While I’m known as an options trader, who throws around wonky terms like Iron Condor, or Deltas, or Vega, when it comes to investing, I can be fairly simple. For example, during earnings season I target earnings winners for new buys, and strictly avoid earnings disasters.

For example, while subscribers to my Cabot Options Trader advisory made over 1,000% in Peloton (PTON) calls last year, riding the stock from 45 to above 100, I had no interest in buying the stock last week after it fell all the way to 57 on earnings.

Essentially, I figured that the sellers were going to continue to pound PTON stock in the days to come, and not surprisingly the stock has fallen another 10 points since that big earnings decline. (Note: PTON rebounded on Tuesday, thanks to a stock offering, which was an interesting development and stock reaction.)

[text_ad]

2 More Earnings Disasters

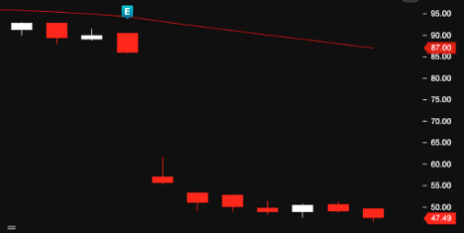

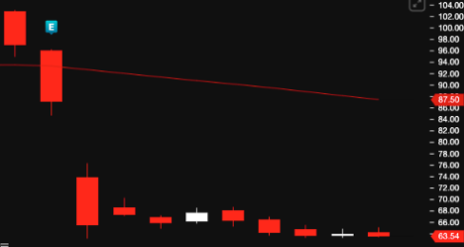

Next, let’s look at a couple more examples of earnings duds continuing to get hit, or at least making no attempts at a rebound, after their initial stock decline. First, here is Zillow (Z), which fell from 87 to 65 and has not bounced at all, followed by Snap (SNAP) ,which dropped from 75 to 57 and has chopped aimlessly since.

Z:

SNAP:

No thank you on a buy of any of these earnings disasters!

Earnings Winners

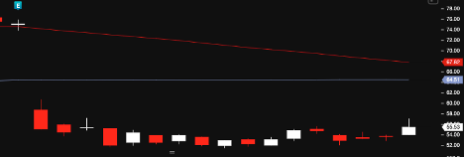

Conversely, I’m very intrigued by the earnings reaction of The Trade Desk (TTD), which jumped from 70 to 87 last week and has continued to build on that momentum, trading as high as 105 on Monday. Here is a look at the TTD stock chart, which includes its continued gains after earnings:

Also on my radar for a new buy is earnings star Canada Goose (GOOS), which rallied from 40 to 48 last week after reporting quarterly results, and since then the stock has tacked on another four points of gains.

So how would I play further stock gains in TTD and GOOS using options?

First off, I never buy options that are expiring in the coming weeks as these earnings stars do often times have some short-term choppiness.

Instead, I would look to buy calls that are expiring three to six months from now. For example, I might look at:

TTD February 105 Calls for $13

GOOS February 50 Calls for $6

Both of these trades have unlimited profit potential should the stocks continue to march higher (think PTON last year, when my Cabot Options Traders achieved 1,000% gains).

And to the downside, there is minimal loss potential should the stocks give back their earnings gaps. For example, the most one can lose on the TTD February calls is $1,300 per call purchased, while the downside in the GOOS trade is $600 per call bought.

Now, does this strategy of avoiding earnings disasters and buying earnings winners always work? Of course not.

It’s very possible that a year from now PTON, Z and SNAP will be back trading at all-time highs, while TTD and GOOS will be long forgotten stars tossed to the side of the road by investors.

That being said, it’s been my experience that the odds favor TTD, GOOS, as well as fellow earnings winners such as Teradyne (TER), Wolfspeed (WOLF), Airbnb (ABNB), Shake Shack (SHAK), Goodyear Tire (GT), Unity Software (U), Trex Company (TREX), Five9 (FIVN), Roblox (RBLX), will be trading higher in the months to come.

Do you trade options during earnings season? Tell us about your successes and challenges in the comments below.

[author_ad]