Fears of the coronavirus turning into a horrible pandemic that will spread all over the world has sent the S&P 500 lower by 7.5% in the last week. And while I too am concerned about what this means for the global economy, and more importantly my family, I always tell my kids, “Stay calm, panicking never pays.” As investors, call and put options are a good way to profit while others are panicking. More on those in a bit.

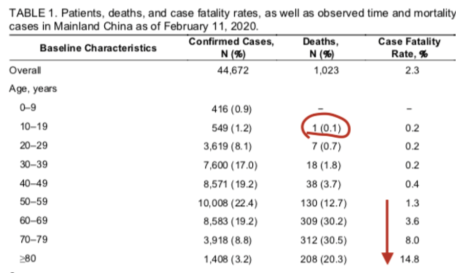

I’m no CDC (Center for Disease Control) scientist, nor do I know how this situation will disrupt the global supply chain. But it is interesting to see the fatality rates from the coronavirus based on age below (note: these numbers only go through February 11).

And while the rising numbers of individuals who have been confirmed to have contracted the coronavirus in Italy is shaking the markets this week, according to @DeanFantazzini on Twitter, the “age of the people who died of coronavirus in Italy so far (as of February 24)) is 78, 77, 68, 84.”

[text_ad]

And for those who have compared the coronavirus to the Spanish flu that will impact a major portion of the population, here are some calming comments from Professor John M. Nicholls from the Department of Pathology/University of Hong Kong from a recent CLSA (Credit Lyonnais Securities Asia) conference call, as shared by @saxena_puru on Twitter:

“Professor Nicholls was a key member of the research team at the University of Hong Kong, which isolated and characterized the novel SARS (Severe Acute Respiratory Syndrome) virus in 2003.

“During the CLSA conference call, this real expert opined that coronavirus is not similar to SARS or MERS (Middle East Respiratory Syndrome), but a bad cold which mostly kills people who already have health issues.

“According to this real expert, the virus will burn itself out in May when temperatures rise. His advice - wash your hands often.

“According to Prof. Nicholls, we are talking about a coronavirus that has a mortality rate which is eight to 10 times LESS deadly when compared to SARS or MERS. So, according to him, the correct comparison is not SARS or MERS but a severe cold.

“When will the virus peak? Three things the virus does not like: (1) sunlight, (2) heat. (3) humidity. In his view, sunlight will cut the virus’ ability to grow in half and at 30 degrees Celsius you will get inactivation.”

Again, I am not claiming to understand the long-term ramifications of the coronavirus, nor do I know if Professor Nicholls’ theory is correct. And I am certainly not telling you it’s safe to fly to China today (or South Korea or Italy, for that matter).

However, by using options there is a way to get bullish or bearish exposure to the market via calls and puts depending on how you think the market will respond to the coronavirus outbreak in the days/weeks to come.

How to Play Coronavirus Fears with Call and Put Options

If I was bullish, and think markets will rebound in the coming months, I might buy the S&P 500 ETF (SPY) September 320 Calls for $14. This would give me upside exposure to the market for seven months. If I’m wrong and the market falls further during that time, the most I can lose on this trade is the premium paid, or $1,400 per call purchased.

However, if I was concerned that we’re headed for a bear market, I might buy the S&P 500 ETF (SPY) September 300 Puts, also for $14. This would give me bearish exposure to the market for seven months. If this coronavirus market pullback is short-lived and stocks rally soon, the most I can lose on this trade is the premium paid, or $1,400 per put purchased.

How this coronavirus situation will play out, and the impact it will have on the market, is truly anyone’s guess (especially in the short term). However, with call and put options we have the ability to get bullish and bearish exposure to any outcome.

[author_ad]