Sometimes Cabot Analysts Agree … Sometimes We Do Not

Last week I received a great email from a Cabot Options Trader subscriber. Here’s what it said: “Jacob, I took the S&P 500 298 put position as you suggested last week as a protective measure … Given that Michael Cintolo, and today Tim Lutts, are more positive on the market does it still make sense to keep these put positions?”

This email followed my recommendation that Cabot Options Traders and Cabot Options Trader Pro subscribers hedge a portion of our bullish portfolio. Here is more on my reasoning, with a bit of options education mixed in, for adding a put position from my trade alert:

[text_ad]

“For the past several months the Cabot Options Trader portfolio has been holding 8-12 bullish positions without a hedge. This has been the right play as big picture the market has mostly chopped around, and is today back within 1% of all-time highs. And while I do think the odds favor the market making new highs, which is why we are holding so many bullish positions, with the VIX below 14, the price is again right to add a hedge to the portfolio. Also, with one bearish position in the portfolio, I can more comfortably add even more bullish exposure should the market continue to strengthen.

“Please note, as is always the case when we buy a hedge, we hope this trade goes bad, and the rest of our bullish positions trade much higher.”

As you can see, I am still fairly bullish on the market. Though I have to admit, perhaps I am a bit less bullish than Tim, who is very positive on the market, and Mike, who is bullish, but with some reservations. Here is some of what each wrote last week:

Tim: The bull market is alive and well, with all major indexes near all-time highs and all Cabot’s market timing indicators giving positive signals, telling us the market will likely be higher months from now.

Mike: All in all, then we’re still tilted to the bull camp because most of the evidence out there is positive, and the fact that it’s a bull market shouldn’t be forgotten. But few stocks are running away on the upside and there remain plenty of crosscurrents, so we’re favoring holding some cash and being choosy on the buy side.

Cabot analysts often have different views when it comes to the market’s health and overall environment, given that we employ different methodologies.

These varying views on how we see the market are totally healthy; that’s what makes a market, as they say. And really, I don’t think our views are all that divergent. If you fall into my camp of being bullish, but also a bit wary of a potential short-term market decline, here is an excerpt from an options education article I found years ago on the Chicago Board of Options Exchange website that helps Calculate the Index Contracts to Hedge a Portfolio.

Please note, when we trade the S&P 500 in my Cabot Options Trader advisory, we trade the SPY, which is worth 1/10th of the SPX. For example, today the SPX is trading at 2,990, while the SPY is trading at 299.

Options Education: Calculating Index Contracts to Hedge a Portfolio

“Stock prices tend to move in tandem with the overall stock market as measured by the S&P 500 ETF Trust (SPY). The 500 stocks that comprise the S&P 500 Index represent almost 85% of the stock market value in the United States. Therefore, the index is an excellent reflection of the overall stock market. If an investor owns a portfolio of stocks and is concerned about a near-term downward move in the overall market, purchasing the appropriate SPX put options could be a desirable alternative to hedging each stock individually. (Please note in the example below the SPX is quoted at a price below the current price.)

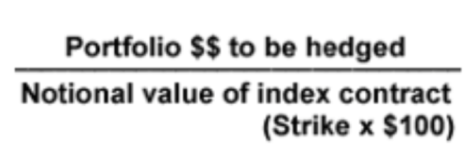

“Determining the number of contracts to use to hedge a portfolio is a fairly simple process using the following formula:

“Each SPX option represents $100 times the strike price. For instance, if an SPX put with a strike price of 1250 is utilized, it would represent $125,000 of market value (1250 x $100). So, an investor with a stock portfolio valued at $500,000 would purchase 4 SPX 1250 puts ($500,000 / $125,000) to hedge the portfolio.

“For example, consider an investor who has a diversified stock portfolio valued at $500,000 and is concerned about a market correction of 10% over the next 30 days. With the S&P 500 Index quoted at 1,250, a correction of 10% would result in the S&P 500 trading at 1,125.00. The investor could choose to purchase four 30-day SPX 1,250 puts quoted at 25.00 ($2,500 per contract) that would have a total cost of $10,000, or 2% of the value of the portfolio.

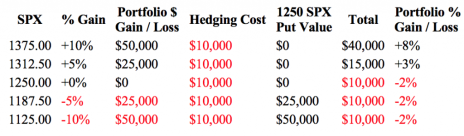

“The above table shows the dollar and percent results of this strategy based on the S&P 500 index at a few levels upon option expiration. Because at-the-money SPX option contracts are used for hedging, the maximum potential loss is equal to the 2% cost of hedging. Thus, 2% of performance is sacrificed on the upside if an unanticipated market rally occurs. A payout comparison between a hedged and un-hedged portfolio appears in the payout diagram below.”

If I felt that I needed a hedge today, I would look at puts in the SPY and QQQ, both of which have 3-6 months until their expiration, and are just below the current price of the index. For example, I might look at:

S&P 500 ETF (SPY) February 295 Puts

Nasdaq ETF (QQQ) March 188 Puts

Big picture, I am hopeful that the market makes new highs in the weeks and months to come as Tim and Mike are expecting. However, just in case things get worse, I hope this bit of options education has taught you how to protect your portfolio.

[author_ad]