Stocks like Square (SQ) and Micron (MU) have led the market higher for most of 2017. But in the last two weeks, these stocks and many other leading growth stockshave begun to weaken. Do you want to know how to protect your stock gains while continuing to hold those two stocks for upside? Buy protective puts.

Fellow Cabot analyst Mike Cintolo, chief analyst of Cabot Growth Investor, wrote last Friday about “10 Ways to Sell Winning Stocks Better.” Today I’m going to add the protective put strategy to Mike’s playbook.

First, let’s look at what Mike wrote about Square:

[text_ad]

Square (SQ), which also had a big run recently, rallying a bit more than 30% during the past two weeks before Monday’s plunge. However, prior to this rally, the stock had enjoyed a monster move, rallying from a breakout point near 16 in February (and even more from its mid-2016 low near 9!). Combined with the recent downdraft, the action raises the odds of an intermediate-term top and is probably a good reason to at least sell some of your shares.

However, if you didn’t want to sell your shares because of tax reasons, belief in the stock in the long term or any other reason, you could use a protective put options trading strategy.

How to Protect Your Stock Gains with Protective Puts

A protective put is used when a trader is bullish on a stock he already owns, but wary of the stock’s short-term future. It is used as a means to protect unrealized gains, while giving the trader continued upside potential.

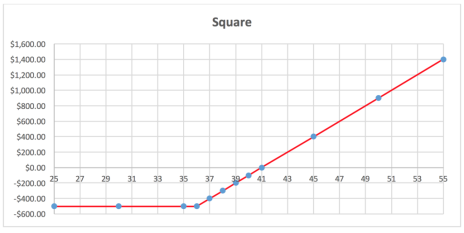

Theoretically, if you own 100 shares of Square (SQ), and the stock is trading at 38, this is how I would implement the strategy.

First, I would continue to hold my 100 shares.

Second, I would Buy to Open one SQ March 36 Put for $3

The total cash outlay for the put is actually $300 because each put represents 100 shares. That $300 is the insurance policy you took out on your stock position, and will protect your 100 shares if SQ were to take a much bigger fall. Here’s a graph of the stock position combined with the put purchased:

In essence, you have bought an insurance policy that will protect you for four months from a big fall. If SQ falls, your losses are stopped at 36, which is the strike price of the put that you bought. At 36 or below, you have the right, but not obligation, to exercise your put, which would take you out of your SQ stock position. You would likely exercise this right to sell your stock at 36 if SQ had fallen precipitously lower.

However, to the upside, your potential gains are unlimited!

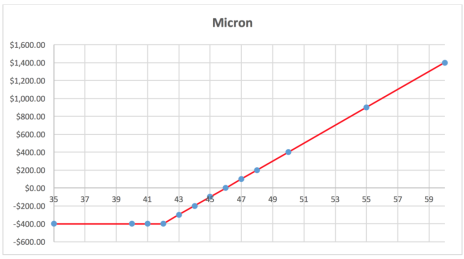

Next let’s apply this strategy to Micron (MU), which had been on a monster run, but has recently been under pressure.

Again, assuming you own 100 shares of MU, which is trading at 42, and want to execute a protective put strategy, you could Buy to Open one MU March 42 Put for $4.

When you buy this put for $4, your total cash outlay is actually $400 because each put represents 100 shares. That $400 is the insurance you took out on your stock position and will protect your 100 shares if MU were to take a much bigger fall. Here is the graph of the stock position, combined with the put purchased:

Similar to the SQ example, you have bought an insurance policy that will protect you for several months. If MU falls, your losses are stopped at 42, which is the strike price of the put that you bought. At 42 or below, you have the right, but not obligation, to exercise your put, which would take you out of your SQ stock position. You would likely exercise your right to sell your stock at 42 if it had fallen precipitously lower.

However, to the upside, your gains are again unlimited!

What makes these such compelling trades is that they protect the stock holding for several months against general market drops, North Korea headlines, Washington D.C. risk, etc. And because the puts don’t expire for several months, they also protect your holding against Square’s and Micron’s next earnings announcements.

While I don’t love paying for insurance/puts, given the recent dramatic drops in Square and Micron, this strategy is a great way to protect my stock holding while continuing to give me upside potential.

To learn more about how to trade options and how to protect your profits using calls and puts, consider getting a trial subscription to Cabot Options Trader.

[author_ad]