One of my favorite components of my role as Chief Analyst of Cabot Options Trader is working with beginner options traders. Very quickly they come to realize that you don’t need to be a rocket scientist to learn to trade options, and with my assistance, these subscribers realize that options should be a part of every investor’s trading playbook.

And once I have worked with a beginner options trader at Cabot Options Trader, they can choose to graduate to Cabot Options Trader Pro, where I teach about and execute more advanced strategies such as Bull Call Spreads, Bear Put Spreads, and my personal favorite, Iron Condors.

How Iron Condors Work

While the name Iron Condor may be foreign to you, it’s a risk-defined options strategy that is a great way to create yield. It is a strategy that has a high probability of success, allowing for a modest profit with enough room for error. Also, it’s meant to be a directionally neutral trade.

[text_ad]

Essentially, Iron Condors are a strategy that will profit if a stock stays within a defined trading range. And the profits can be substantial.

The Long Iron Condor position is the combination of a short call spread and a short put spread in the same underlying stock.

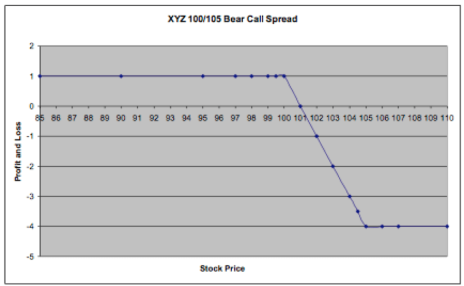

Here’s the hypothetical short call spread:

Stock XYZ is trading at 90. You’d theoretically sell the 100/105 bear call spread for $1. To execute this trade, you would:

Sell the 100 calls

Buy the 105 calls

For a total credit of $1.

Here is the graph of this trade at expiration.

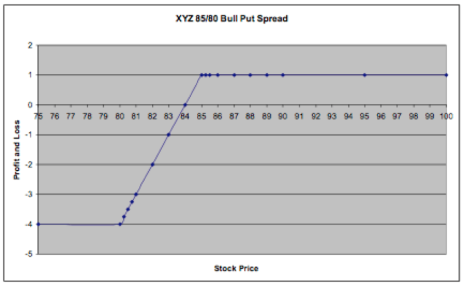

Here’s the hypothetical short put spread:

Stock XYZ is trading at 90. You’d sell the 85/80 put spread for $1. To execute this trade you would:

Sell the 85 Puts

Buy the 80 Puts

…for a total credit of $1.

Here is the graph of this trade at expiration:

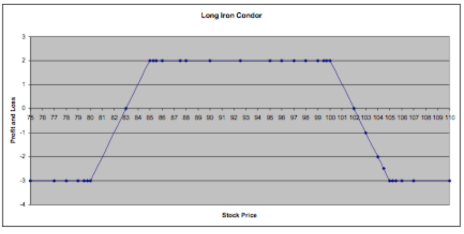

Now we will combine these two spreads to make a Long Iron Condor. To do this, you need to simultaneously:

Sell the 100 calls

Buy the 105 calls

…for a total credit of $1, and…

Sell the 85 Puts

Buy the 80 Puts

…for a total credit of $1.

This would give you a total credit of $2.

Here is the graph of this trade at expiration:

As you can see in this last chart, at expiration, you’d make $2 as long as the stock stays between 85 and 100. Meanwhile, your downside is limited to $3 if the share price goes lower than 80 or higher than 105.

If you are new to options I recommend starting slow and working with me to first learn how to buy a call, buy a put, and trade Covered Calls. However, once you have mastered those strategies, Iron Condors are a great next step to adding even more yield to your portfolio.

[author_ad]

*This post has been updated from an original version.