The way we lived our lives, up until a few months ago, may be a thing of the past. The coronavirus has wreaked havoc around the world, causing us to change to a new reality during the lockdown, and quite possibly forever.

From ordering groceries online to Zoom meetings, the new tech-driven economy has become the way for us to keep ourselves safe while going to work, school and communicating with friends and family. High-tech is delivering most essentials to us, even entertainment, from the comfort of our homes.

Considering all of these recent, extreme changes to our lives, what has most people confused is why the stock market is up 30% since the lows in March. How does that make sense with the economy currently on lockdown; oil trading at negative prices, and with so many people out of work?

Let me explain…

Humans are Hardwired to Resist Change

People are naturally resistant to change - Not you? How would you like to start a new diet? Change your exercise routine? Or have your boss tell you to do something you have been doing for years, a new way?

The fact is: change is an emotional process! The part of the brain, the amygdala, construes change as a threat, and in this process, it releases hormones that instigate fear. Don’t worry, it’s that way for all of us! This is the way the body protects itself against change and why so many people have a challenging time with new processes.

Why am I telling you this? Because the lock-downed economy, spawned by the coronavirus, has expedited everyone’s change process, whether they like it or not.

The Five Segments of Technology Adoption

For most innovations, under normal circumstances, new technology is slowly absorbed into the market. This idea was first made famous by Geoffrey Moore, and his influential bestseller, Crossing the Chasm. Moore argued that not everyone will immediately adopt an innovative approach, despite all its benefits; but instead, each customer will respond differently to innovations.

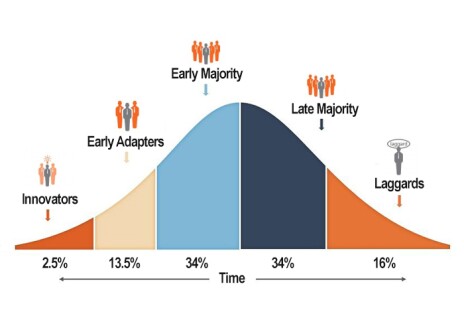

Here’s the technology adoption curve:

Innovators (2.5%): These are the technology enthusiasts who often have an engineering mindset and actively pursue innovations. It’s not uncommon for this group to seek out new ideas before they are officially introduced into the marketplace.

Early Adapters (13.5%): The customers entering the market during this growth stage are those who quickly adopt to innovation. They are eager to buy into new concepts, but unlike the innovators, they are driven by imagination and creativity.

Early Majority (34%): Individuals in this category adopt a new technology based on a strong sense of practicality. Their main concern is what the technology can do for them and carefully weigh the benefits versus the cost, before adapting.

Late Majority (34%): The next wave of growth makes up the final lion’s share of the market potential. The late majority shares most of the concerns as the early majority, the only difference being, early majority users are confident in their ability to adopt new technology, while late majority users are not.

Laggards (16%): Finally, laggards are the last group to adopt new innovations. These are the people who only adopt a new product if it’s absolutely necessary. This group generally doesn’t want to learn or use new technology.

The Coronavirus has Forced Us Across the Chasm at an Expedited Rate

Innovators and early adopters have been using the world’s best technology for some time now, but the rest of the groups have been slow to catch on. However, with the coronavirus wreaking havoc on the world, people who may not have tried new technology for many years, have been forced down the chasm.

The technology trends that were already in motion have been sped up dramatically, giving people little option but to adapt to cutting-edge technology just to get by.

Let’s Try Something New

Even the laggards have already adapted to the comforts of Amazon (AMZN), being able to order nearly anything anyone could ever want, and have it delivered to one’s doorstep in one or two days, has its advantages. But very few people, up until about eight weeks ago, had given Amazon Fresh, Amazon’s food delivery service a try.

Today, the advantages are obvious, not only do we eliminate the risk of coming into contact with the infected, but now we get to say goodbye to parking lots and those long register lines. The early majority and some late majority users have been swept-up, over a very short period, resulting in Amazon running out of many food items quite rapidly.

Innovation Becomes the Norm

With the shelter-in-place order preventing us from leaving our homes, we had to find a new way to work and play. Most people had probably never even heard of Zoom Video Communications (ZM) before the pandemic. Today there’s likely at least one person in every household that is using the platform for work, school or play.

Slack Technologies (WORK) can also be combined with Zoom, or used on its own, to make collaboration easy among colleagues. Slack has always enabled users to get information more efficiently, but now they’re adding users faster than they could have ever imagined; including, adding more teams and more upgraded plans.

The Cloud Gets Bigger

With the coronavirus forcing customers, who may not have adopted the new technology for years now, into it at an exponential rate, there has been an enormous surge in demand for data and storage. Some type of platform has to store all these TV shows, video games, inventory data, and keep tabs on customers and what they’re buying.

This is where big tech comes into play. Since the coronavirus has decimated the economy, Microsoft Azure has seen a boost in sales growth of 59%, Google Cloud reported an increase in revenue of 52%, while Amazon Web Services saw sales growth of 33%. Those are big numbers!

Technology is Flourishing

Whether you’re talking about Fiverr (FVRR), the freelancer marketplace, Chewy (CHWY), the online service for ordering pet supplies, GrubHub (GRUB), the restaurant food delivery service, or one of the other thousand tech companies that make life easier for our new way of life, people are being forced to adapt to new methods. The companies supplying these innovations are rapidly increasing their revenues. It’s no wonder the stock patterns of the tech-heavy NASDAQ composite index have been outpacing the Dow Jones industrial average and S&P 500 index since the March 23 lows.

A new reality is here. Restaurants, airlines, and casinos are getting decimated; however, the innovative technology companies are generating sales they didn’t think were possible for years to come, as late majority and laggards are being forced to adopt new products due to absolute necessity.

Going forward, the markets will continue to reward the technology-driven companies that put the systems in place to ensure the smoothest transition possible during a lockdown economy. With that said, we still need to do our research and make sure we’re buying into companies at the right price and apply the proper investment plan. For those looking to benefit from the new economy, doing your homework, and then applying the appropriate option strategies to the companies positioned to take advantage of the new economy will have its rewards. Nobody knows for sure how long this new way of living will last, so we need to envision what the future looks like, and profit on the companies that’ll take us there.

Chris Douthit, MBA, CSPO, is a former professional trader for Goldman Sachs and the founder of OptionStrategiesInsider.com. As the lead analyst, he has achieved over a 90% success rate with options and teaches others how to attain similar success. Sign up for his free course today!

SIGN UP NOW!