Options trading can be tricky, so it helps to learn some important options trading strategies that can help maximize return and limit risk. Here are some of the flexible and powerful options strategies I use in my options trading advisories, Cabot Options Trader and Cabot Options Trader Pro. You can click those links to subscribe now, or click here to hear what my subscribers have to say about my options advisories.

Read on to learn more about the strategies I use.

===========================

With a little knowledge of the best strategies, you can use options to rig the odds in your favor and make trades that have up to an 80% probability of success. Find out how in this free report, How Options Work—and How to Hedge Portfolios with Options. Read Your Free Report Here.

============================

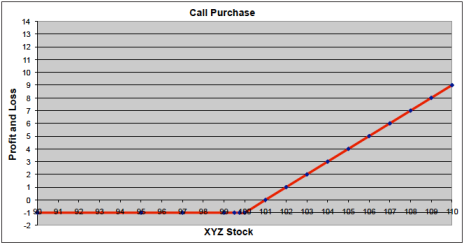

Options Trading Strategy 1: Call Purchase

A call purchase is used when a rise in the price of the underlying asset is expected. This strategy is the purchase of a call at a specific strike price with unlimited potential for profits. The maximum loss on this trade is the amount of premium paid.

For example, the purchase of the XYZ 100 strike call for $1 would only risk the $1 paid. If the stock were to close at $100 or below at expiration, that call purchase would be worthless. If the stock were to go above $101, the holder of this call would make $100 per contract purchased per point above $101.

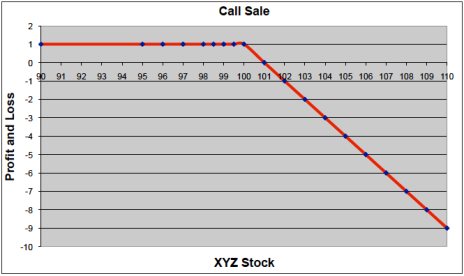

Options Trading Strategy 2: Call Sale

A call sale is used when a decline in the price of the underlying asset is expected.

This strategy is the sale of a call at a specific strike price with unlimited potential for loss. The maximum gained on this trade is the amount of premium received.

For example, the sale of the XYZ 100 strike call for $1 would collect a maximum of $1 if the stock were to close below $100 at expiration. If the stock were to go above $101, the seller of this call would lose $100 per contract sold per point above $101.

===========================

Secret Trading Blueprint Delivers 100% Gains Every 90 Days

Our revolutionary EZ options trading system easily delivers quick profits like these in both up and down markets:

• 506% gain in Nvidia (NVDA) Calls

• 320% gain in Fiat (FCAU) Calls

• 311% gain in White Wave Foods (WWAV) Calls

Start benefiting from options trading and get gains like these! Details Here

============================

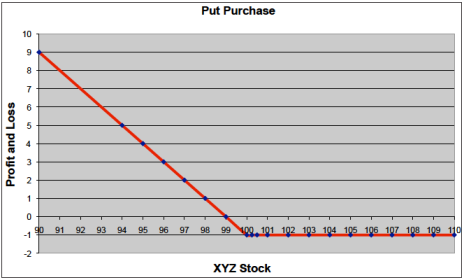

Options Trading Strategy 3: Put Purchase

A put purchase is used when a decline in the price of the underlying asset is expected. This strategy is the purchase of a put at a specific strike price with unlimited potential for profits. The maximum loss on this trade is the amount of premium paid.

For example, the purchase of the XYZ 100 put for $1 would only risk the $1 paid. If the stock were to close at $100 or above at expiration, the put would expire worthless. If the stock were to go below $99, the holder of this put would make $100 per contract purchased per point below $99.

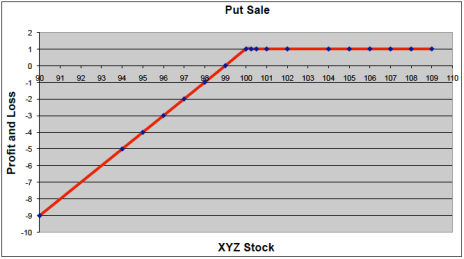

Options Trading Strategy 4: Put-Write

A put-write is used when a rise in the price of the underlying asset is expected.

This strategy is the sale of a put at a specific strike price with the potential for loss till the stock hits zero. The maximum gained on this trade is the amount of premium received.

For example, the sale of the XYZ 100 strike put for $1 would collect a maximum of $1 if the stock were to close above $100 at expiration. If the stock were to go below $99, the seller of the put would lose $100 per contract sold until the stock hit zero.

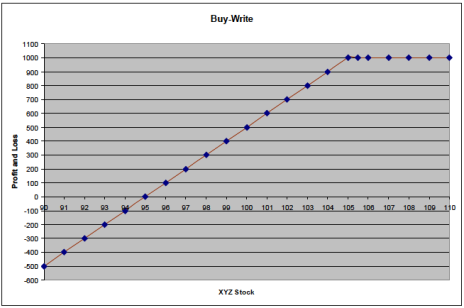

Options Trading Strategy 5: Buy-Write (Covered Call)

The term buy-write is used to describe an options strategy in which the investor buys stocks and writes or sells call options against the stock position. The writing of the call option provides extra income for an investor who is willing to forgo some upside potential.

My example shows the purchase of 100 shares of stock XYZ, which is trading at 100, and the sale of the XYZ 105 strike call for $5. If the stock were to close at 100 on expiration, the trader will collect $5 on the expiring call. If the stock were to close at 105, the trader would make $500 on his stock appreciation and $500 on his call. If the stock were to fall to 95, the trader would lose $500 on his stock, but make $500 on the call, which would leave him at breakeven.

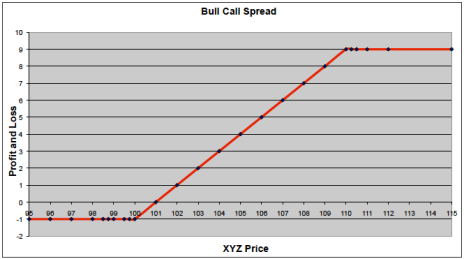

Options Trading Strategy 6: Bull Call Spread

A bull call spread is used when a rise in the price of the underlying asset is expected. This is a strategy that involves purchasing a call at a specific strike price while simultaneously selling a call at a higher strike price. The maximum profit on this strategy is the difference between the strike price of the long and short option, minus the premium paid.

For example, the purchase of the XYZ 100/110 bull call spread would entail buying the XYZ 100 calls and selling the XYZ 110 calls. If you paid $1 for this spread, the most you can lose is the $1 paid. The most you can make is $9 if the stock were to go to $110 or above.

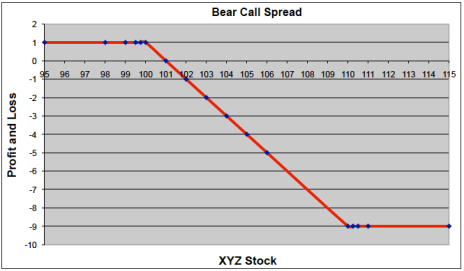

Options Trading Strategy 7: Bear Call Spread

A bear call spread is used when a decline in the price of the underlying is expected. This strategy involves the selling of a call at a specific strike price while simultaneously buying a call at a higher strike price. The maximum profit on this strategy is the premium collected. The maximum loss is the difference between the strikes minus what you received.

For example, the sale of the XYZ 100/110 bear call spread would entail selling the XYZ 100 calls and the buying of the XYZ 110 calls. If you collect $1 for this spread, the most you can make is $1. The most you can lose is $9 if the stock were to go to $110 or above.

[text_ad use_post='129625']

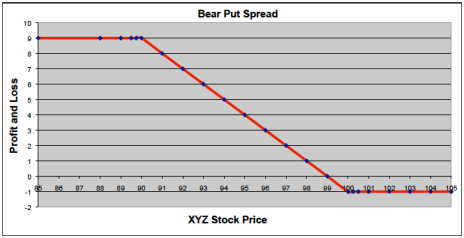

Options Trading Strategy 8: Bear Put Spread

A bear put spread is used when a decline in the price of the underlying is expected. This strategy involves the buying of a put at a specific strike price while simultaneously selling a put at a lower strike price. The maximum profit on this strategy is the difference between the strike price of the long and short option, minus the premium paid. The maximum loss is the premium paid for the put spread.

For example, the purchase of the XYZ 100/90 bear put spread would entail the buying of the XYZ 100 put and selling of the XYZ 90 puts. If you paid $1 for this spread, the most you can lose is the $1 paid. The most you can make is $9 if the stock were to go to $90 or below.

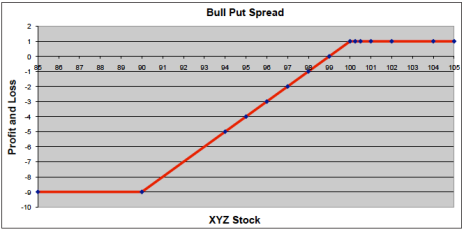

Options Trading Strategy 9: Bull Put Spread

A bull put spread is used when a rise in the price of the underlying is expected.

This strategy involves the selling of a put at a specific strike price while simultaneously buying a put at a lower price. The maximum profit on this strategy is the premium collected. The maximum loss is the difference between the strikes minus the premium that was received.

For example, the sale of the XYZ 100/90 bull put spread would entail the selling of the XYZ 100 puts and the purchase of the XYZ 90 puts. If you collect $1 for this spread the most you can make is $1. The most you can lose is $9 if the stock were to go to $90 or below.

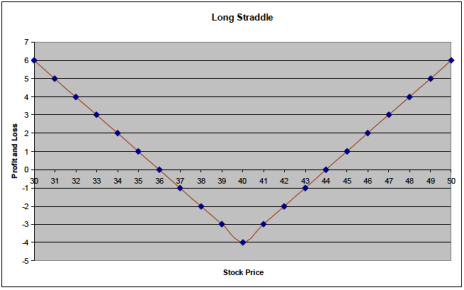

Options Trading Strategy 10: Long Straddle

A long straddle is a good options strategy to pursue if a trader believes that a stock’s price will move significantly, but is unsure of which direction. A long straddle is also a good strategy if a trader believes that option volatility is priced below a stock’s potential movement. The gain is unlimited to the upside and limited to the downside if the stock were to go to zero. The maximum loss is the premium paid.

For example, the purchase of the XYZ June 40 Straddle would entail buying the XYZ June 40 Call and buying of the XYZ June 40 Put. If you paid $4 for this straddle, the most you can lose is the $4 paid. Your profits are limited to $36 if the stock went to zero, and unlimited to the upside.

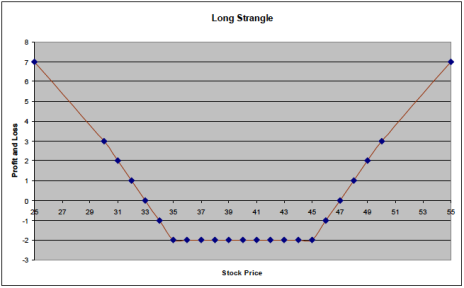

Options Trading Strategy 11: Long Strangle

A strangle is a good options strategy to pursue if a trader believes that a stock’s price will move significantly, but is unsure of which direction. A strangle is also a good strategy if a trader believes that volatility is priced below a stock’s potential movement.

To purchase a strangle, a trader buys a long position in both a call and a put with different strike prices, often out of the money, but with the same expiration date.

For example, the purchase of the XYZ June 35/45 strangle would entail buying the XYZ June 35 Put and the XYZ June 45 Call. If you paid $2 for this strangle, the most you can lose is the $2 paid. The most you can make is $33 if the stock were to go to zero and your profits are limitless to the upside.

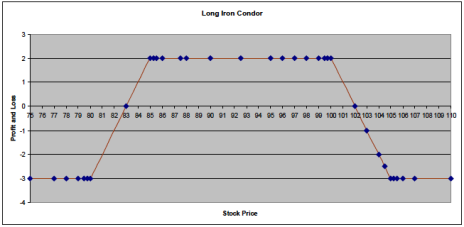

Options Trading Strategy 14: Long Iron Condor

A long iron condor is a directionally neutral spread used when a stock’s price is expected to stay within a range. This is a strategy used when volatility is believed to be too high. The strategy involves the selling of an out-of-the-money put spread and an out-of-the-money call spread. The maximum profit on this strategy is the premium received. The maximum loss is the difference between the strike’s sold price minus the premium received.

For example, the long iron condor would entail the sale of the 85/80 put spread and the sale of the 100/105 call spread for a $2 credit. If you collected $2 for the iron condor, the most you can make is $2 if the stock stays between 85 and 100. The most you can lose is $3 if the stock were to go to 80 or below, or 105 or above.

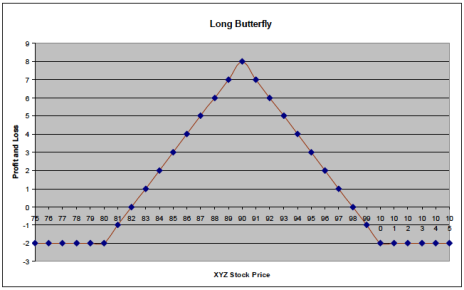

Options Trading Strategy 13: Long Butterfly Spread

Long butterfly spreads can be used to enter either a bullish or bearish trade. Butterfly spreads use four option contracts (puts or calls depending on directional opinion) with the same expiration but three different strike prices to create a range of prices the strategy can profit from. The trader sells two options at the middle strike price and buys one option contract at a lower strike price and buys another option contract at a higher strike price. The most you can lose is the premium spent if the stock were to close below the lower strike price or above the higher strike price. Your maximum return is achieved when the price of the stock closes near the middle strike price at expiration.

For example, the purchase of the XYZ January 80/90/100 Long Butterfly for $2 would entail buying one 80 call, selling two times the 90 calls, and buying one of the 100 calls. The most you can lose on this spread is the $2 paid. The most you can make on the trade is $8 if the stock closes at $90 on expiration.

[text_ad]

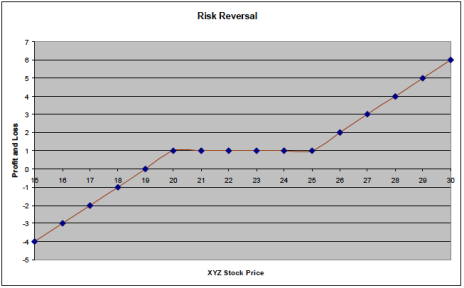

Options Trading Strategy 14: Risk Reversal

A risk reversal is typically used when a rise in the price of the underlying asset is expected. This strategy is typically the sale of an out of the money put and the purchase of an out of the money call. This trade has unlimited profit potential to the upside and extreme loss potential to the downside.

For example, a January 20/25 risk reversal for a $1 credit would be the sale of the January 20 Put and the purchase of the January 25 Call. If the stock stays between $20 and $25, the trader collects the $1 credit. If the stock goes to $20 or below, the trader will be forced to buy the stock. If the stock goes to $25 or above, the trader will exercise his right to buy the stock, or simply sell out his call for a profit.

Options Trading Strategy 15: Long Time Spreads

A time spread is used when a stock or index is believed to be range-bound and when volatility is believed to be too low. The strategy involves the selling of an option in a near-term expiration cycle and the purchase of an option in a longer-term expiration cycle. This spread looks to take advantage of time decay of the option closer to expiration. The maximum loss is the premium paid.

For example, the purchase of the XYZ January/February 100 Call spread would entail the sale of the January 100 Call and the purchase of the February 100 Call. The goal of the trade is for the January call to expire worthless while the February call appreciates in value.

Options Trading Strategy 16: Diagonal Spreads

A diagonal spread is a bullish position that reduces capital outlay. The strategy involves the selling of an out-of-the-money near-term option and buying a longer-term option closer to at-the-money. This spread looks to take advantage of the time decay of the option closer to expiration. The maximum loss is the premium paid.

For example, one could sell the October 25 call (expiration 10/19/2014) and buy the January 20 call (expiration 1/19/2015) for a net debit. The goal of the trade is for the October call to expire worthless while the January call appreciates in value.

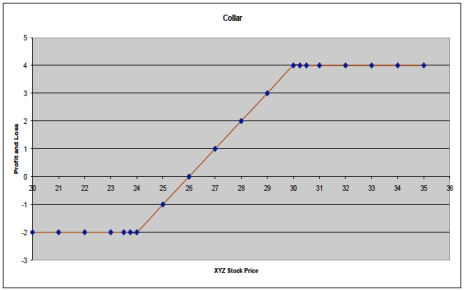

Options Trading Strategy 17: Collar

A collar is a protective options strategy that is implemented with a long stock position. It’s created by purchasing an out-of-the-money put and selling an out-of-the-money call. The put protects against downside movement in the stock, and the call, while limiting the upside of the position, helps reduce the cost of the put protection.

For example, if you purchased 100 shares of stock XYZ, to collar this trade you would buy one XYZ January 23 Put and sell one XYZ January 30 Call for $1 debit. If the stock went to 23 or lower at expiration, you would exercise the put, which would take you out of the stock position. If the stock went to 30 or above at expiration, you would be forced to sell your stock position.

[author_ad]