The first two weeks of earnings season have had plenty of disasters as well as monster winners. And with Apple (AAPL), Square (SQ), iQIYI (IQ), Tesla (TSLA) and many other high-profile companies reporting this week, there’s a way to price in risk heading into those events: by simply looking at the options market. It can tell you how much stock movement the options market is pricing in for earnings, or any event.

For example, let’s take a look at what the options market is expecting from Apple (AAPL), which will report earnings today after the close.

With AAPL stock trading at 190 we need to look at the call and put options that are trading closest to 190. And these options need to be the calls and puts that expire the week of earnings.

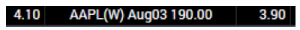

In this case, with earnings today, we look for the options that expire Friday, August 3. Here is the options market for these calls and puts:

The calls (on the left) are worth approximately $4.10, and the puts (on the right) are worth $3.90. When we combine these two values it tells us that the options market is pricing in an expected move of $8, or 4.2%, this week.

And here are a couple more expected moves for the other high-profile stocks reporting this week:

[text_ad]

iQIYI (IQ) - $3.50 expected move

Square (SQ) - $6 expected move

Tesla (TSLA) - $26.50 expected move

Shake Shack (SHAK) - $5.75 expected move

I send this information, as well as a breakdown of recent bullish and bearish option activity on many of the hot companies reporting earnings, to my Cabot Options Trader subscribers. Though of note, I don’t price these expected moves until hours before the earnings are released since a lot can change between today and the earnings day.

For example, here is a sample of my analysis of NFLX from two weeks ago:

“Netflix (NFLX) earnings today after the close.

“With the stock trading at 400, the options market is pricing in a move of $35, or 365 to the downside and 435 to the upside. Last earnings cycle, NFLX rose from 307.75 to 336 on earnings. Skew is pricing in extreme fear to the downside and upside. Open interest is skewed bearish on a ratio of 1.2:1 put over call. Year-to-date NFLX is higher by 107%.

“Friday and this morning NFLX received a couple downgrades including commentary from UBS noting investors ignoring rivals eating into market share, and Buckingham cutting to sell noting international competition.

“On Friday a trader rolled a massive winning position when he sold to close 15,000 December 270 Calls and bought 15,000 December 350 Calls for $74.65. This trader is essentially cashing in on a big winner, but still has a $111 million position open.”

The reaction to Netflix’s earnings should be a great read on traders’ willingness to take risk in growth stocks as earnings season progresses.

And you can do this exercise with any stock or index.

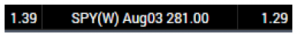

For example, with the S&P 500 ETF (SPY) trading at 281, we can price the expected move this week ahead of the July Jobs Report by again looking at the call and put expiring this week that is closest to the stock price. In this case that is the 281 strike expiring Friday, August 3. Here is the options market for these calls and puts:

The calls (on the left) are worth $1.39, and the puts (on the right) are worth $1.29. When we combine these two values it tells us that the options market is pricing in an expected move of $2.68, or just under 1%.

This is also a great exercise to price in the potential move for a biotech announcement or any other binary event.

And as earnings season progresses and one of your stocks (or a stock you’re waiting to buy) blows up much like Facebook (FB) and Intel (INTC) have, keep in mind my “Three-Day Rule”—a rule I learned from my days on the Chicago Board of Options trading floor that warns about buying immediately after an earnings miss. If you want to know more about the Three-Day Rule, click here.

[author_ad]