Options trading is a powerful investing strategy. How powerful? Powerful enough to protect your stocks from the most powerful man in America.

Let me explain.

Earlier this week, President-elect Donald Trump sent Tweets targeting General Motors (GM) and Ford (F), America’s top two auto manufacturers. Though Trump isn’t President yet, he’s already moving stocks and sectors via his Twitter account!

Here’s the Tweet that Donald Trump sent about GM on Tuesday:

“General Motors is sending Mexican made model of Chevy Cruze to U.S. car dealers-tax free across border. Make in U.S.A. or pay big border tax!”

GM stock immediately dipped 3%, though it has since recovered.

[text_ad use_post='129624']

Trump’s harsh criticism of GM comes on the heels of some pointed comments aimed at its chief rival, Ford, for its proposal to create a new small-car manufacturing plant in Mexico, a move he termed a “disgrace” back in September. Then, this week, Ford abandoned its plans for a Mexican plant, earning applause from Trump—once again, on Twitter.

“Thank you to Ford for scrapping a new plant in Mexico and creating 700 new jobs in the U.S. This is just the beginning—much more to follow.”

Ford stock was up more than 8% in just two days after receiving Trump’s praise. Prior to that, however, Ford shares had tumbled as much as 6.5% after originally drawing Trump’s ire nearly four months ago.

Clearly there is now the risk that a Trump Tweet sent without warning could sink the shares of a holding of yours. And really, would it shock you if one day he took a shot at a Facebook (FB), Apple (AAPL) or Tesla (TSLA)?

So how can you protect your stocks if Trump goes after one of your holdings and turns it into a losing position?

First off, don’t panic and sell right away. Instead, look to the options trading market to get a feel for how the hedge funds and institutions are trading following this news.

The options market is where I get my clues about how the biggest traders are positioning themselves. And when I do have a stock go against me, I continue to monitor the options trading market to get a feel for the bullish and bearish positioning.

In the case of General Motors following this week’s Trump Tweets, hedge funds and institutions have not been aggressively buying put options—indicating that a big fall isn’t anticipated.

Here’s how I looked to the options trading market when one of our positions was down.

One of our Cabot Options Trader holdings, a Microsoft (MSFT) call, was down along with the technology sector and sitting at a small loss.

A subscriber asked me in an email, “The calls we bought are down $0.25, should we buy more?” My answer was the same as always: “I NEVER double down on a trade!”

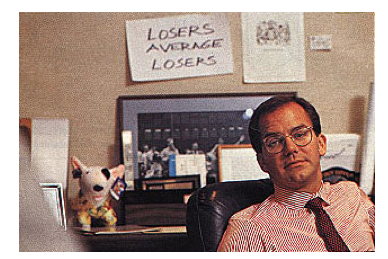

If I’m going to be wrong (and I’m not worried about the MSFT trade yet), I’m only going to be wrong once. Here is a picture of famed trader Paul Tudor Jones in his office. On the wall behind him is a saying that many top traders adhere to “Losers Average Losers.”

(By no means am I calling the e-mailer a loser! Everyone has his own trading styles and rules. And it’s always your choice if you want to buy more of a losing position. I know plenty of Cabot readers who double down—sometimes it works, and other times, not so much. However, I never will.)

But I continue to check the option order flow. For now, the bullish option order flow remains very strong in MSFT, so I will hold my position.

That said, clearly I bought the MSFT call too early. And that’s okay. All honest traders will tell you that picking the market’s or a stock’s bottom or top is impossible, especially in a market like the current one that’s seeing intense sector rotation. While I would like all trades to work quickly, I don’t get too worked up about short-term price swings.

And though it’s painful at times, I also don’t beat myself up too badly if I decide not to enter into a trade because it doesn’t meet my criteria.

Here’s an example of a trade I missed.

Cognizant Technology Solutions (CTSH) had been on my radar for the past month because a trader had bought over 30,000 April 55 Calls in late October. However, 20,000 of these calls were bought right before the company reported earnings, so I decided to pass on a trade. Earnings passed, the stock barely moved, and I figured the trade was likely going to be a losing earnings trade for the buyer.

But recently, activist investor Elliott Management published a letter it had sent to the board of Cognizant Technology Solutions noting the stock’s underperformance and suggesting steps to create value. In the letter, Elliott noted that the company could achieve a value of 80 to 90 per share by the end of 2017. The letter caused the stock to jump from a close at 53.25 to 57.15 the next afternoon.

So it now appears that the buyer of the April 55 Calls was Elliott Management, and they weren’t targeting an earnings trade.

There is always the risk of missing out on the next big winner and timing risk like MSFT, and now, there’s Trump Risk (and, in Ford’s case, Trump Reward). But by watching options order flow, you can see what the hedge funds and institutions are doing, and by buying or selling options, you can gain along with them and protect your stocks from too much harm.

[text_ad use_post='125418']