In the last six weeks, precious metals and mining stocks have been on the comeback trail along with the broad equity market. Short-covering activity has unquestionably served as a major catalyst behind the recent gains in the metals, but now that much of those short positions have been covered, it’s time to ask the question many investors have been dreading, namely: “What—if anything—will fuel the next leg of the recovery?”

The reason for the reticence is obvious. While the benchmark S&P 500 index (SPX) has gone on to make a string of higher highs during its recovery rally, recently hitting its highest level since early May, most precious metals stocks and ETFs haven’t kept pace with the SPX.

[text_ad]

Industrial & Precious Metals Market Conditions

One of my favorite ways of tracking the dominant trend in the overall industrial and precious metals market is via the SPDR S&P Metals & Mining ETF (XME). As the following chart shows, while the metals ETF is above its 200-day line (a bullish factor), it hasn’t yet overcome its nearest peak from early June. This means that XME is lagging the SPX on a relative basis—hardly an encouraging sign from a short-term technical standpoint.

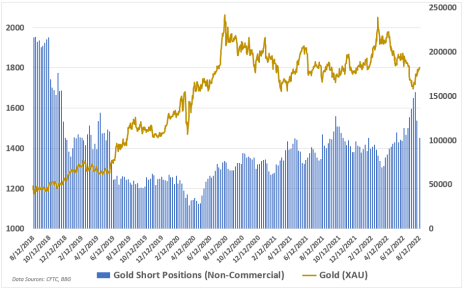

On the gold investing front, the rally that has been underway since July was largely fueled by small-time speculators being forced to cover one of their highest short position levels in years. Indeed, bearish bets against gold by speculators reached the highest level since November 2018 as of late July, according to CFTC Commitments of Traders (COT) data.

Along those lines, DailyFX analyst Thomas Westwater recently observed, “By August 2, as gold prices rose, those short bets fell 23.3%, helping to fuel further gains as traders bought back those borrowed contracts.”

Gold Shorts

More recent COT reports for gold, however, have shown that short positions have fallen to historically normal levels. With the lower level of short positions to serve as fuel for further major rallies, the path for gold prices in the near term looks to be a bit bumpier than what we experienced in the last few weeks.

Meanwhile, ongoing inflationary data should shed more light on whether or not gold will get another major supporting bid from safe-haven buying or from a more accommodative Fed stance toward interest rates (which would improve the opportunity cost of owning non-yielding gold vis-à-vis Treasury bonds).

Elsewhere in Precious Metals

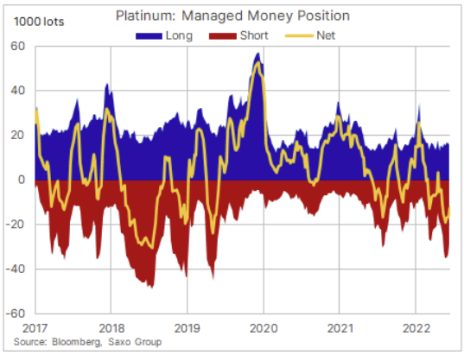

In contrast to gold, however, other precious metals still have the benefit of high short interest levels that can serve to potentially fuel additional gains in the near term. Foremost among the high short interest metals is platinum (see chart below). Recent COT data has revealed that managed money positions in the catalyst metal are above normal levels, while long positions are below normal.

Elsewhere in the metals market, lithium has resumed a leadership position on the back of tightening global supplies and relentless demand for clean energy and battery electric vehicle-related applications. For this reason, I’m moving to add another position in our trading portfolio to take advantage of the strength.

[author_ad]