I am a raging bull on the stock market right now, and have been for the past three weeks. This isn’t because of dovish actions by the Federal Reserve, or hopes of a Covid vaccine. Instead, it’s because a hedge fund or institution has been amassing a billion-dollar position that is the biggest bullish option trade I’ve ever seen.

Starting on Wednesday, August 5, EVERY single day a trader has been buying bull call spreads in Apple (AAPL), Amazon (AMZN), Facebook (FB), Adobe (ADBE), salesforce.com (CRM), Google (GOOG), Netflix (NFLX) and Microsoft (MSFT). For example, here is one day’s activity:

Buyer of 8,000 Amazon (AMZN) October 3,420/4,100 Bull Call Spreads for $176 – Stock at 3,430 ($140 million position)

Buyer of 10,000 Google (GOOG) October 1,650/1,950 Bull Call Spreads for $74.50 – Stock at 1,650 ($74 million position)

Buyer of 10,000 Adobe (ADBE) October 520/620 Bull Call Spreads for $30.75 – Stock at 522.5 ($30 million position)

Buyer of 12,000 Netflix (NFLX) October 550/650 Bull Call Spreads for $26.5 – Stock at 541 ($31 million position)

[text_ad]

Net/net this trader bought $275 million in bullish positions that day. And this is fairly normal trading day for this trader. And when a trader is buying a billion dollars’ worth of upside positions in mega-cap technology stocks, I want to be long the market as well.

Now some might ask me, “Jacob, how do you know it’s one trader who has been doing all this buying, and not several traders?”

In reality I don’t know for sure that is the case. However …

If my wife buys a bag of Cheetos for our family, and asks later that day who ate all the chips, it would be pretty obvious to her it was me as I was the the only person who was home, and has orange Cheeto dust all over my face and fingers. My wife isn’t Sherlock Holmes, but she knows a chip crook when the evidence points to just one suspect.

Similarly, while I will never know for sure that it is one fund or institution that is buying these bullish positions, the fact that these trades are being structured exactly the same way, every single day, in the same eight stocks, is a pretty glaring clue.

What this Bullish Option Trade Means

So is a billion dollars of bull call spreads a sure-fire signal that the market is headed higher? In reality, no.

Hedge funds and institutions get trades wrong all the time. No trader is perfect.

However, along with these bullish positions in mega-cap tech stocks has been “normal” call buying and nearly zero put buying for weeks. And following hedge funds/institutions positioning is what I do in my Cabot Options Trader advisory; in essence, I get a real-time look at how the smartest traders in the world are positioning their portfolios, and share that information to my subscribers every single morning via an easy-to-read graphic.

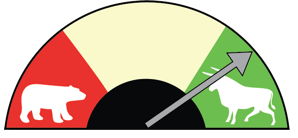

Here is an example of that graphic, which I refer to as my Options Barometer:

If option activity from the previous day had been bearish the arrow would point to the left, where the bear is in red.

If option activity had been mixed, the arrow would end up somewhere in the middle/yellow.

If option activity had been bullish that day the arrow would point to the right near the green bull.

And for the past three weeks, somewhat tied to the big bull call spread buyer noted above, my Options Barometer has been pointing at the bull, and that is why I have been adding more and more bullish exposure to the Cabot Options Trader/Cabot Options Trader portfolios.

Only time will tell how this trader’s billion-dollar positioning will work out. However, until he/she stops buying I am going to remain wildly optimistic that the market is going higher in the months to come.

[author_ad]