The market seems destined for another pullback, as several indicators show. Protect your downside with these two put options trades.

Stocks have gone almost straight up since November 2020, as more widespread vaccines provided hope for the economy getting back to “normal” soon. The S&P 500 Index is up 27.5% over the past five and a half months alone!

After a recent pause in March, the Dow Jones Industrial Average and S&P 500 have notched new highs as the rally continues. The move has been spectacular and somewhat unusual. That’s because there have not been any significant pullbacks of more than one or two weeks in between before the rally resumes again.

This relentless upside price action may be lulling some investors into a false sense of complacency, expecting the one-way upside trade to continue indefinitely. That’s never the case, which means it’s time to protect your portfolio from an inevitable downturn. I suggest two put options trades to use as a hedge. More on those in a bit.

[text_ad]

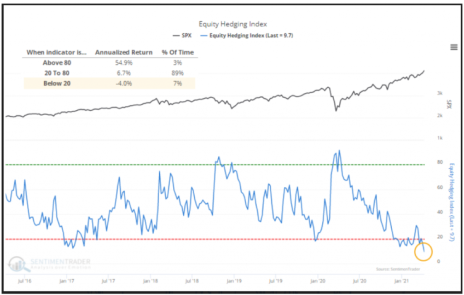

Back to the market, analysts at SentimenTrader recently raised a red flag. They note that with stocks ripping higher, investors don’t see any need to hedge their portfolios against a possible correction.

SentimenTrader’s Equity Hedging Index recently dropped below 10 for one of the very few times since they began tracking this data nearly 20 years ago. This is a contrary indicator, so the lower the index reading the more potentially bearish the signal is, suggesting that stocks may struggle in the near term.

In fact, in the firm’s nearly two decades of data, there have been only nine other times when the hedging index sank this low. Weak stock market returns followed every one of those signals.

Bearish Bet Made

This does not mean a major sell-off is looming, just that the upside in stocks may not be as robust as investors have gotten used to in recent months.

My colleague Jacob Mintz also noted one other interesting tidbit last week: “The market may not be completely out of the woods as last week a trader executed a very large bullish bet on the VIX.”

Options on the CBOE Market Volatility Index (VIX) are widely used by professionals to hedge their long equity positions. And last Thursday, this trader bought 200,000 VIX July 25/40 Bull Call Spread for $2.15.

This represents a $43 million bearish bet on the stock market that would pay off only if the VIX moves above 25 by July expiration from less than 17 now. That would mean a roughly 50% jump in the VIX over the next three months.

An upward move like that in the VIX would almost certainly be accompanied by a sharp downward move in the stock market.

So, while many investors see no need to hedge with stocks moving mostly up for months, the big boys are still looking for ways to protect their downside, just in case. Perhaps you should consider it too.

2 Potential Put Options Trades

Aside from VIX options, which can be volatile and difficult to trade, you might consider put options trades on some of the major index ETFs. For example, put options on the SPY and QQQ index ETFs, which track the S&P 500 and Nasdaq 100, respectively, are very liquid and relatively easy for individual investors to access as a handy hedge against a market downturn.

If you’re looking to protect your portfolio from a potential (likely?) downturn, those would be a good place to start.

[author_ad]