As many people know, the Federal Reserve and Central Bankers across the globe have driven interest rates to near zero percent. This has created a real problem for traders and investors looking to create yield in their portfolio. This is a problem!

Fortunately, at Cabot we have come up with a solution. We are going to combine stock ideas from Mike Cintolo, Chief Analyst of our Cabot Top Ten Trader advisory, along with my covered call trades to make money three ways. It’s called Cabot Profit Booster.

The Solution!

First, a little bit about Mike. Mike is someone who eats, sleeps and dreams about stock charts. And what he does at Top Ten Trader is recommend to his subscribers the 10 stocks that have the best charts, numbers and stories every Monday evening. Mike’s recommendations can make money two ways for his subscribers as these stocks can rise in value, and some of the stocks he recommends pay dividends.

The third way Cabot Profit Booster subscribers can profit is to then add one of my covered call ideas, which I learned about as a former market maker on the floor of the Chicago Board of Options Exchange, on Mike’s stock picks. These covered calls can boost profits on Mike’s picks 3%-15% in one month!

So what do subscribers of Cabot Profit Booster get?

Every Monday evening Mike will release his Top Ten stock ideas to his subscribers.

Then Jacob will find the stock from Mike’s list that has the best covered call potential and send you my trade idea Tuesday morning shortly after the market open. That trade idea will include a portion of Mike’s analysis of the stock, as well as his full technical analysis, the chart, and his stop, which we will be tied to.

Then I will break down my trade idea along with the breakeven, as well as the potential outcomes. And lastly I will include an analysis of our current open positions.

Here is an example of what you will get every Tuesday morning:

If you would like to get on the list for Cabot Profit Booster, which will publish its first idea next week, and get Mike and Jacob’s trade ideas, here is the link.

What is a Covered Call?

A Covered Calls is a VERY basic options strategy, and a great way for those who have never traded options before, to start learning about options and options trading.

When you execute a covered call, you either Own or Buy a stock and sell a call option on that stock.

For every 100 shares of stock you own, you can sell 1 call. It’s a multiplier of 100. So if you own 500 shares of stock you can sell 5 calls. Again, it’s a multiplier of 100.

When you sell that call, you collect a premium.

So if you sell one call for $1, you actually collect $100 … again it’s a multiplier of 100. If you sell one call for $5, you collect $500.

So why is this such a popular strategy for investors?

This is a great way to create yield against stocks you own. Also, this is a VERY conservative strategy as selling covered calls doesn’t increase your risk … in fact it REDUCES your cost basis

Mike’s Stock Idea with Jacob’s Covered Call Trade

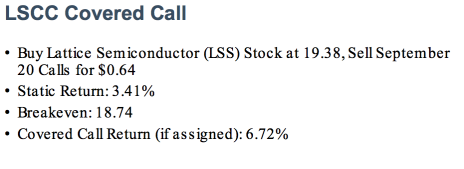

So let’s take a look at a Covered Call I executed on Lattice Semiconductor (LSCC), which is a stock that Mike recommended for his Top Ten subscribers.

I bought LSCC stock at 19.38, and sold the September 20 Call for 64 cents. Now remember, when I sell a call for 64 cents, that 64 cents is actually $64 as it’s a multiplier of 100. That $64 dollars comes into my account.

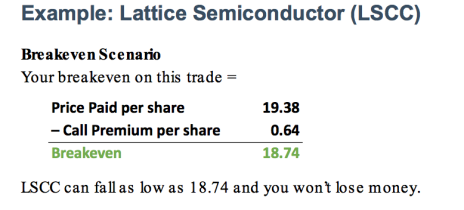

Now let’s break down the various scenarios of this trade. I bought stock at 19.38 and sold the call for $0.64, which reduces my breakeven on this stock purchase to 18.74. Remember this is a conservative strategy that reduces my breakeven on my stock purchase. So in this case LSCC can fall as low as 18.74 and I won’t lose money.

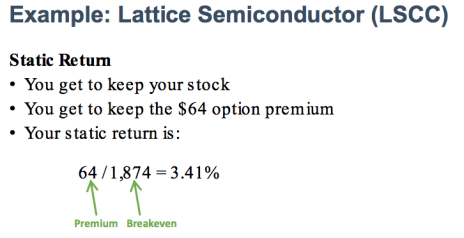

Now let’s move on to the scenario I refer to as Static Return. If LSCC doesn’t move for the next month that September 20 call that I sold would expire worthless, and I will collect that $64, and create a yield of 3.41% in one months’ time. We have created yield against a stock that hasn’t moved.

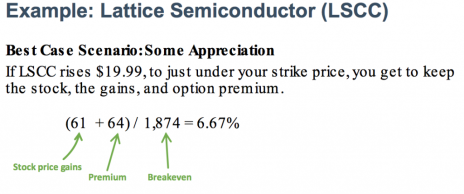

The best-case scenario for this trade is if LSCC rises to 19.99, or to just under the September 20 strike that I sold. In this scenario I get to keep the stock holding, as well as the stock gains as the stock rose from 19.38 to 19.99, and the call premium. I have created a yield of 6.67% in one month.

The worst-case scenario for a covered call is where the stock drops dramatically. In this scenario I would lose money on my stock holding, much like if I owned any stock. However, because I collected a call premium, my losses aren’t as bad, as I lowered my cost basis. Remember: this is a very conservative, risk reducing strategy.

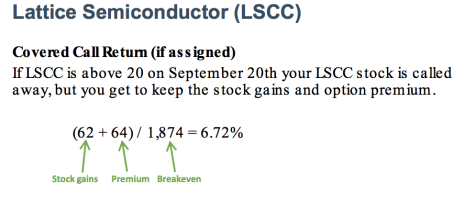

The next scenario is what I refer to as Covered Call Return (if assigned). In this scenario LSCC rises above 20 on September expiration. If this were to happen the trader who bought the call from me would exercise his right to buy the stock from me, and I would not participate in significant upside should the stock rise dramatically. However, I would have made $62 on the stock rise, as well as $64 from the call sale, and net/net I would have a profit of 6.72% in one month. This would be a great scenario.

So how did this trade work out for me? The September 20 call that I sold expired worthless and I created a yield of 3.41% in September.

Then in October I sold the October 20 Call for $0.80, and created a yield of 3.2%.

While a yield of 3% in one month doesn’t sound like a home run, in this 0% interest rate environment if I can create yields of 3% to 15% EACH MONTH, then these trades amount to home runs.

Access to Jacob

And if you have any questions about this trade idea, our open positions, or if you are new to options and want to discuss with me how to execute a covered call you have access to my personal email at Jacob@cabotwealth.com.

I am very excited about the awesome potential of Cabot Profit Booster and look forward to creating yield on great growth stocks in the weeks/months and years to come.

[author_ad]