Earnings season has already had a handful of blowups as Netflix (NFLX) fell $160 on earnings, and tech leader Amazon (AMZN) dropped 14% following disappointing results. While I really like the potential of these stocks to bounce back, my experience tells me that I should would wait at least three days before buying these stocks. I call it The Three-Day Rule.

I began my career on the floor of the Chicago Board of Options Exchange in 1999 straight out of college. For a year, I stood next to two options trading legends, soaking up all of their wisdom as their clerk. That year, the market ripped higher as virtually every dot-com stock exploded higher day after day. I learned a great deal during that bull run.

[text_ad]

Here is a picture of a younger me (with more hair) in my trading pit on the CBOE.

Soon after I became a trader myself, and the Nasdaq fell apart. The dot-com bubble burst, and valuations were reset for virtually the entire market. I learned even more during those bearish years than during the bull market years!

One rule that I took away from the bear years—and that I continue to tell subscribers to my Cabot Options Trader and Cabot Options Trader Pro advisories—is about stocks that have taken a big dive.

The old trading rule that was hammered into my brain by my two trading legend mentors was this:

If a stock takes a big fall, whether it’s on earnings or some other news event, you MUST wait at least three trading days before even thinking about putting on a bullish position.

The rationale behind The Three-Day Rule is that if a large hedge fund or institution owns millions of shares of a stock, it won’t be able to sell out of its entire position in a day or two without causing the stock to fall.

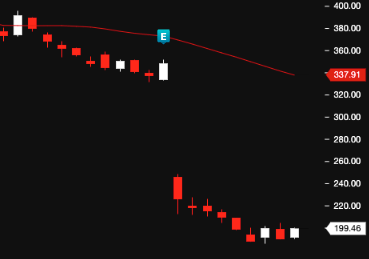

My Netflix (NFLX) Example

Instead, the institution will parcel out its sales over a couple of days, so they don’t depress the stock and can sell at better prices.

For example, let’s take a look at Netflix (NLFX), which fell from 349 to 226 two weeks ago following a disappointing earnings release. That was a staggering fall! The next day, the downgrades came pouring in from the brokerage houses (thanks for the downgrades AFTER the fall, people!).

Based on the three-day trading rule, I wouldn’t have considered adding a bullish position on Wednesday, April 20, Thursday, April 21 or Friday, April 22. But on Monday, April 25, according to the rule, I could begin to think about adding a bullish position.

Here were NFLX’s closing prices on the day of its earnings report and the following days:

April 19 - 349

April 20 - 226

April 21 – 218

April 22 – 215

April 25 – 210

April 26 – 198

April 27 – 188

April 28 – 199

April 29 – 190

May 2 - 200

As you can see, there remained selling pressure on NFLX in the days after the big drop. Then, slowly but surely, the stock stabilized, and buyers began to at least put up a fight.

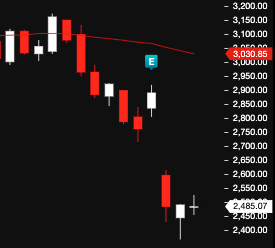

My Amazon (AMZN) Example

Somewhat similarly, though not as ugly as NFLX, here are the prices for AMZN ahead of earnings, and in the days that followed:

April 28 – 2,892

April 29 – 2,485

May 2 – 2,367 (low price of the day)

May 3 – 2,485

As you can see from AMZN, while shares fell dramatically following earnings, the stock hasn’t continued to implode like NFLX, though it also hasn’t surged back to life just yet either.

The Three-Day Rule

I did not buy the dip in NFLX after the three days that the rule mandated because other stocks offered much better opportunities than NFLX. But after that initial decline, and once the sellers have had time to get out of their positions in NFLX or AMZN, if my Unusual Options Screening tool tells me that big traders are stepping in and buying Call options, I could get involved.

Finally, as earnings season continues this week, and we have already seen other earnings disasters such as Teladoc (TDOC), Lyft (LYFT) and many others, there will inevitably be some big drops in stocks you have interest in buying. However, before buying the dip that first day, remember what all experienced floor traders refer to as The Three-Day Rule.

[author_ad]

*This post has been updated from an original version, published in 2016.