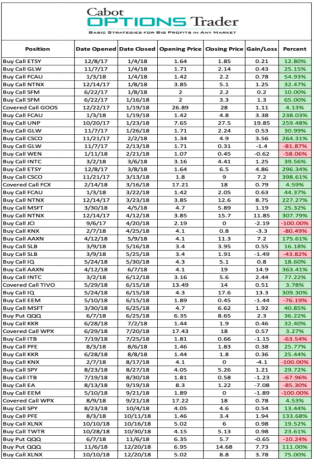

2018 was a mess for most traders and investors, but NOT for Cabot Options Trader. With a 71% win ratio on 31 trades closed in 2018, and seven trades with gains of well over 100%, 2018 was a banner year for my subscribers. Here is the full list of our options trades and my thoughts:

January through July were absolutely spectacular. We had seven trades that returned well over 100%, in Etsy (ETSY), Fiat Chrysler (FCAU), Union Pacific (UNP), Cisco (CSCO), Nutanix (NTNX), Axon Enterprises (AAXN) and iQIYI (IQ). We also had solid returns of between 25%-80% in Sprouts Farmers Market (SFM), Intel (INTC), Microsoft (MSFT) and KKR (KKR). What is interesting about this great trading run is that the market was choppy during those months, yet following bullish option order flow combined with strong stocks paid off time and time again.

July through December was a bit choppier, but all in all our trades still performed well. Pfizer (PFE) and Xilinx (XLNX) were our standouts, and we also had decent returns in S&P 500 (SPY) calls as well as Nasdaq (QQQ) puts.

[text_ad use_post='129624']

The trades that went wrong I put into two categories.

Options Trades that Went Wrong

The first category are the options trades that I would make again if I had the chance (in reality I wouldn’t know the results, but you get the gist). I LOVED the option action in Electronic Arts (EA) and PagSeguro (PAGS). Unfortunately, EA warned on earnings shortly after we bought, and PAGS got caught up in emerging markets malaise.

The trades I am most upset about this year happened when I was trying to play a turnaround in Emerging Markets (EEM) and Housing (ITB). I reached and was punished for it. I am less upset about buying PureStorage (PSTG) days before the market began its ugly fourth quarter as it was just a case of really bad timing/luck.

What I also find interesting about our best trades is that they came in two categories of stocks. “Wild” stocks like NTNX, AAXN and IQ gave us very quick profits on expensive calls. Conversely, “slow” stocks like FCAU, CSCO, INTC, MSFT, PFE and KKR turned into big winners as we bought calls that were dollar cheap, and rode them steadily higher.

My strategy of buying calls/puts with several months until their expiration is always a double-edged sword. Too often this past year I gave our losers time to recover because they had so much time. This proved to be a mistake in most cases, as the market continued to punish stocks/sectors out of favor. However, on the other end of the spectrum, this strategy worked perfectly with our big winners, as I really let the winners run because we had so much time.

Big picture, even though there was an occasional misstep, given the overall market malaise of 2018, and the wild volatility, I feel our portfolio performed spectacularly!

Making my subscribers money is the number one goal of my Cabot Options Trader advisory. And while I give my readers the exact details on how to get in and out of trades, so that they can simply follow my instructions, I also want Cabot Options Traders to develop their own options trading skills.

Options on Your Own

And because the options education component of my role is so important to me we created an easy-to-read infographic to help investors learn about the basics of options trading.

2019 has gotten off to a great start as well. So far we have locked in profits of 27.5% on half of our Ciena (CIEN) calls and 23% in four trading days on half of our Zscaler (ZS) calls. Because I expect 2019 to be as rocky as 2018 in terms of volatility I strongly recommend you get bullish and bearish exposure to the market via Cabot Options Trader/Cabot Options Trader Pro.

To subscribe, click here.

[author_ad]