The marijuana stock boom is the story of 2018 as stocks such as Canopy Growth (CGC) and Tilray (TLRY) are up 67% and 250%, respectively. However, in the last two weeks the sector has been hit, and there is a chance that this boom may turn out to be a bust. One way to get bullish exposure to the marijuana trend, while risking fewer dollars just in case the bubble bursts, is to buy call options on marijuana stocks.

Further down in this article I will outline a couple of intriguing call buying opportunities in CGC and TRLY. But first let’s understand the risks and rewards when buying call options.

Risks/Rewards of Buying Call Options

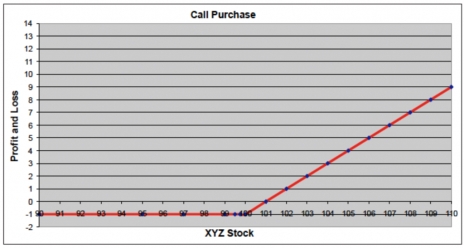

A call purchase is a bullish position, used when a rise in the price of the stock is expected.

[text_ad]

This strategy has unlimited potential for profits.

The maximum loss of a call purchase is defined. The most you can lose is the premium paid.

For example, the purchase of the XYZ 100 strike call for $1 would only risk the $1 paid. However, that $1 for the call is actually $100 as each 1 call represents 100 shares of stock. And thus when you pay $1 for a call, the total risked is actually $100.

If the stock were to close at 100 or below at expiration, the call purchased would be worthless. You would have lost $100.

The breakeven on the trade is at 101.

If the stock were to go above 101, the holder of this call would make $100 per call purchased per point above $101. The upside is unlimited.

Here is the graph of this fictional trade:

Tim Lutts, Cabot CEO and chief analyst of our Cabot Marijuana Investor advisory, was very early to the boom in marijuana stocks and his picks are up a staggering 43% year-to-date. Here is a small portion of his recent research notes sent to his Cabot subscribers on CGC and TLRY.

Canopy Growth (CGC 40)

Canopy remains the undisputed king of the cannabis industry, not least because of the $4 billion contribution of Constellation Brands (STZ), whose investment kicked off the August blastoff of all stocks in the industry.

That blastoff took the stock from 25 to 57 in just nine weeks, and as I write, the stock has given back roughly half of that gain, which is substantially less of a haircut than the other Canadian growers have received. One likely reason: the presence of long-term oriented institutional investors.

Tilray (TLRY 110)

Tilray was the hottest marijuana stock on the planet in September—in part because of its Nasdaq listing—and it’s been cooling off since. But it’s still valued at $10 billion, which is more than any other cannabis business on the planet today and the question is whether it’s worth it. You see, Tilray is not a major Canadian grower in the mold of Canopy, but a grower/deal-maker in the medical cannabis industry, selling to medical providers in 10 countries around the world.

These are just a small sample of two of the 15 marijuana stocks that Tim highlighted in his most recent Cabot Marijuana Investor issue. To learn more about Cabot Marijuana Investor, click here.

How to Buy Call Options on Marijuana Stocks

So if I was bullish on CGC and TLRY, how might I buy call options to participate in a potential move higher in the stocks?

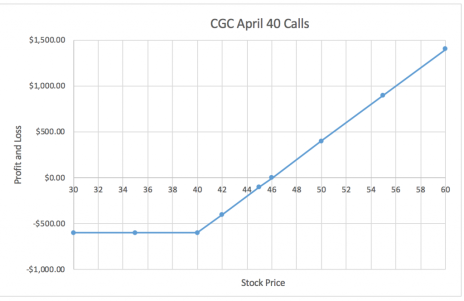

One idea would be to Buy the CGC April 40 Calls for $6

The breakeven on this position is at 46 on April 18, 2019.

The most I could lose on this position is the premium paid, or $600 per call purchased if CGC closes below 40 on April 18, 2019.

My upside is unlimited.

Here is the graph of this position:

And if I was bullish on TLRY, I might Buy the TLRY March 105 Calls for $15.

The breakeven on this position is at 120 on March 15, 2019.

The most I could lose on this position is the premium paid, or $1,500 per call purchased, if TLRY closes below 105 on March 15, 2019.

And like the CGC idea, my upside profit potential is unlimited.

Will marijuana stocks boom or bust is truly anyone’s guess. However, if you want to get upside exposure, with limited risk, knowing how to buy call options on marijuana stocks is a great way to play this hot sector.

For more call options ideas, consider joining Cabot Options Trader.

[author_ad]