In many ways, it’s beginning to look like 2008 for gold and other commodities.

That fateful year is remembered by most investors as being a time of frightful economic contraction, crashing equity prices and sky-high oil prices. And while the U.S. isn’t in recession or facing an imminent debt crisis, there are some similarities between those times and today worth discussing.

Similarities Between 2008 and 2022

To begin with, the energy market is experiencing a similar degree of inflation today vis-à-vis 14 years ago. Around this same time, in late January 2008, the price of Brent crude oil was between $85 and $90 a barrel. Today it’s within that same range, hitting $88 a barrel as of January 20. Then, as now, broad commodity price increases (led by fuel price hikes) were a problem for producers and consumers alike.

[text_ad]

Significantly, oil prices had established a sustained rising trend heading into 2008, which ultimate peaked at mid-year at just under $150 a barrel. Today, there’s also a sustained rising trend in oil prices, which one major Wall Street investment bank (JP Morgan) forecasts will hit $125 this year…and possibly as high as $150 in 2023!

As an aside, I would add that it was skyrocketing oil prices that many analysts regarded as the “final straw” in 2008 that triggered the financial market meltdown in the second half of that year.

Then there’s the real estate market which, now as then, has experienced a runaway rising trend that’s beginning to show the early signs of losing steam. According to the latest data from the National Association of Realtors, U.S. home sales fell nearly 5% in December, even as a low supply of houses continues to put upward pressure on prices in most metropolitan markets.

A recent article by TheStreet.com addressed this concern, observing that “rising home prices, relatively easy-to-get mortgages, and consumers who seem unconcerned about prices raise the specter of the 2008 housing market crash.”

Moreover, since December, the average rate for the 30-year fixed mortgage was approximately 60 basis points lower compared to now. And as a CNBC report observed, “Mortgage rates have been rising quickly over the last month, and some expect that to take some of the heat out of home prices going forward.”

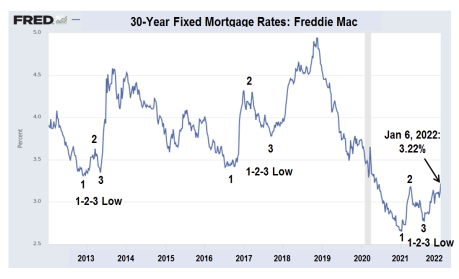

Housing market expert Robert Campbell, editor of The Campbell Real Estate Timing Letter, noted in his January letter that whenever mortgage rates establish what he calls a “1-2-3 reversal,” rates typically move much higher for an extended period. He provided the following graph to illustrate what happened the last two times the 30-year mortgage rate exceeded the nearest peak at point number 2.

Rates are currently around 3.6%—the highest level in two years—and also above the prior “point 2,” which was at 3.2% (from last April). So, if Mr. Campbell’s forecast is correct, this denotes the end of a downward trend for mortgage rates and the start of an upward trend. And this in turn could serve as a significant headwind for future home price increases.

A final similarity between 2008 and 2022 is the equity market outlook. Granted, the U.S. stock market isn’t in anywhere near as bad a shape now as it was back then. But there are some undeniable cracks starting to appear in the market’s edifice. From several weeks of triple-digit new 52-week lows in the Nasdaq, to a formal bear market having just begun for many growth stocks (not to mention the small-cap Russell 2000 index being down almost 20% from its prior peak), to several foreign countries being on the brink of a bear market or recession, investors are clearly worried about the 2022 outlook.

2 Gold ETFs to Buy Now

All of the above-mentioned factors are why gold is poised to begin a longer-term period of outperformance. In the first quarter of 2008, gold prices shot up 20% as the brewing financial storm caused investors to flee risk assets and seek the traditional safety of bullion. And while the gold price did decline along with other assets between July and October of ’08 (when the credit crisis was in full swing), gold was one of the first major assets to turn around and commence a new bull market. One year later, gold was up a very respectable 75% on soaring safety-driven demand.

Between mounting worries over inflation, turmoil in the Ukraine and Middle East and increasing concerns over the equity market outlook, gold has plenty of reasons to attract safety-oriented investors in the coming months. And if 2008 is any guide, the upside potential for the yellow metal is better than it has been in recent years.

Accordingly, safety-minded investors might consider having a conservative position in either physical gold or an actively traded gold ETF — like the iShares Gold Trust (IAU) or the GraniteShares Gold Trust (BAR) — as an “insurance policy” against financial market turbulence and rising inflation in the coming year.

If you want even more ideas for the best-performing precious and industrial metals stocks and ETFs right now, please consider subscribing to my Sector Xpress Gold & Metals Advisor, where I regularly provide you with some of the market’s strongest metals and mining stocks/ETFs from both a technical and a fundamental perspective.

Do you own any gold stocks or ETFs? How have they performed? Tell us about them in the comments below.

[author_ad]