My most successful strategy throughout my two-decade-plus options trading career has been using my unusual options activity scanner to find the next hot stock. Here’s how it works.

The first—and perhaps biggest—challenge of options trading is understanding what an option is.

An option is a contract giving you the right, but not the obligation, to buy or sell a specific security at a specific price over a specific period of time. After that period of time has elapsed (known as “expiration day”), the option ceases to exist.

Call options give you the right to buy the security.

Put options give you the right to sell the security.

There are numerous types of options trades. Depending on which method you choose, options trading can be used to hedge a portfolio, create yield or gain significant market exposure and returns with little capital risk.

And that’s the most important part of the unusual options activity scanner. A call gives the buyer the right to purchase 100 shares of the underlying stock, so if a trader is buying a large number of calls, they’re effectively buying control over an even larger number of shares.

When my proprietary options screener alerts me to a trader buying 10,000 calls and risking many millions of dollars, my alarm bells go off. Who is buying these calls, and why is he taking such a big position? Does he have insider information?

Warren Buffett, Carl Icahn and Bill Ackman are just a few of the many hedge funds and institutions known for using options to build positions.

While straight call purchases are bullish, the trade structure that I find to be the biggest tell of the conviction hedge funds have in a stock is an option trade called a “bull risk reversal.”

[text_ad]

When My Unusual Options Activity Scanner Sees Bull Risk Reversals

Bull risk reversals are a favorite tool for sophisticated hedge funds and are just about the most bullish trade you can execute using options because both components of the trade benefit if the stock heads higher: both the call buy is bullish and the put sale is bullish.

And what makes these trades so profitable (if they work) is that the premium collected via the put sale often pays for the premium paid for the call purchase.

Here’s how bull risk reversals work.

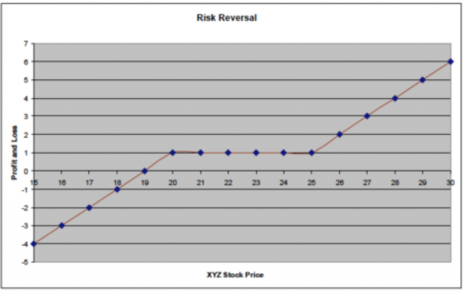

A bull risk reversal is typically used when a rise in the price of the underlying asset is expected. The strategy usually involves the sale of an out-of-the-money put and the purchase of an out-of-the-money call. The trade has unlimited profit potential to the upside and extreme loss potential to the downside.

For example, a June 20/25 bull risk reversal sold for a hypothetical $1 net credit would be:

Sale of June 20 Puts, and...

Buy of June 25 Calls.

If the stock stays between 20 and 25, the trader collects the $1 credit.

If the stock goes to 20 or below, the trader will be forced to buy the stock at 20.

If the stock goes to 25 or above, the trader will exercise his right to buy the stock or simply sell his call for a profit.

Here is a profit and loss graph of this position:

Large call buys or bull risk reversal trades are just the sorts of events that signal that a stock is on the radar of institutional investors, which means we should be paying attention too.

There is great mystery that surrounds options trading. Some investors avoid it altogether because they think it’s too confusing or too risky. But understanding options is easier than you think. And once you get the hang of options trading, the risks can be easily minimized.

If done right, options trading can be simple and—more importantly—lucrative.

[author_ad]

*This post is periodically updated to reflect market conditions.