I’m always puzzled why so many investors move to cash when the market turns sour, especially when there are risk-defined strategies to take advantage of a volatile and challenging market.

I mean, I get it, but oftentimes there are far better alternatives, especially if you know how to properly incorporate options strategies. And if not, well, it behooves us as self-directed investors to learn as much as we can about how to make money in all market environments, not just bullish ones. And that’s the beauty of options strategies—they allow us to make money regardless of the overall market trend. It’s all in the approach.

I recently wrote about the overall spike in options prices across the board due to the volatile nature of the market. In the article I displayed a few images from my platform going over the difference on options prices during a “normal” market environment, compared to that of a highly volatile market like the one we’re in now.

[text_ad]

The difference is stark. Options prices are inflated by three to five times in the major market indexes like the S&P 500 ETF (SPY), Nasdaq 100 (QQQ) and several others.

But a couple questions come to mind: How can we take advantage of the inflated options pricing and what is an appropriate strategy to do so?

Well, there are numerous, risk-defined options strategies, all with weird names of course. Bull put spreads, iron condors and the strategy I want to discuss today, bear call spreads.

A bear call spread, otherwise known as a short call vertical spread, is one of my favorite risk-defined options strategies.

As the name of the strategy implies, a bear call spread is, well, a bearish-leaning strategy.

But it is important to note that the strategy doesn’t require the security to move lower to make money. Unlike the binary nature of stock strategies, a stock can either go up or down with a bear call spread and you still have the opportunity to make money.

A high-probability approach to the strategy gives you a built-in margin of error just in case the stock moves against you. And in this highly volatile environment that margin of error is significantly greater than during a so-called “normal” market environment.

So again, with a bear call spread you not only have the ability to make a return when a security moves lower, you can also make money if the stock stays flat or even if the stock pushes slightly higher.

Let’s take a look at a quick example using a bear call spread with a high-probability approach. And when I say “high-probability approach,” I’m talking about a trade that has at least an 80% probability of success.

An SPY Bear Call Spread

When SPY was trading for 390.89 last month, we took a look at a potential trade using a bear call spread, focusing more on the mechanics of the trade.

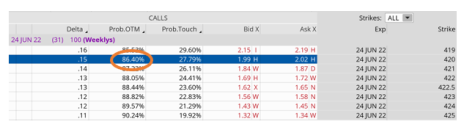

Below is the SPY options chain for the June 22, 2022 expiration cycle which, at the time, was 27 days from expiration.

The SPY 420 call strike with an 86.40% probability of success is where I want to start. By choosing the 420 call strike, not only is our probability of success well over 80%, our margin of error is roughly 29 points. Basically, SPY can move as high as 420 (as indicated by the orange line on the chart) and we can still have the potential to make a profit on the trade. The short call strike defines my probability of success on the trade. It also helps to define my overall premium or return on the trade.

Once I’ve chosen my short call strike, in this case the 420 call, I then proceed to look at a 3-strike wide, 4-strike wide and 5-strike wide spread to buy.

The spread width of our bear call helps to define our risk on the trade. The smaller the width of the spread the less capital required. When defining your position size knowing the overall defined risk per trade is essential. Basically, my spread width and my premium increase as my chosen spread width increases.

For our example, let’s take a look at the 5-strike, 420/425 bear call spread.

Trade Example: 420/425 Bear Call Spread

Simultaneously:

Sell to open SPY June 24, 2022 420 strike

Buy to open SPY June 24, 2022 425 strike for a total net credit of roughly $0.65 or $65 per bear call spread

- Probability of Success: 86.40%

- Total net credit: $0.65, or $65 per bear call spread

- Total risk per spread: $4.35, or $435 per bear call spread

- Max Potential Return: 14.9%

As long as SPY stays below our 420 strike at expiration, I have the potential to make 14.9% on the trade. In most cases, I will make slightly less, as the prudent move is to buy back the bear call spread prior to expiration. Typically, I look to buy back the spread when I can lock in 50% to 75% of the original credit.

Since we sold the spread for $0.65, I want to buy it back when the price of my spread hits roughly $0.30 to $0.15. Of course, there are a variety of factors to consider with each trade. And we allow the probabilities and time to expiration to lead the way for our decisions. But taking off risk by locking in profits is never a bad decision and by doing so, we have the ability to take advantage of other opportunities the market has to offer.

Risk Management

Since we know how much we stand to make and lose prior to order entry we have the ability to precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so by keeping each trade at a reasonable level (I use 1% to 5% per trade) allows not only the Law of Large Numbers to work in your favor…it also allows you to sleep well at night.

I also tend to set a stop-loss that sits 1 to 2 times my original credit. In my example, I sold the 420/425 bear call spread for $0.65. As a result, if my spread reaches $1.30 to $1.95 I will exit the trade.

As I wrote the other day, we are getting more than three times as much per trade now, while our probabilities on each trade remain the same. Thus, a trade with an 80% probability of success pays significantly more during volatile periods than that same 80% probability of success trade during normal times of volatility.

And that’s why now is the time to start selling options premium using risk-defined strategies!

Now, if you need help doing it, and want to learn about some of my other options selling strategies, just this week I have launched FIVE new options trading advisories for Cabot, under the umbrella of what we’re calling the Cabot Options Institute. To learn more about it, and to decide which of the five advisories might be right for you - or, if you’d prefer to start small, to sign up for my free newsletter - simply click here.

Have you ever traded bear call spreads? If so, tell us about your past trades in the comments below.

[author_ad]