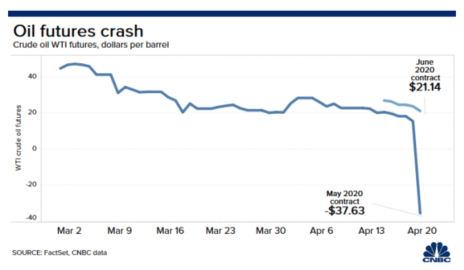

On Monday West Texas Intermediate crude oil for May delivery fell to negative-$37 per barrel ... meaning producers would PAY traders to take oil off their hands. You read that right: the price of a barrel of oil is worth NEGATIVE-$37! It’s the first time in history the price has turned negative for an oil futures contract. How can a barrel of oil be worth less than zero, you might ask?!!

Since Monday, I’ve reached out to some of my hedge fund associates in that space to get their insight as to how could oil be sold for negative $37 a barrel.

Now before I get into their explanation, I want to note this disclaimer: I am not an oil trader and I am not an expert in this field. However, the possible reason given for this historic move is similar to something that goes on in my world, options trading. This is what I mean …

[text_ad]

Let’s say I sell one put option on stock XYZ at the 10 strike. If XYZ stock falls below 10 on expiration, I have two choices. The first is to buy back that put and take a loss. The second is to let myself get assigned, and take ownership of 100 shares of XYZ stock at 10, which would cost me $1,000. Either scenario is fine as I can take a loss, or take ownership of the stock.

Now let’s move to the oil futures scenario, and to answer my own question from earlier...

How Can a Barrel of Oil Be Worth Less than Zero?

Tuesday was expiration of the May West Texas Intermediate crude futures. And if hedge fund ABC is long futures that would require them to take delivery of 500,000 barrels of crude, and they don’t have the mechanism to receive and store that oil, they would need to sell at ANY price, as they literally can’t take delivery. And as the price dropped—no matter the price—this hedge fund HAD to sell. That’s one reason producers would get paid to take oil off the hands of traders.

The other explanation for how oil can trade for negative-$37 per barrel is tied to the global economic slowdown. With most of the world under stay-at-home orders or quarantine, airplanes fly less frequently and global industry grinds to a halt, and there simply is not enough demand for the supply.

And as storage facilities and tankers for oil near capacity, the question becomes is whether this negative price situation is a short blip on the radar, or will prices for June contracts and beyond go negative as well?

Here is a graph of the price of the June West Texas crude contract that shows that June futures are trading at $21, well above the May contract that fell to negative-$37.

As you might imagine the research community is feverishly updating clients with their thoughts on this once-in-a-lifetime event. Here are some of their thoughts:

Deutsche Bank: “We expect extremely weak fundamentals to persist for at least the next month. Continued pressure on infrastructure may result in negative pricing at some point again before the end of May, on the current trajectory.”

Citibank: “Even as OPEC++ oil production cuts are set to kick in May 1, and supply and inventories should tighten significantly in 2H?20, the next 4-6 weeks are seeing severe storage distress, likely to drive wild price realizations and unusual disconnects, including … negative prices.”

How to Profit from Negative Oil Prices

This could lead to major reverberations throughout the oil and financial markets as bankruptcies and job losses in the oil sector could become a real issue for an already weak economy.

And while I am not trying to be overly negative, if this oil situation is concerning to you, or if you simply are looking for a hedge for your portfolio, one options trading idea is the S&P 500 ETF (SPY) September 280 Put for around $25.

But this is a fast-developing situation, and the stock market is holding up fairly well given this unprecedented move in oil prices, as the Dow “only” lost 590 points on Monday. Also, most oil stocks held up fairly well as industry leaders such as Exxon Mobil (XOM), Chevron (CVX), Halliburton (HAL) etc., were down only marginally, and some were even up on the day.

In a world in which once-in-a-lifetime events have become the norm, this oil situation is just another wild card for the economy and the stock market that we need to keep our eyes on.

[author_ad]