No doubt everyone who has even a passing interest in the stock market has heard the tale of the short squeeze in GameStop (GME) stock, triggered by an online community of traders. But what does the GME short squeeze mean for stocks, and is it the kind of Black Swan event that could sink the market, and the many hedge funds that are betting against GME?

GME Short Squeeze: How it Happened

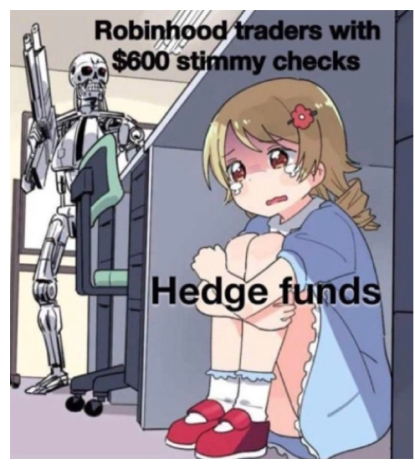

First, let’s start with a funny picture making the rounds in the trading world portraying a cartoon version of the current market conditions, and then we will get into why the hedge funds are in hiding.

Just five months ago GME was a sleepy, money losing $5 stock, that was the target of many hedge funds who were shorting it. Then the day traders on a Reddit message board named #WallStreetBets (WSB) “ganged up” and succeeded in driving the stock to ridiculous levels in just a matter of weeks.

[text_ad]

The coordinated GME short squeeze involved people buying the stock plus cheap out-of-the-money call options. This forced options market makers to go long the stock to hedge against their growing short call option position. If this happens enough a stock’s price can quickly spin out of control, resulting in a short squeeze. That’s when the hedge funds that were short millions of shares of the stock scrambled to buy back GME stock, desperate to cover their short positions.

The result: GME shares soared 10,500% higher – that is NOT a typo – in less than five months as of last Thursday. In fact, at one point last week GME’s market capitalization had swelled so much that it was among the 500 largest publicly traded companies!

The pain for those who were short GME, and other short squeeze plays, was brutal. Here are some of the losses from leading hedge funds through January:

-SUNDHEIM’S $20 billion D1 Capital lost about 20% in January

-POINT72 lost 10-15% in January

-Maplelane lost 33% in January

-Melvin Capital needed a $3 billion infusion

Never in their wildest dreams could these hedge funds have foreseen GME, which was assumed to be a dying company/stock, rally as high as 483 a share! This was undoubtedly a Black Swan event in the investing/risk management world.

What it Means for the Market

But what do these losses mean for the stock market as a whole?

What day traders do with their spare time and spare pocket change isn’t my concern.

But this kind of activity elevates overall market volatility and risk in my view, as large hedge funds, many of which were short GME, Bed Bath & Beyond (BBBY) and other stocks, have been reporting massive losses. When these hedge funds are facing these types of losses, they are often forced to liquidate liquid leaders such as Apple (AAPL) and Uber (UBER) in order to pay for the losses, which could trigger a deeper market correction.

And, according to Goldman Sachs: Last week was the largest active hedge fund deleveraging event since February 2009, with long positions sold and shorts covered in every sector.

These losses, and the selling the hedge funds were almost certainly doing in the liquid leaders, clearly weighed on the market, as the S&P 500 and Nasdaq each lost more than 3.3% last week.

Now, I’m not yet ready to sell all of my positions in my Cabot Options Trader advisory and swing massively short. We have seen these dislocations in the trading world before, and often, with a bit of time, the market digests these situations, then resumes normal trading.

Lastly, I’ve received many questions about how to get long/short exposure to GME via options. My takeaway is this: big picture, the spreads in GME options between the bid and ask makes any buys or sales very difficult. Essentially, you have to give up a ton of edge to get in and out of trades.

Also, the prices of options in GME are so ridiculous, that it is very difficult to make big money.

For those reasons, in my opinion, you should stay away from GME.

[author_ad]