U.S. Stocks are Rolling. But Other Global Stock Markets are Performing Even Better. Should You Invest in Any of Them?

A new year (and new decade) has done little to dampen enthusiasm for U.S. stocks. The S&P 500 is coming off its second-best year of the 21st century, and the bull market is now more than a decade old. But several overseas stock markets outperformed U.S. stocks in 2019.

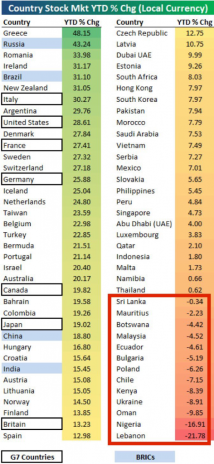

Here’s a list of how overseas stock markets performed in 2019:

You can see the eight countries whose benchmark stock markets outperformed the S&P, led by Greece at 48%, Russia at 43% and Romania at just under 34%. The other five were just two or three percentage points better than the S&P’s 28% return, which was its best showing since 2013 (+29.6%).

[text_ad]

Greece’s Athens Stock Market is still in recovery mode after the country’s infamous sovereign debt crisis sent Greek stocks spiraling downward in the first half of the 2010s. Even after a 48% gain last year, it’s still more than 80% below its 2007 peak!

Russian stocks, however, are at all-time highs, and have been on steady climb since mid-2017, boosted by steady (if unspectacular) GDP growth following a 2015-16 energy price-induced recession.

Romania’s Bucharest Stock Exchange is also at new highs after bouncing back from a down 2018.

How to Invest in These Overseas Stock Markets

There are ways to take advantage of the strength in each of these three overseas stock markets, plus the other five that edged out U.S. stocks in 2019. All but Romania has at least one stock trading as an American Depositary Receipt (ADR) in the U.S.

Russia has three ADRs—two on the New York Stock Exchange, one on the Nasdaq—plus 16 more that trade on over-the-counter markets and pink sheets. Greece has more than a dozen ADRs. Italy has four on major exchanges, a whopping 51 ADRs that sell over the counter. There are five Irish ADRs on major U.S. exchanges, 16 over the counter. The Argentina stock market actually has 17 ADRs on major U.S. exchanges. New Zealand has no stocks on major U.S. exchanges but 21 that trade over the counter.

Plus, seven of the eight markets (again, aside from Romania) have their own ETF, which basically tracks the performance of the country’s benchmark index. For instance, here’s what a chart of the VanEck Vectors Russia ETF (RSX) looks like over the past year:

Or the iShares MSCI Ireland Capped ETF (EIRL), which looks like this:

Those are pretty good charts!

To gain exposure to the U.S.-beating performance in those overseas stock markets, buying one or two of those country ETFs is probably the most efficient way to play it.

However, if you want to know which global stocks are the very best to invest in right now, I highly recommend you check out our Cabot Global Stocks Explorer advisory, where chief analyst Carl Delfeld boasts an average gain of 44% on his 11 stocks from around the globe, including a company based in one of the outperforming emerging markets mentioned above.

To learn more, click here.

Given the strong performance in the U.S. stock market of late, it’s easy to fall into the trap of investing solely in American companies. But in a world in which faster growth is happening in many places outside U.S. borders, it’s never been more important to have a global portfolio.

At some point, this decade-plus bull market in U.S. stocks will come to an end. When it happens, you’ll need a few international stocks to help weather the storm.

[author_ad]