Meme stocks are still on the rise, but it’s impossible to know where they’ll be months from now. There’s a far less risky way to profit from them.

Dreams of Fed-fueled daily lifetime highs continue to dominate the minds of investors. The S&P 500 is now 25.7%—that’s right, 25.7%—above the pre-pandemic high set back on February 19, 2020. Over the past year I’ve received phone calls from friends I haven’t talked to in years to discuss SPACs, meme stocks, Dogecoin and the like … and they all trade on Robinhood.

Hmmm.

Now, some may argue that we are entering a new age of investing, and I’m certainly not going to stand in their way. I don’t have a crystal ball and I understand that as an options trader, my market biases mean very little. And while I may have a directional bias from time to time, I always rely on probabilities, not predictions, to ultimately lead the way.

[text_ad]

As traders, we can only take what the market offers. Trying to force the issue never works. And the market is offering some incredible opportunities, particularly if you understand a little bit about the options market. And if you don’t, well, you might want to reconsider that decision.

Opportunities abound.

Back on January 22 of this year, when GameStop (GME) began its quest to become a household name, the meme stock phenomenon was born.

At the time no one, other than the participants, thought the movement would last. It’s a fad, right? I wouldn’t argue with the sentiment, but it still doesn’t hide the fact that six months later many meme stocks are still thriving.

And the best part, we, as traders, are much better equipped to take advantage. The liquidity is there, and when liquidity is prevalent, more and more strategies become available. Strategies with precision. Strategies that, again, rely on probabilities, not predictions.

The Meme Stock Opportunity and Trade

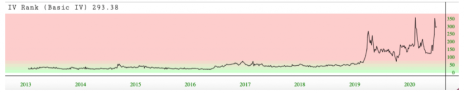

The chart below displays the implied volatility (IV) of AMC Entertainment Holdings (AMC) since 2013. It doesn’t take a long gaze to realize levels of implied volatility are at historic levels. And options traders are chomping at the bit. Why? Because the IV of options is mean reverting.

The question is, how can we take advantage of the heightened volatility? Easy: sell options premium through the use of risk-defined options strategies like bear call spreads, bull put spreads or iron condors, just to name a few.

Admittedly, I am a bit bearish on AMC at current levels. But as I stated before, I don’t have a crystal ball, so I allow probabilities to lead the way.

With AMC trading for 57.00, implied volatility sitting above 293 and a bearish leaning, the risk-defined strategy I would like to use is a bear call spread. A bear call spread or short vertical call spread is a bearish-leaning, risk-defined options selling strategy that consists of a short call with a lower strike price and a long call with a higher strike price. Both calls have the same expiration date.

But before we make any rash decisions, let’s see what the options market is offering.

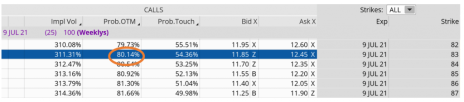

Let’s look at the options chain for the July 19, 2021 expiration cycle.

I like to start by looking for a potential short call strike with a probability of success hovering around 80%. Again, this is just where I start, as it gives me a good idea how much premium I can bring in at different strike prices. The short strike always defines your trade as it tells you what your probability of success is on the trade. In our case, the 83 call strike has an 80.14% probability of success. That’s 45.6% above the current price of AMC.

My next decision is which call strike to buy. The long call strike defines how much premium I will ultimately bring in and defines my overall risk on the trade. I can increase my risk exposure by choosing a wider spread or decrease my risk by choosing a strike closer to my short call strike.

The IV is absolutely jacked right now, currently sitting above 300% for the expiration cycle.

As a result, we can sell an AMC 83/87 bear call spread with a probability of success of just over 80%. The max return on the trade is $0.57, or 16.6% over the next 25 days.

If AMC stays below our short call strike of 83, again currently 45.6% above where the stock is trading, we have the ability to make a max profit of 16.6%.

However, if I am given the opportunity for an 8% to 12% profit, I would be more than happy.

The best part? Our risk is defined. Yes, we have the potential for a max loss of $343 per bear call spread, but I typically get out of the trade when the spread hits 1 to 2 times my original credit of $0.57. Moreover, I keep my position size to roughly 1% to 5% per trade.

I know, this type of trade isn’t going to make you rich. But the market is offering quite a few high-probability, mean-reversion trades right now. And I’m fine with a few singles and doubles over the next three to four weeks. And I can almost guarantee that no one is going to call me to talk about these high-probability opportunities. They are too busy taking the other side.

[author_ad]