In the week since Russia invaded Ukraine, the daily fluctuations of how the conflict is progressing and how it might impact the rest of the world, America included, has sparked plenty of uncertainty and volatility in the stock market. And while Russia making moves further into Eastern Europe is concerning, historically not panicking, and in fact deciding to buy the invasion, has been the right trading move, as shown below by @thebearablebull on Twitter:

Taking this a step further, historically the market has responded well to major world events as highlighted by @ryandetrick on Twitter, with the most similar event being Russia’s annexation of Crimea in 2014, as seen below:

Now let me be clear: I’m not a Russia expert, and if you asked me to find Ukraine on a map I might struggle. So, take this all with a grain of salt.

However, the market has been a mess since November, mostly tied to worries that the Federal Reserve will hike interest rates aggressively this year. How bad has it been?

[text_ad]

According to LizAnn Sonders, the chief investment strategist at Charles Schwab, year-to-date the average drawdown in the Nasdaq and Russell 2000 is 23%, and taking that a step further, 46% of the Nasdaq components’ drawdown is greater than 50%!

But what if, maybe, the Russia/Ukraine situation forces the Federal Reserve to pump the brakes on aggressive rate hikes?

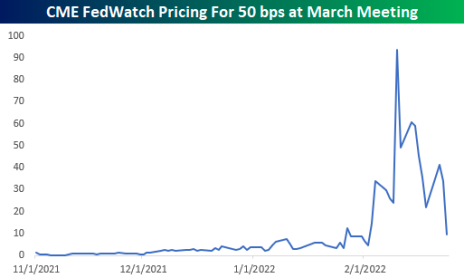

As shared by @bespokeinvest, the odds of a 50bps hike at the March meeting, which had spooked investors, has fallen off a cliff, as seen below:

So, if I wanted to add a bit of risk and bullish exposure to my portfolio, and “buy the invasion,” how might I do that via options?

In terms of buying the S&P 500 ETF (SPY), I might look at this trade, which would give me time for the market to rebound:

Buy to Open the SPY December 430 Calls (exp. 12/16/2022) for $35

The most you can lose on this trade is $3,500 per call purchased if the SPY were to close below 430 on December expiration. However, to the upside you would have unlimited upside exposure.

Similarly, if I wanted to play a bounce in the Nasdaq ETF (QQQ), I might look to:

Buy to Open the QQQ December 340 Call (exp. 12/16/2022) for $35

The most you can lose on this trade is $3,500 per call purchased if the QQQ were to close below 340 on December expiration. However, to the upside you would have unlimited upside exposure.

And taking this a bit further, if you wanted to get bullish exposure to the Russian stock market, via the Russia ETF (RSX), which is down 66% year-to-date (and continuing to plummet), I might:

Buy to Open the RSX January 10 Calls for $3

The most you can lose on this trade is $300 per call purchased if the RSX were to close below 10 on January expiration. However, similar to the SPY and QQQ trades, you would have unlimited upside exposure.

Stepping back, no one truly knows how the market will react to the Russia/Ukraine situation going forward. However, to pay $35 for a call on the SPY or QQQ, or $3 for a RSX call, it’s a decent risk/reward opportunity given the market’s reaction to historical events over the years.

What are your thoughts on the Russia-Ukraine situation? Are you tempted to buy the invasion or do you prefer to wait and see what happens first?

[author_ad]

*This post has been updated from an original version.