Trading stocks and options the past three weeks has been a roller coaster. One week the S&P 500 is shattering records to the upside, the next week a crash seems inevitable. Risk management has never been so important. Fortunately, I was able to identify the best option trade for a risky market. More on that in a bit.

Risk is something we all deal with in our everyday life. And just one week before the market melted down, on our trip to Disney World and Universal Studios in Orlando, I got to see how the members of my family deal with their perception of risk.

How Disney World is Like the Stock Market

Throughout our trip my daughter and I raced from roller coaster to roller coaster, looking for thrills. The highlights included the amazing new Avatar ride at Animal Kingdom, Star Wars at Hollywood Studios and my daughter’s favorite, anything Harry Potter-related at Universal Studios. We had no fear!

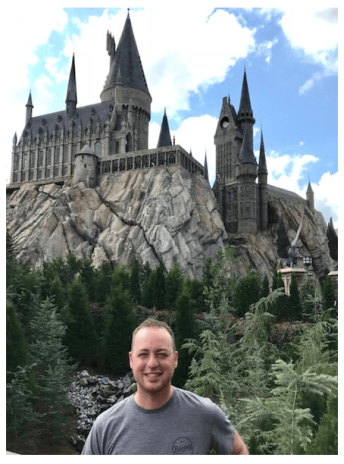

Here is a picture of me in front of Hogwarts at Harry Potter World Universal Studios:

On the other end of the spectrum were my wife and son, who passed on some of the scary rides. They just didn’t see the joy in being whipped upside down at high speeds. The risk/reward just wasn’t right for them.

Similarly, many investors have decided not to buy into the latest market slide. I don’t blame them. When the Dow drops more than 1,000 points twice in one week and when the “fear index” (VIX) spikes to multi-year highs, it is not the time to be a hero with new buys.

[text_ad]

However, if the right setup presents itself, traders also need to be willing to take the risk. And Cabot Options Trader subscribers bought a new position last week after the market slid approximately 7% from its all-time high.

My Best Option Trade for a Roller Coaster Market

Over the course of my nearly five years working at Cabot, some of my best option trades have come when my Options Scanner picks up on bullish activity in a stock, and at the same time Mike Cintolo’s chart reading points to higher prices in that stock, along with fellow editors liking the fundamentals of that same stock. In the last two weeks, all three of those signals came together.

Here were Crista Huff’s, chief analyst of Cabot Undervalued Stocks Advisor, thoughts on the stock that peaked all of our interests:

The company reported a strong fourth quarter 2017 earnings beat last week. Adjusted earnings per share (EPS) were $0.52 when analysts were expecting $0.41. Quarterly revenue came in on target, expenses came in below estimates and operating income came in much higher than expected.

Wall Street is expecting EPS growth rates of 52% and 21% in 2018 and 2019. Those estimates have risen every week this year. The 2018 P/E is 21.9. Meanwhile, the tiny dividend (0.5% annual yield) has remained unchanged for many years and, encouragingly, the long-term debt-to-capitalization ratio is quite low at 10.4%.

And here were Mike Cintolo’s, chief analyst of Cabot Top Ten Trader, thoughts on the stock and chart:

Analysts see earnings booming 64% this year, which could prove conservative if the economy remains strong and management achieves synergies faster than expected.

The recent upmove began in November, with shares moving to new highs late last year and then gapping up last week after earnings. The market-induced dip since then looks normal, so we’re OK picking up shares around here.

And lastly, the in the days after earnings, my unusual options activity scanner saw very aggressive call buying. Here were those trades:

January 31 - Buyer of 20,000 March 50/55 Bull Call Spreads for $1.70

February 1 – Buyer of 4,000 May 50/55 Bull Call Spreads and Sold 2,000 May 45 Puts (bull risk reversal)

The combination of Crista’s research, Mike’s chart reading and the bullish options trading was enough for me to take the risk, and add the stock to Cabot Options Trader/Cabot Options Trader Pro portfolios.

Obviously with the extreme volatility in the market lately, the trade has some downside. However, in my opinion, when the fundamentals, chart and options activity line up, the potential reward is worth the risk. In a suddenly risky market, this was the best option trade you could make, in my opinion.

If you want to know which stock Crista, Mike and I like, click here.

[author_ad]