Create extra portfolio yield by selling covered calls on your best dividend stocks

You can sell covered calls on dividend-paying stocks to create extra portfolio yield. This is a very conservative strategy that should be a part of every investor’s trading playbook.

How Covered Calls Work

A covered call is an options strategy in which the trader holds a long stock position and sells a call option on the same stock in an attempt to generate income. For every 100 shares of stock you own, you can sell one call. If you own 500 shares of stock, for instance, you can sell five calls.

A covered call is a VERY conservative strategy that requires no margin. It’s a great way to create yield and lower your cost basis on your stock position. (The downside is that you give up the potential for explosive upside gains.)

[text_ad]

Best Stocks for Covered Calls

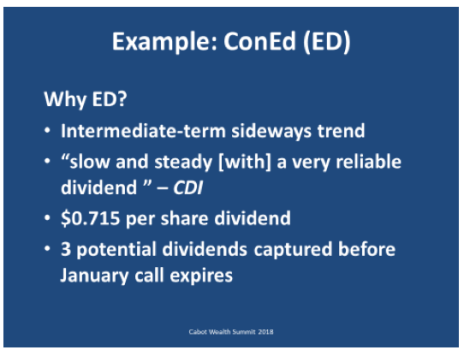

For example, Consolidated Edison (ED).

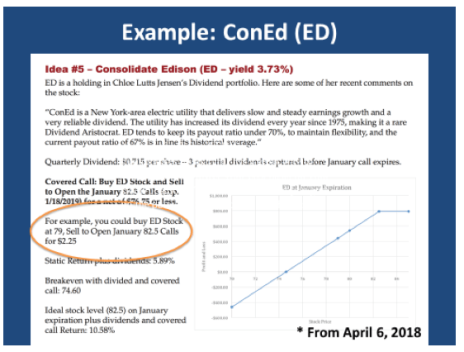

When I send a trade alert at Cabot Options Trader I give detailed instructions on how to execute the trade. In the slide below you can see in the circled section I give exact details on the prices you are likely to pay for the stock, and the price for the call sale. Here is the example:

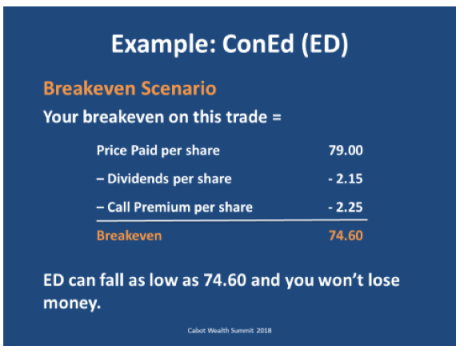

After the trade was executed, here is how you price the breakeven on this position:

As you can see, by selling a call against a stock position, it actually drops your breakeven. It’s why this is considered a conservative strategy.

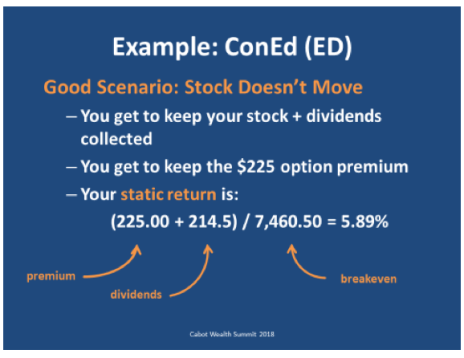

And here is the breakdown on each scenario of this trade, starting with if ED stock doesn’t move:

If ED doesn’t move, the option that you sold expires worthless, and you have collected the three dividends. I refer to this scenario as the static return.

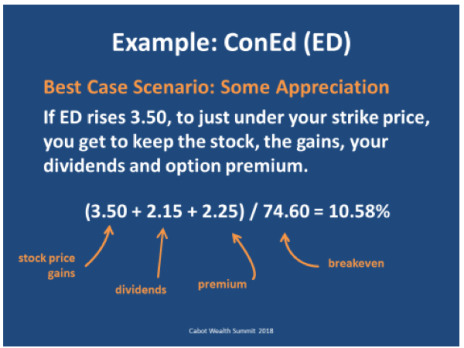

Next is the best-case scenario:

In this case you made $350 on the stock rise, collected the dividends, and the call expired worthless. And because the stock closed below the strike price of the call you sold, you keep your stock.

Here is the worst-case scenario:

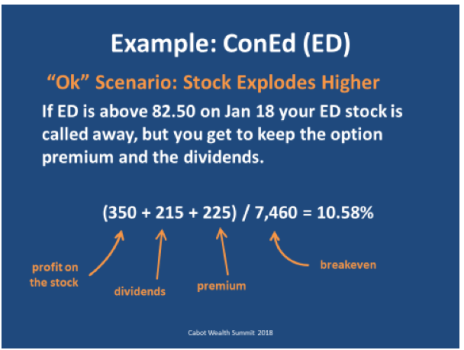

And here is the “OK” scenario:

In this scenario, the stock trades above 82.5 on January expiration and the trader who bought the call from you exercises his right to buy the stock from you. You no longer own the stock. However, you have made $350 from the stock appreciation, collected the dividends, as well as the call premium. The trade worked, though you don’t own the stock anymore, and may miss out on further gains.

Create Income from Stocks You’re Holding with Covered Calls

Virtually every investor I know has stocks in their portfolio that they have been holding for too long, and are not profiting from. Executing a covered call strategy is a great way to create income against those holdings, and should be a part of every investor’s trading repertoire.

If you have any questions on how to execute this strategy, you can join Cabot Options Trader here to receive further guidance on your trading.

Once you become familiar with the strategy, you can execute more covered calls. By adding this strategy to your investing arsenal, you can create more yield for your portfolio every month.

What other questions do you have about covered calls? Leave a comment below.

[author_ad]