2021 has seen strong sales for electric vehicles (EVs), both domestically and worldwide. EVs depend heavily on batteries which utilize so-called “battery metals” like lithium, cobalt, manganese and nickel, which means the companies that mine and utilize those metals are in high demand right now. Here we’ll look at some select battery metal stocks (actually one is an exchange-traded note) that have solid intermediate-to-longer-term growth potential.

One of the most widely utilized metals in EV battery production in recent years has been lithium, with nickel-containing batteries taking the top spot in 2020 in the so-called “pure” battery EV market, constituting 65% of the market last year.

[text_ad]

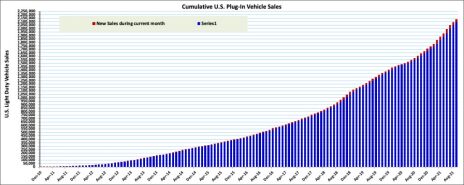

Electric vehicle sales have significantly increased since last year and is being called by some analysts one of today’s biggest growth industries. In the U.S. alone, some 60,850 HEVs (18,877 cars and 41,973 light trucks) were sold in September—up 41% from a year ago—according to U.S. Energy Department statistics. The following chart illustrates the eye-catching rise in demand for plug-in EVs over the last decade. The trend shows no sign of slowing and is expected by industry experts to continue accelerating.

Source: U.S. Energy Dept.

Worldwide EV sales rose 114% in August (the latest date for which stats are available), reaching an 8% share of all autos sold. In top consumer China, EV sales were up 186%, reaching a 19% share, while sales in Europe rose 60%, reaching a 22% share.

In a major boost for the industry, the White House is calling for 50% of U.S. new car sales to be electric by 2030, which has lit a huge fire under the lithium industry in particular. In order to meet this ambitious goal, lithium miners will have to dramatically increase production many times above last year’s average despite limited available supplies.

Year-to-date, lithium prices are up 325% as EV battery demand has persistently increased while supply worries linger. The governments of several major countries, led by the U.S., are making huge bets on the future of the lithium-based battery industry, which has caused the market to boom.

Another key battery metal, nickel, is also benefiting from elevated demand from stainless steel mills and EV battery makers. Indeed, nickel inventories are quickly diminishing thanks in part to China, recently hitting a record low in China warehouses.

Consequently, nickel prices have increased 33% so far this year and are close to a 10-year high. Among factors driving the surge was a report published by The Economic Times of India, which forecast that India’s EV demand for commercial use is likely to increase by 15 times in the next six months.

With these trends in mind, let’s take a look at some leading battery metal producers that stand to benefit from the boom in EV sales in the coming years.

Battery Metal Stock #1: Livent Corp. (LTHM)

Livent Corp. (LTHM) is the largest U.S. lithium-only miner, providing a range of lithium-based products and serving the EV, chemical, aerospace and pharmaceutical industries. Revenue and earnings projections for Livent are strongly optimistic for the next several years, with analysts expecting top-line growth of 34% this year and around 20% next year, while earnings are projected to grow at an even faster pace. Livent isn’t just hanging its hat on EV sales growth, however; it expects that “increased support for electrification from OEMs, governments and consumers” will create substantial long-term lithium demand growth. Longer-term, the company plans to complete its lithium hydroxide addition in North Carolina and a lithium carbonate expansion in Argentina, with commercial production expected by Q3 2022 and Q2 2023, respectively.

Battery Metal Stock #2: iPath Series B Bloomberg Nickel Subindex Total Return ETN (JJN)

The iPath Series B Bloomberg Nickel Subindex Total Return ETN (JJN) seeks to replicate the dominant trend in nickel prices. It basically tracks an index comprised of a single nickel futures contract, beginning with two months left to maturity, then rolling shortly prior to expiration. Keep in mind that this is an exchange-traded note (ETN), not a traditional ETF, and is an unsecured debt note that trades more like a bond than a stock. That said, JJN provides an excellent way to participate in a nickel bull market.

Battery Metal Stock #3: Western Uranium & Vanadium (WSTRF)

Western Uranium & Vanadium (WSTRF) is an indirect play on the future of vanadium ion batteries, which have advantages over lithium batteries, including a lower ignition risk and the ease of sourcing vanadium. Moreover, vanadium batteries are considered to be complementary to lithium batteries and have high energy, performance and safety (though not as compact as lithium batteries). The company is a uranium and vanadium conventional mining company focused on low-cost near-term production of both metals in the western U.S., along with development and the application of kinetic separation. Aside from its uranium and vanadium mining assets, Western Uranium & Vanadium also has other energy-related assets and is expected to begin receiving monthly royalty payments for its Weld County, Colorado oil and gas lease in early 2022. Additionally, Western’s common shares were recently added to the Global X Uranium ETF (URA), as well as to the North Shore Global Uranium Mining Index and the North Shore Global Uranium Mining ETF (URNM). All told, Western is positioned to benefit as global energy demand peaks, from the coming winter rush for its uranium and oil and gas commodity resources, and from rising vanadium demand.

If you want even more ideas for the best performing precious and industrial metals stocks and ETFs right now, please consider subscribing to my Sector Xpress Gold & Metals Advisor, where I regularly provide you with some of the market’s strongest metals and mining stocks/ETFs from both a technical and a fundamental perspective.

[author_ad]