppy rebound.

EEM has been in an uptrend for more than a year, although the two significant corrections along the way would have made it a bad idea to just buy EEM and forget about it.

The bigger story is in the daily chart, and includes the ETF’s 25- and 50-day moving averages. Here’s that daily chart. You can see EEM trading at its highest level since May 2015 and holding above its moving averages even during its two pullbacks.

But the real story can be seen by comparing EEM to the PowerShares Golden Dragon China ETF (PGJ). PGJ has been stronger, corrected less and has powered ahead over the last five trading days with greater power than EEM. It’s clear that investors have a greater appetite for Chinese stocks specifically than for emerging market stocks generally. Here’s the daily chart.

The strength of Chinese stocks comes after a long period of underperformance, when risk avoidance kept Western investors either out of the market or sticking to safer income and value stocks.

As we always say, though, bull markets aren’t so common that you can afford to let one pass without participating. And Chinese stocks are very bullish right now. So crank up your brokerage program and get started. And if you’d like to have some advice about the best Chinese stocks to invest in, a click right here will get you to the subscription page for Cabot Global Stocks Explorer, a top-performing advisory for just that purpose.

[author_ad]