Inflation, inflation, inflation!

It’s all you hear about these days. And when my contractor, dentist hygienist and local convenience store clerk start a morning conversation talking about inflation in the ‘70s, well, it’s just confirmation that inflation has hit the mainstream.

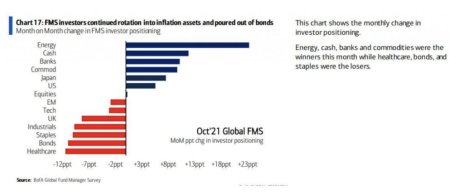

According to a recent survey conducted by the Bank of America, “38% of clients are betting the inflation era is here to stay – a higher conviction than the previous month. Around the world, fund managers keep bidding up banks, leveraged loans and commodities,” as the graphic below (courtesy of Bank of America) shows.

Now, I’m not going to get into the lengthy details on my inflation stance. As an options trader, I fully understand my opinion on the matter means little; it’s more about the strategy I employ that truly allows me to take advantage of a glaring opportunity. So today I’m going to focus on one of several options strategies I’m using to take advantage of a rise in inflation. This inflation options trade is safe, but has the chance to earn you a good profit in a short amount of time.

[text_ad]

Inflation and interest rates typically go hand in hand. And with rates near historic lows and prices on the rise, whether transitory or not, banks should benefit as they can charge higher rates for deposits. And even if interest rates continue to linger near historic lows, in theory, the economy should continue to expand, and banks will continue to benefit from business growth.

Regardless of what happens with inflation, banks should benefit.

So, as a result, I am going to present a trade idea centered around the financial sector using U.S. Bancorp (USB) as my underlying security. Hopefully, the following will not only give you an inflation trade idea to mull over, but also educate you on how to properly use a high-probability approach to trading options. I hope this helps.

My Favorite Inflation Options Trade

A bull put spread, otherwise known as a short put vertical spread, is one of my favorite risk-defined options strategies.

As the name of the strategy implies, a bull put spread is a bullish-leaning strategy. But it is important to note that the strategy doesn’t require the security to move higher to make money. With bull put spreads you not only have the ability to make a return when a security moves higher, you can also make money if the stock stays flat or even if the stock pushes slightly lower.

The first step in placing a bull put spread, or any trade, is making sure the security we are interested in is highly liquid. We always want to use the most efficient products possible. It just doesn’t make sense to have to make 3% to 7%, possibly more, to get back to breakeven.

USB is a highly liquid product, and as a result we can move forward with a potential bull put trade. With USB trading for 62.44 and near all-time highs I want to place a bull put spread with a high probability of success.

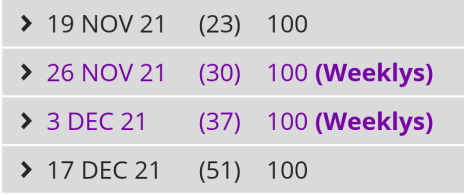

Let’s take a look at the options chain for USB going out 20-60 days until expiration.

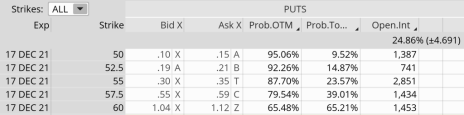

It looks like the December 17, 2021 expiration cycle, with 51 days left until expiration, fits the bill. As a result, let’s take a look at the put strike with approximately a 60% probability OTM (out-of-the-money) or greater, otherwise known as the probability of success on the trade.

It looks like the 60 put strike, with a 65.48% probability of success, is where I want to start. The short put strike defines my probability of success on the trade. It also helps to define my overall premium, or return, on the trade.

Once I’ve chosen my short put strike, in this case the 60 put, I then proceed to look at a 2.5-strike-wide and 5-strike-wide bull put spread to buy.

The spread width of our bull put helps to define our risk on the trade. The smaller the width of the spread, the less capital required. When defining your position size, knowing the overall defined risk per trade is essential. Basically, my spread width and my premium increase as my chosen spread width increases.

For example, let’s take a look at the 2.5-strike, 60/57.5 bull put spread.

The Trade: USB 60/57.5 Bull Put Spread

Simultaneously:

Sell to open USB December 17, 2021 60 put strike

Buy to open USB December 17, 2021 57.5 put strike for a total net credit of roughly $0.50, or $50 per bull put spread

- Probability of Success: 65.48%

- Total net credit: $0.50, or $50 per bull put spread

- Total risk per spread: $2.00, or $200 per bull put spread

- Max Potential Return: 25.00%

As long as USB stays above our 60 strike at expiration in 51 days, I have the potential to make 25% on the trade.

In most cases, I will make slightly less than max profit, as the prudent move (and all research backs this up) is to buy back the bull put spread prior to expiration and lock in some of the potential gains.

Of course, there are a variety of factors to consider with each trade. And we allow the probabilities and time to expiration to lead the way for our decisions. But taking off risk by locking in profits is never a bad decision and by doing so we have the ability to take advantage of other opportunities the market has to offer.

Risk Management

Since we know how much we stand to make and lose prior to order entry we have the ability to precisely define our position size on every trade we place. Position size is the most important factor when managing risk, so by keeping each trade at a reasonable level (I use 1% to 5% per trade) you are able to sleep well at night while simultaneously becoming a far more prepared trader.

After using a proper position size based on my own personal risk-tolerance guidelines, I look to set a mental stop-loss at 1 to 2 times the original credit. Since I brought in a credit of $0.50, I would look to buy it back if losses in my bull put spread reached $1.00 to $1.50.

If you’re looking for an inflation options trade, this USB bull put spread is a safe way to play it and earn a quick profit.

Do you own any inflation-specific stocks at the moment? If so, how have they fared?

[author_ad]