As an options trader, the recent pullback in the market has led to some interesting opportunities. Namely, it’s a great opportunity to employ an options selling strategy.

The CBOE Volatility Index (VIX), also known as the market’s fear gauge, is on track for its sharpest rise to start a year…in history. Moreover, this is the biggest jump we’ve seen in the VIX since the initial impact of COVID hit the market.

Central bank monetary tightening spurred by inflation fears, geopolitical conflict and growth fears stemming from the pandemic are just a few of the concerns circling the market airwaves. Regardless of the reason or rationale behind the recent correction, it’s a good time to use an options selling strategy.

[text_ad]

Bear call spreads, bull put spreads and iron condors are just a few of the options strategies that are now on the table. Why?

Just look at the IV (implied volatility) rank of the S&P 500 ETF (SPY). IV rank is an important tool when measuring the current levels of implied volatility in a stock or, in this case, an ETF. The volatility measure tells us if the current implied volatility is high or low compared to levels of volatility over the past 12 months.

And as you can see, the current IV rank is pegged. The high IV rank simply means that it is a good time to start considering a few options selling strategies like the three I mentioned before. When implied volatility is high, options premium is high, so options selling strategies, like credit spreads, become a logical choice.

For instance, let’s take a look at an iron condor on SPY going out roughly 25 days.

An iron condor is not only one of the most powerful options strategies, it’s also one of the best all-around investment strategies that we as investors have at our disposal.

The strategy consists of a short call vertical spread (bear call spread) and short put vertical spread (bull put spread).

If all the aforementioned seems like a foreign language, no worries. This is a strategy I want all investors to learn, so I’m going to go through the strategy and my approach in a step-by-step process.

4 Steps to an Iron Condor Options Selling Strategy

Step One – Liquidity

Liquidity is king. The first step when trading iron condors, or any options strategy for that matter, is to make sure you are choosing a highly liquid stock or ETF. Some of the best ways to find out if an underlying security is liquid is to take a look at the open interest, volume and bid-ask spread for the at-the-money options.

Why would I want to trade an underlying security that requires me to make 5% to 15% on average just to get back to breakeven? It doesn’t make sense. Remember, we want to use efficient products that allow us to get in and out of the trade with ease. Don’t overlook the importance of using highly-liquid securities.

Step Two – Expected Move

Let’s say we decide to place a trade in the highly liquid SPDR S&P 500 (SPY) going out roughly 25 days until expiration.

The expected move, also known as the expected range, is from 416 to 464 over the next 25 days.

The expected move is the amount a stock or ETF is predicted to advance or decline from its current share price, based on the security’s current level of implied volatility and days to expiration. Additionally, the expected move fluctuates, in real time, based on changes in a security’s price and its implied volatility.

Simply stated, the expected move shows us the future expected range of a security over a specific time frame.

In most cases, my goal is to place my iron condor outside of the expected move. Moreover, I prefer to have my probability OTM or probability of success around 75%, if not higher, on both the call and put side.

Step Three – Choosing Expiration Cycle and Strike Prices

Since I know the expected range for the S&P 500 (SPY) for the February 18, 2022 expiration cycle is from 416 to 464, I can then begin the process of choosing my strike prices.

Call Side of the Iron Condor:

The high side of the expected move is, again, 464 for the February 18, 2022 expiration cycle, so I want to sell the short call strike just above the 464 strike, possibly higher.

As you can see above, the 466 strike with an 86.99% probability of success fits the bill. Once I’ve chosen my short call strike, I then begin the process of choosing my long call strike.

Remember, buying the long strike defines my risk on the upside of my iron condor. For this example, I am going with a 5-strike wide iron condor, so I’m going to buy the 471 strike.

As a result, I am going to sell the 466/471 bear call spread for roughly $0.65. But, before I place the trade I want to choose the bull put portion of my iron condor.

Put Side of the Iron Condor:

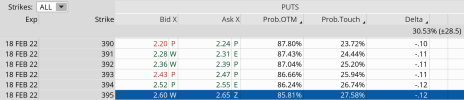

The low side of the range is, again, 416 for the February expiration cycle, so I want to sell my short put strike just below the 416 strike, possibly lower.

As you can see above, the 395 strike with an 85.81% probability of success fits the bill. Once I’ve chosen my short put strike, I then begin the process of choosing my long put strike. Remember, buying the long put strike defines my risk on the downside. For this example, I am going with a 5-strike wide iron condor, so I’m going to buy the 390 strike.

We can bring in roughly $0.40 from the bull put portion of our iron condor. This brings our total premium to $1.05 ($0.40 + $0.65) for the iron condor.

Again, it’s all about the probabilities when using an options selling strategy. The higher the probability of success, the less premium you should expect to bring in. But as long as I can bring in a reasonable amount of premium, I always side with the higher probability of success, as opposed to taking on more risk for a greater return.

So, with a range of $71 ($395-$466) and SPY trading for roughly 439.84, the underlying ETF can move higher by 5.9% or lower by 10.2% over the next 25 days before the trade is in jeopardy of taking a loss.

Here is the theoretical trade:

Simultaneously…

- Sell to open SPY February 18, 2022 466 calls

- Buy to open SPY February 18, 2022 471 calls

- Sell to open SPY February 18, 2022 395 puts

- Buy to open SPY February 18, 2022 390 puts

We can sell this iron condor for roughly $1.05. This means our max potential profit sits at approximately 26.6%.

Again, I wanted to choose an iron condor that was outside of the expected move and has a high probability of success. This is why I sold the 466 calls and the 395 puts.

Step Four – Managing the Trade

I typically close out my trade for a profit when I can lock in 50% to 75% of the original premium sold. So, if I sold an iron condor for $1.05, I would look to buy it back when the iron condor reaches $0.50 to $0.25. This way I’m pocketing $0.55 to $0.80 on the trade.

If the underlying moves against my position I typically adjust the untested side. Most roll the tested side, but all research states that rolling the untested side higher/lower allows me to bring in more premium and thereby decreases my overall risk on the trade. Moreover, I look to get out of the trade when it reaches 1 to 2 times my original premium. So in our case, when the iron condor hits $2.10 to $3.15.

Ultimately, position size is the best way to truly manage an iron condor. We know prior to placing a trade what we stand to make and lose on the trade, therefore we can adjust our position size to fit our own personal guidelines. Iron condors are risk-defined, so it’s important to take advantage of their risk-defined nature by staying consistent with your position size for each and every trade you place.

Do you have any questions about iron condors or any other options selling strategy? Leave us a question in the comments below.

[author_ad]