We’ve written before about how weekly options are more like gambling than investing, but there’s an even riskier type of trading that’s been skyrocketing in popularity over the last few years: 0DTE options, or 0-days-to-expiration options.

In a nutshell, these short-term options trade just like any other option but expire on the same day and allow investors to maximize their leverage on a position at a relatively low cost.

[text_ad]

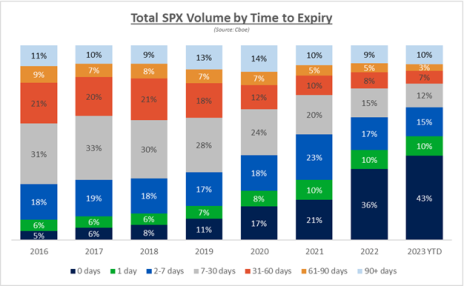

According to the Chicago Board of Options Exchange (CBOE), as of August 2023, 0DTE options represented 43% of the total daily volume on the SPX index (the cash-settled futures index of the S&P 500).

As you can surmise from the chart below, that figure is likely even higher in 2024.

Structurally, these options work the same way as weekly options, monthly options or LEAPS. You trade them on an underlying security (they’re not available for all underlying securities but are popular for QQQ and SPY), you trade a specific strike price, and the option is valued by intrinsic value (how much they’re in the money) and time and volatility premium.

The key difference is that they expire on the same day, so an option with an expiration of June 4 would be opened and closed on that day.

The benefit is that you can take on a significant amount of leverage at a low cost. With SPY trading at 526 as I write this (on June 3), you can buy a 0DTE 527 strike call for only $0.77, or $77 per contract. Should SPY trade back to its opening price of 529, those would be worth $2.00, or $200 per contract.

Of course, should SPY continue trading below 527, the position would expire worthless at the end of the day.

As I said, highly risky.

The Hidden Risk of 0DTE Options

Beyond those risks, however, is another risk that retail traders should be aware of before trying to trade 0DTE options: exercise risk. Not exercise risk for individual investors (which is the possibility your options contract could be exercised in your account), but your brokerage’s assessment of expiration risk for the position.

All brokers have options risk departments that manage the risk to the firm, namely, that your in-the-money options contract could be exercised and end up costing you more than you can afford. If SPY were to close at 527.01 and you had a 527 call, it would exercise at the total cost of $52,700 (527 x 100 shares per contract).

If your account doesn’t have the funds to support that exercise, then your broker is left with the risk that you carry a negative balance, require collection action, and the firm subsequently loses money.

The reason that this is something of a hidden risk for 0DTE options is that your broker will often begin selling to close contracts that are at risk of being exercised before the close of the day. In my experience, most large firms start the process around 3:00 p.m. ET, although the popular online broker Robinhood (HOOD) begins automatically selling at 3:30.

The problem with that is that recent reporting from Bloomberg highlighted that 30% or so of the total daily trading volume for equities happens in the last 10 minutes of trading.

In essence, brokerage house risk controls may prevent you from having exposure to one-third of the total trading volume during the day. We saw the consequences of that very clearly on Friday. Here’s a five-minute chart of the SPY for that day.

Many retail investors who attempted to trade 0DTE options on Friday missed out on a sizeable (and potentially profitable) swing in the SPY simply because of how their brokerage firm manages risk. If their broker sold them out of SPY calls at 3 or 3:30, they would have missed a 1% swing in the last 20 minutes of trading.

Now, this would also be a risk to weekly options, monthly options or LEAPS on expiration day, but it’s significantly more pronounced with 0DTEs because that’s the only day you have.

So, what can you do about it?

The easiest way to avoid it is to avoid buying 0DTE options altogether. Consider options expiring on the next day. You’ll pay more in premium but will alleviate missing out on a third of the trading day’s volume (until the next day that is).

The other potential solution is to submit “do not exercise” (DNE) instructions to your broker. In essence, you tell your broker not to exercise options contracts, whether or not they’re in the money. Now, you take on the risk that your in-the-money options contracts will simply expire worthless, but you avoid having your broker sell your options to manage their own perceived risk.

The process for submitting those instructions can vary by broker, so talk to them. Plus, it does require more diligence on your part; if you have options with intrinsic value (in the money) you have to sell to close before the end of the trading day. Otherwise, any value you have in them is lost.

There are enough risks with trading options. Hopefully this will help you avoid risks that you may not have even considered. If you are looking for guidance with your options trading, consider subscribing to Cabot Profit Booster, or adding yourself to the waitlist for Cabot Options Trader. Chief Analyst Jacob Mintz doesn’t use 0DTE options, but he’s an expert at managing risks and identifying promising opportunities.

[author_ad]