One of the key strategies of my Cabot Options Trader and Cabot Options Trader Pro advisories is tracking unusual call and put option activity, as we are essentially getting a real-time inside look at how hedge funds and institutions are positioning in the market and in individual stocks.

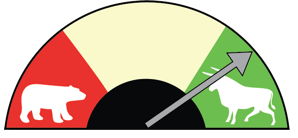

Last year I introduced a new feature for my subscribers called the Options Barometer, which I now post at the top of my daily morning email highlighting these big options trades. I described this new function to my readers, with a visual included:

“As you look at the graphic, the bull on the Barometer represents a bullish day of options trading, and the bear represents a bearish day. And the more bullish/bearish the day was, the needle will move toward either extreme of the graphic.

[text_ad]

“The big advantage of the Options Barometer is that it will give you a quick and straightforward view of the tone of institutional options trades from the prior day. At a glance, you’ll be able to know whether the big boys were positioning on the bull side or bear side (or if there wasn’t much activity at all). Depending on market action, a handful of very bullish (or bearish) days usually has me changing my outlook, so the Barometer gives you a clear view of my interpretation of what’s going on.”

And while this information is extremely valuable, of course not all of the trades made by these big traders will be winners. For example, here is my analysis of some of these big trades, and how they performed:

Where the Hedge Funds Won, Where the Hedge Funds Lost

The Winners - Kohl’s (KSS) and ServiceNow (NOW)

Early last week a trader aggressively bought puts in Kohl’s (KSS) specifically targeting a move lower on earnings. Here are those trades:

Tuesday – Buyer of 5,000 Kohl’s (KSS) November 51 Puts (exp. 11/22) for $1.70 – Stock at 54

Wednesday – Buyer of 4,500 Kohl’s (KSS) November 55 Puts (exp. 11/22) for $4.40 – Stock at 52.6

Kohl’s will report earnings on 11/19, which makes these puts expiring on 11/22 a pure earnings play that will likely be a big winner or a big bust.

Kohl’s announced earnings and cut their annual profit forecast sending the stock lower by 20%.

The 5,000 November 51 Puts (exp. 11/22) that were bought for $1.70 closed Friday at $4, or a profit of $1.15 million.

The 4,500 November 55 Puts (exp. 11/22) that were bought for $4.40 closed Friday at 8, or a profit of $1.6 million.

ServiceNow (NOW) stock chart looks like nearly every other hyper-growth stock’s chart. 2019 started with an explosive run from January to mid-July, followed by a sharp decline July through October, and more recently a bit of a rebound. And last week a trader bought a large premium call position looking for the stock to rebound in early 2020. Here are those trades:

Wednesday - Buyer of 2,700 ServiceNow (NOW) February 250 Calls for $21.60 – Stock at 252

Thursday - Buyer of 1,800 ServiceNow (NOW) February 250 Calls for $23.20 – Stock at 255

What I like about these trades is the net combined premium outlay of these two positions is approximately $10 million, plus the fact that the trader was willing to buy more calls, at a higher price, as the stock advanced on Thursday.

Just a couple days later, it was announced that NOW would replace Celgene in the S&P 500. This sent the stock higher by 11.50.

The 4,500 February 250 Calls purchased for an approximate price of $22 closed Friday at $39, or a potential profit of $7.65 million.

The Losers – Cronos Group (CRON) and Canopy Growth (CGC)

Marijuana stocks started 2019 on fire, and have since then come crashing back to earth. Interestingly, though, on Friday two of the leading stocks in this sector saw their stocks surge higher, as well as bullish option activity. Here are those trades:

Friday – Buyer of 5,000 Cronos Group (CRON) December 8 Calls for $0.93 – Stock at 8.25

Friday – Buyer of 5,000 Canopy Growth (CGC) December 20 Calls for prices ranging from $1.70 to $2.50 – Stock at 20

The trades listed above were the largest of those made in CRON and CGC on Friday … though of note, there was considerably more bullish option activity in these stocks. And while I am very intrigued by this action, and the potential for the sector to heat up again, CRON will report earnings on 11/20 and CGC will announce their numbers on 11/14, which could be the catalyst for this activity.

Earnings were disappointing for both of these stocks and the stocks fell, hurting both of these positions.

The 5,000 CRON December 8 Calls purchased for $0.93 closed Friday at $0.40, or a potential loss of $265,000.

The 5,000 CGC December 20 Calls purchased for an average price of $2.10 closed Friday at $0.90, or a potential loss of $600,000.

How to Use this Information to Profit

If you are looking to track and execute similar trades as these hedge funds and institutions then Cabot Options Trader will provide you with the inside real-time look at these types of trades.

However, if you prefer to play things a bit closer to the vest and are looking to get started trading options, our soon-to-be-launched Cabot Profit Booster advisory is a great place to get started as we will be exclusively trading conservative risk reducing covered calls.

To learn more about Cabot Profit Booster, click here.

[author_ad]