At their last meeting, the Federal Reserve reduced the Fed Funds rate by 50 basis points. Long-term mortgage rates had already begun declining in anticipation, and today’s average 30-year mortgage rates range from 6.135% to 6.887%, depending on the mortgage program you choose.

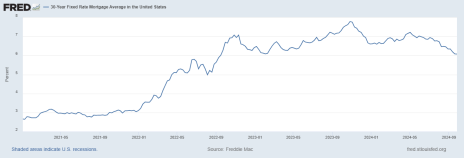

The following graph from the St. Louis Fed shows the arc of mortgage rates since the end of the pandemic. As you know, rates and housing prices rose pretty quickly.

Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MORTGAGE30US, October 3, 2024.

The good news is that rates are finally coming down and housing prices are not rising as quickly.

And with rates declining, the question on many homeowners’ minds is…

[text_ad]

Should I Refinance My Mortgage Now?

There are a few good reasons why you may want to consider refinancing your mortgage:

Lower monthly payment. The general rule of thumb is if your mortgage rate declines by 2% or more, and you plan to stay in your home for a few more years, it makes sense. But even if you can’t quite refinance at a 2% lower rate, it may still be an option for you.

Let’s look at an example:

Mortgage amount: $350,000, 30-year fixed

Interest Rate: 8.04% (the recent high); payment = $2,932

Interest Rate: 6.887%; payment = $2,656 (and if you are able to refi at 6.135%, your payment would be $2,483).

I’m guessing that most of us wouldn’t mind keeping an extra $300-$500 per month!

Reduce the term of your loan. Perhaps you would like to pay your loan off in 15 years, instead of 30. The 15-year rate peaked at 6.25% in fall of 2023. Current rates range from 5.21%-5.44%.

Here are some examples of how your payment could change, using the same mortgage amount ($350,000) we used above:

Mortgage amount: $350,000, 15-year fixed

Interest Rate: 6.25% (the recent high); payment = $3,355

Interest Rate: 5.44%; payment = $3,203 (and if you are able to refi at 5.21%, your payment would be $3,160).

Switching to a fixed-rate loan. Most people who had an adjustable-rate loan probably refinanced a few years ago, but if you still have an ARM, you may want to do the math to decide if now is the right time to trade it in for a fixed-rate option.

Cashing out some of your equity. If you purchased your home before COVID, you may want to take advantage of the housing price escalations of the past couple of years. Especially now that home prices have stabilized somewhat, and most experts do not expect them to decrease anytime soon (unless of course, there would be a recession), you may choose to cash in on some of your equity build-up for a specific purpose or purchase.

Online Tools for Calculating Your Mortgage Payment with Different Interest Rates

There are plenty of online tools that will help you determine if now is the right time for you to refinance. Here are a few of my favorites:

https://www.bankrate.com/mortgages/mortgage-calculator/

https://www.mortgagecalculator.org/

https://www.nerdwallet.com/mortgages/mortgage-calculator

Some Considerations Before You Refinance Your Mortgage

1. Refinancing will cost you, anywhere between 2% to 5% of the amount of the new loan. These costs may include an application, origination, and home appraisal fees. But sometimes, mortgage companies are looking for business, and you may find that they will waive some of these fees. And depending on what percentage of your home value you want to refinance, you may not need a full appraisal, which will save you a few dollars. Most of these fees are also negotiable and usually can be included in your new loan. And some may be waived upon request (or negotiation). Lastly, consider whether you want to pay upfront to buy your interest rate down. If you plan to stay in your home for a while, this may significantly lower your costs in the long term.

Just make sure you take them into consideration when you’re figuring out your new payment amount so that you can determine if a refinance will really save you enough money.

2. Refinancing may take longer than you think. As rates decline further, more and more people will opt to refinance, so the mortgage companies may see a large increase in volume.

3. Boosting your credit score should lower your interest rate. In general, the higher your credit score, the lower your interest rate will be. And that will reduce your payment.

While the Fed appears to be on track to reducing rates, with expectations of two more rate cuts by the end of this year, I don’t anticipate that we will see major reductions in mortgage rates anytime soon. However, economists are predicting that mortgage rates may decline to somewhere between 5.7% and 5.9% by the end of 2025.

It’s up to you—do the math and see if it benefits you to refinance right now or wait a bit. I’ve had mortgages that I have refinanced several times to reduce my payment as rates began declining, so don’t be afraid to take the plunge. You may save enough for a nice vacation!

To stay on top of the latest trends in personal finance, investing, and more, consider subscribing to Cabot Money Club today.

[author_ad]