If you are like me and a bit hesitant about the longevity of bitcoin and various other cryptocurrencies, now you have the ability to dip your toes in the water without going through all the red tape.

Yes, there have been opportunities in the bitcoin space through periphery stocks, mostly centered around blockchain and the like, but now we have the opportunity to dabble in a pure bitcoin play, through trading bitcoin options.

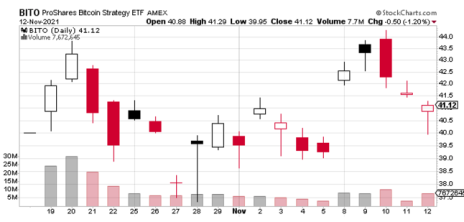

ProShares Bitcoin Strategy ETF (BITO) is the first bitcoin-based ETF offering, with several others due to follow.

Regardless of your stance on cryptocurrencies, we now have the opportunity to use options to create sound trading strategies around the leading cryptocurrency. Who knows – this could be the opportunity doubters have been waiting for since bitcoin hit the headlines several years ago.

[text_ad]

The Strategy

As most of you know, I am a huge proponent of using covered calls.

But today I want to introduce a different strategy, one that has characteristics similar to a covered call strategy but requires far less capital.

A poor man’s covered call strategy is essentially a long call diagonal debit spread that is used to imitate a covered call position, but again, for far less capital.

The strategy doesn’t require buying 100 shares of stock. In fact, no shares are needed. As an alternative to purchasing 100 shares, poor man’s covered calls require purchasing a LEAPS contract.

In most cases, it costs 65% to 85% less to use a poor man’s covered call strategy. The savings in capital required should be reason enough to at least consider using the strategy. And I’m certain after reading this you will indeed find the strategy worthy of adding to your strategy toolbelt.

Like a covered call strategy, a poor man’s covered call is an inherently bullish options strategy. But again, rather than spend an inordinate amount of money to purchase at least 100 shares of stock, you have the ability to buy what is essentially a stock replacement. The replacement? An in-the-money LEAPS call contract.

LEAPS, or long-term equity anticipation securities, are options with at least one year left until they are due to expire. The reason we choose to use LEAPS as our stock replacement is because LEAPS don’t suffer from accelerated time decay like shorter-dated options.

Trading Bitcoin Options with Poor Man’s Covered Calls

Bitcoin ETF (BITO) is currently trading for 41.12 and has an implied volatility (IV) around 90%.

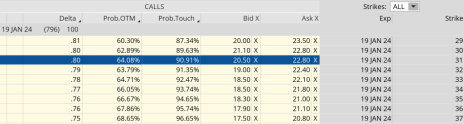

When looking at BITO’s option chain I quickly noticed that the 31 call strike has a delta of 0.80. The 31 call strike price is currently trading for approximately $21.80. Remember, always use a limit order. Never buy an option at the ask price, which in this case is $22.80.

So, rather than spend $4,112 for 100 shares of BITO, we only need to spend $2,180. As a result, we are saving $1,932, or 46.9%. Now we have the ability to use the capital saved to diversify our premium, or income stream, amongst other securities if we so choose.

After we purchase our LEAPS call option at the 31 call strike, we then begin the process of selling calls against our LEAPS.

My preference is to look for an expiration cycle with around 30-60 days left until expiration and then aim for selling a strike with a delta ranging from 0.20 to 0.40, or a probability of success between 60% to 85%. However, with lower-priced stocks we often have to use a delta closer to 0.50 in order to bring in an acceptable level of premium.

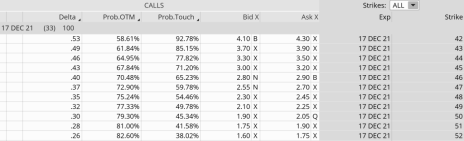

As you can see in the options chain below, the 48 call strike with a delta of 0.35 falls within my preferred range.

We can sell the 48 call option for roughly $2.35.

Our total outlay for the entire position now stands at $1,945 ($2,180 – $235). The premium collected is 10.8% over 33 days.

Poor Man’s Covered Call Example Trade:

- Buy ProShares Bitcoin ETF (BITO) January 19, 2024 31 LEAPS call contract for roughly $21.80

- Sell ProShares Bitcoin ETF (BITO) December 17, 2021 48 calls (33 days until expiration) for $2.35, or $235 per contract

Static or Return on Premium: 10.8% over 33 days

So, as you can see above, all things being equal, we have the potential to make roughly 10% every 30 days selling calls against our LEAPS.

I also want to add that if BITO pushes above 48 we still have the ability to make capital gains on our LEAPS contract, thereby increasing our overall return. Inherently the overall position is long deltas (0.80 – 0.35 = 0.45) so it would take a move that pushed the delta of the short call (0.35) at parity with the long call (0.80). Unlike a covered call the gains are not capped by the short call. The gains are capped when both the long call and short call have a delta that is the same. When this does occur, we simply take the position off, lock in our profits, or buy back the short call and continue to sell more calls. Either way, we are left with a profit.

By trading bitcoin options with poor man’s covered calls, we can make regular profits, with little capital outlay, on one of the hottest assets in the market today.

Do you own any bitcoin? When did you get in on it? Tell us about your experience in the comments below.

[author_ad]