Poor leadership and a devalued currency have sunk Brazil stocks this year. Here are three buy-low ways to play a rebound.

When I speak about investing in global and emerging markets, a common question I get afterwards is this:

“Carl, what markets look good right now?

I sometimes give the answer that the legendary global investor John Templeton always gave when asked this same question:

“This is the wrong question; you should be asking me where in the world it looks absolutely miserable?”

This brings me to Brazil and Brazil stocks, which indeed look miserable from both a political and economic point of view.

The country’s real currency also has been among the world’s weakest, down by around 25% against the dollar year to date.

[text_ad]

While initially thought to be the chosen one to save Brazil’s economy, President Jair Bolsonaro now seems to be more of a problem than a savior. There are allegations of corruption and Bolsonaro dismisses the pandemic as a “fantasy” or “a little flu.”

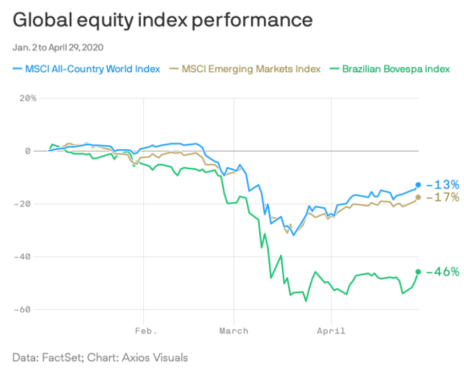

All this is reflected in the poor performance in Brazil’s stock market.

Take a look at the below graph that shows how the iShares MSCI Brazil Capped ETF (EWZ), proxy for Brazil stocks, opened 2020 at almost 50 per share and is now trading at about half that value.

But Brazil has always been a boom and bust story and canny investors can make money by anticipating and acting on both.

My experience is that when markets like Brazil look like a train wreck is when they have the most upside potential. And these markets tend to bounce back far ahead of real economic and business conditions on the ground.

This sort of situation is not for everyone, that’s for sure. But if you do wish to explore a rebound opportunity in Brazilian stocks you have to have a strategy and be aware of the risks as well as the potential rewards.

3 Ways to Play a Rebound in Brazil Stocks

Aggressive investors should watch this bellwether Brazil ETF closely and wait for an uptrend to develop before placing a small bet on this diversified basket of Brazil stocks. As you might imagine, the leading stocks in this ETF are from the financial and mining sectors.

If you are looking for a specific stock, you might consider a company providing essential products or services.

Nothing is more essential than water, so I always take a look at Companhia de Saneamento Basico do Estado de Sao Paulo (SBS), the largest water company in Brazil and one of the largest in the world.

Majority owned by the state of Sao Paulo, SBS has a monopoly on providing water and sewage services to over 28 million people in 365 of the 645 municipalities in the State of Sao Paulo.

The company has plenty of room to grow in its monopoly territory of Sao Paulo, with 15 million not yet connected to its services. Sao Paulo has a population over 44 million and represents 30% of Brazil’s total economic output.

In addition, the company is expanding to other regions in Brazil, and even in neighboring countries.

This water stock is a conservative value play on water in a country going through political and economic turmoil. This is reflected in its stock trading at around 7, down from 15 earlier this year.

Or, You Could Make the LEAP

There is one more strategy that I like for situations like Brazil but you need to look ahead more than a year and know something about how options trading works.

One positive about options is that you only have to put a limited amount of capital at risk.

Each option contract controls 100 shares of the underlying stock. Buying three call options contracts, for example, grants the owner the right, but not the obligation, to buy 300 shares.

Many traders often buy or sell options that expire within the next month or two. Although that kind of a strategy can offer some significant returns, it also gives the underlying stock very little time to move up or down.

For a precarious situation like Brazil’s, you are going to need some time for its market to recover its footing so I would look at call options expiring at least one year from now.

These are called LEAP options.

If you look at options for the iShares Brazil ETF (EWZ), which is trading at 24 a share as I write this article, you will see that there is one call option available that expires on January 21, 2022.

For a strike price of $40, the price of the option is one dollar so you can control 100 shares for $100. If EWZ moves towards $40 before January 2022, you will do well. If the option expires below $40 you lose the $100.

This LEAP strategy is the one I chose to play an eventual Brazilian rebound.

Now, if you don’t mind paying a higher premium for a lower strike price, you might look at the call option at the $28 strike price which would require a premium of about $3.50.

Brazil stocks are a global gambit that John Templeton would definitely be interested in at these levels. Consider the three above Brazil plays and see if it is appropriate for your personal circumstances.

[author_ad]