The Amazon (AMZN) effect has decimated countless retailers in recent years. As more and more consumers buy online at Amazon and avoid the malls, shares of Macy’s (M), Nordstrom (JWN), J.C. Penney (JCP), L Brands (LB), Foot Locker (FL), and many other retail stocks have been very publicly crushed. But there’s another, less well known mall-related sector that has also been hurt by Amazon: restaurant stocks. I recently saw first-hand why.

A couple of weeks ago, my wife was out of town, and I was in charge of our kids for a couple of days. After soccer practice one evening, I was too tired to cook dinner and decided to take them out to dinner at Five Guys. This was a nice treat for them, as we rarely eat fast food.

However, as I pulled up to the Five Guys, which was in the middle of a very high-end strip mall, I noticed that it was out of business. And so was the high-end coffee shop next door, and the once-successful taco restaurant. I was shocked!

[text_ad]

My family is fortunate to live in an affluent neighborhood in a thriving city. Unemployment in my area is low, and you can tell by the cars people are driving and the amount of work crews in the neighborhood that my neighbors are spending money. So why are the restaurants struggling in the nearby mall?

As more and more people shop on Amazon, foot traffic in malls has been collapsing, and the restaurants attached to those malls are feeling the pain.

Mall-Related Restaurant Stocks Hit Hardest

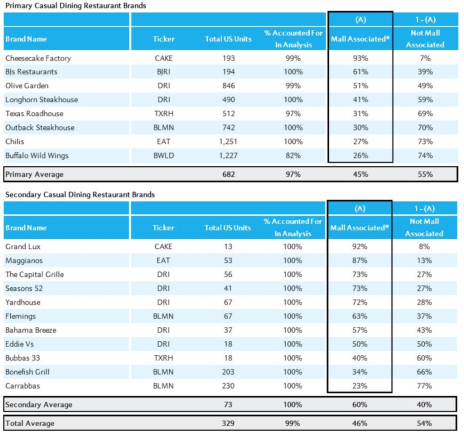

Barclays’ restaurant stock analyst team recently released a research note highlighting the restaurant chains that are most “mall associated” and at risk to weak foot traffic. Here is an excerpt from Barclays’ research highlighting the restaurant stocks at risk:

And here are more details from Barclays:

“Cheesecake Factory (CAKE) operates 90%+ of their stores in a location we define as mall dependent. To be fair, CAKE is often viewed as a destination, with its own separate entrance, and therefore less mall-dependent. And most are in ‘A’ malls which house high-end retailers that draw a more affluent consumer. But the consumer shift to online shopping is less about affluence, and more about a change in behavior.”

As you can see in the Cheesecake Factory (CAKE) chart below, the stock has fallen from 66 to 41 in the last several months.

The charts of all the restaurant stocks listed in the Barclays research note look very similar.

How to Profit from the Decline in Restaurants

If I thought that CAKE was headed for even greater stock declines, as an options trader, I would look to buy a put. A put is a bearish option trade, whose risk is limited to the premium paid.

For example, I might buy the CAKE January 40 Puts for $2.15. The most I can lose if I bought this put is $2.15, or $215 (one put equals 100 shares, so a $2.15 put costs $215).

The limited risk is what makes buying a put such a great tool. If I were to sell short 100 shares of CAKE stock, my upside risk would be unlimited. And if CAKE was taken over or if the stock had already priced in the mall traffic worries, the upside on my short stock is infinite.

With a put, my only risk is that $215.

If CAKE continues to fall before my put expires in January, the put would increase in value by $100 for every $1 CAKE drops below 37.85.

(Here’s the math behind this: The 40 strike allows me to short 100 shares at 40. I paid $2.15 for the put, which makes my breakeven at 37.85. (40 minus 2.15 = 37.85).

In other words, I will make more money the lower the stock goes.

I won’t put all the blame of the struggling restaurants on the Amazon effect. Rising minimum wages is also a likely contributor to the struggles. However, every time you go to your front door, and pick up your new Amazon package, remember that you didn’t visit a mall to purchase that new shirt.

And after not shopping at that mall, you didn’t eat at a restaurant afterwards.

[author_ad]