If you’re financially prepared for retirement (or close), one of the last questions that you may ask yourself is when should you take Social Security.

It’s an important consideration that can affect your income for the rest of your life.

On the one hand, you’ve worked hard all of your life, and now, finally, you’re going to get a reward—your Social Security check!

But as you can see in the table below, the average Social Security benefit (as of December 2024) is not that fabulous and is frequently less than the average rent in the U.S. of $1,640 (as of August 2025).

[text_ad]

The Average Social Security Benefit for Men and Women at Ages 62 - 70

| Age | Average Benefit (Men) | Average Benefit (Women) |

| 62 | $1,485.76 | $1,207.03 |

| 63 | $1,504.97 | $1,233.28 |

| 64 | $1,573.59 | $1,288.65 |

| 65 | $1,784.78 | $1,452.55 |

| 66 | $1,958.41 | $1,580.90 |

| 67 | $2,142.78 | $1,719.20 |

| 68 | $2,197.41 | $1,765.64 |

| 69 | $2,267.09 | $1,816.63 |

| 70 | $2,389.95 | $1,909.42 |

Source: The Social Security Administration.

You can, of course, retire as early as age 62, but if you do so, your Social Security benefits may be permanently reduced by 25% to 30% from the amount you could get at full retirement age.

Alternatively, if you choose to delay your benefits, as you can see in the chart above, you can significantly increase your monthly check.

Each year the maximum benefits increase. For example, if you retire at age 62 this year, your maximum benefit would be $2,831. However, if you retire at your full retirement age this year, your maximum benefit would be $4,018. And if you are age 70 in 2025 and you choose to retire, your maximum benefit would be $5,108.

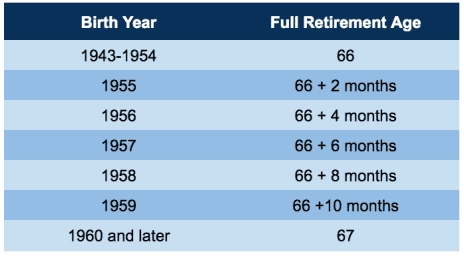

Here’s a chart so you can determine your full retirement age. As you can see, for most folks today, you’re looking at a full retirement age somewhere between 66 and 67. So, at that time, you can collect the maximum benefit for full retirement. However, if you wait until age 70, that benefit increases. For every year that you delay receiving your benefits, your Social Security payments will rise by about 5% to 8%.

Source: socialsecurityintelligence.com

You can go to the Social Security website to get an estimate of your Social Security benefits at early, full retirement, and maximum ages.

As life expectancy continues to increase, you may want to explore delaying your retirement benefits until age 70, so you can maximize your earnings.

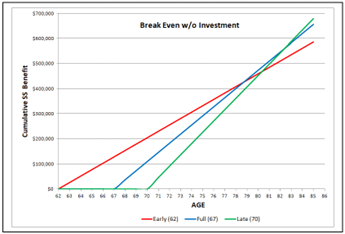

The chart below shows you the approximate break-even point of receiving your benefits early compared to waiting for your maximum benefit.

Source: SeekingAlpha.com

As you can see, if you take your benefits at age 62, you’ll be ahead until about age 79. At that time, you would break even, some 17 years later. If you wait until age 70, your break-even age would be about 82 ½ years of age. After that, your total benefit (over your lifetime) will grow more than if you take your benefit earlier.

You can use this calculator to determine your break-even point.

Ultimately, your decision as to which age you decide to take your Social Security benefits will depend on:

Your life expectancy. You can estimate your life expectancy using this calculator, which takes into account your sex and date of birth.

And you can adjust it based on your family’s longevity history. This site says my life expectancy is 87.6 years, and my Social Security breakeven point is 82 ½ years (by taking my benefits at age 70), that gives me an additional five years to take advantage of my increased benefits. Yahoo!

Your health. Your health issues may encourage you to retire early, or you may need to keep your job in order to make sure you have health insurance (a concern if you retire before Medicare kicks in at age 65).

I have a friend who will be 62 next year, and she would really like to retire at that time. Her husband passed away four years ago, so one-half of her income-producing team is gone. She, fortunately, has a job that offers insurance, and she has enough assets to rely upon (in addition to her expected Social Security check) for her retirement years. But until she turns 65, she feels forced to keep working just to retain her health insurance. Otherwise, she would be paying more than $1,000 a month to buy her own insurance.

Your income needs. You’ll need to consider your current expenses. If you still have a mortgage or dependents, you may need to delay your retirement to a later date.

Whether you will need a part-time job during retirement to supplement your income. If so, you need to be aware that your Social Security benefits may be taxed if you are earning additional income.

For example, for 2025, according to SSA.gov, if you earned between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. And if your income is more than $34,000, up to 85% of your benefits may be taxable.

Of course, there’s no one-size-fits-all answer for when you should start taking Social Security, but an educated assessment of what your needs will look like in retirement (and what your savings look like before that point) is the first step to finally taking the plunge.

This article has been partially excerpted from a previous issue of Cabot Money Club Magazine.

To read the full article and gain access to all of Cabot Money Club’s premium content, subscribe today.

[author_ad]