If you believed everything you read in the newspapers, or watched on CNBC, you would think the world is on fire and we are again on the precipice of a global economic crisis.

For example, the headlines just last week could have read, “Recession is Imminent! Trade War Will Sink the Global Economy! Yield Curve Inversion! Hong Kong Unrest! Argentina Currency Crisis! Washington, D.C. drama!” Yet even as the worries mount, the S&P 500 is within a couple percent of all-time highs.

Let me be clear: I do worry about some of the issues listed above. How can you not?!! In fact, just last week a couple of economic data points hinted that the U.S. economy is on the verge of a recession.

[text_ad]

That said, my job as a trader is to be aware of the news, but not be consumed by it. As legendary mutual fund manager Peter Lynch once said, “If you spend more than 13 minutes analyzing economic and market forecasts, you’ve wasted 10 minutes.”

And while there have been some market wobbles the last several months, bigger picture the indexes are near all-time highs and many leading stocks are reporting spectacular earnings and breaking out to the upside. So if I wanted to ignore the news headlines, and bet on the market and these growth stocks moving higher, how might I get inexpensive upside exposure?

One way is to buy Call Options on the Nasdaq ETF (QQQ).

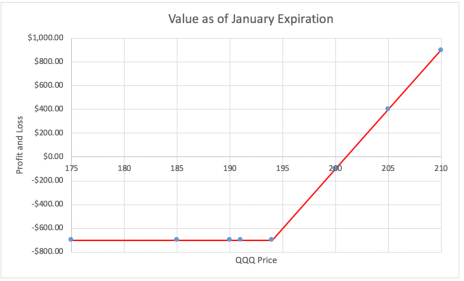

For example, with the QQQ trading at 191, I could Buy to Open the QQQ January 194 Call for $7.

The most I can lose on this trade is $700 per call purchased if the QQQ were to close below 194 on January 17, 2020.

However, this trade has unlimited upside potential, just like a stock purchase, but at a fraction of the cost ($700 vs. $19,100).

Here is the profit and loss graph of this position:

Of course, if you really are worried about all the geopolitical headwinds I listed above and what they might mean for your portfolio, you could hedge by buying puts to protect against a market decline.

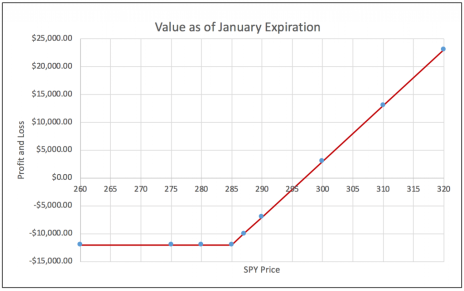

Because I can’t possibly know what you have in your portfolio, I’ll base the strategy on the SPDR S&P 500 ETF (SPY), which corresponds to the price and yield performance of the S&P 500 Index. And for this exercise, I’m going to assume that you own 1,000 shares of SPY, which was trading at 287 as of this writing.

The truest hedge if you owned 1,000 shares of the SPY would be to buy 10 puts against it. If the SPY were to drop below your puts’ strike price, you could simply exercise your puts, and you would be out of your entire stock position. The upside to this strategy is that you do not cap your potential profit if the SPY price continues to rise.

For instance, you could buy 10 of the January 285 puts for $10.

If the SPY were to drop below 285, you would exercise your puts, and you would be taken out of your SPY stock position. However, you have to pay $10, or $10,000, for this insurance. But with the CBOE Volatility Index (VIX) at historically low levels, this insurance is extremely cheap based on historical prices.

This is a profit and loss graph of your put purchase position:

As the graph shows, if the SPY drops below 285, your losses are stopped. However, you still have unlimited upside exposure should the market rally.

Despite the talking heads on TV constantly focusing on the negatives, and social media posts breathlessly forecasting the end of the world, the resiliency of the stock market and leading stocks tells me that while we should be aware of the headlines, now is not the time to panic.

Maybe the market wobbles of the past several months aren’t an early sign of the apocalypse, buy a buying opportunity.

[author_ad]