One of the most important indicators to watch when evaluating the macro picture is the price of copper. Indeed, the red metal is a broad, useful commodity to look at to gauge the overall level of manufacturing activity in the global economy—particularly in China. Here we’ll discuss the recent weakness in copper prices and what it likely portends for the global economic outlook, as well as what it means for investors.

Why Copper Prices are Falling

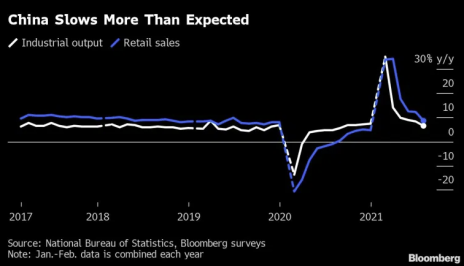

Copper recently fell below the $9,000 a metric ton level, with prices down around 15% from the May peak. One reason for the metal’s underperformance is China, the world’s largest copper consumer. Concerns over China’s growth outlook have been sparked by the news that its economy slowed more than expected in July—fueled by flooding in central China and slowing automobile sales due to the global chip shortage—as the spread of the Delta variant further exacerbate global supply chain disruptions.

The mounting concerns over China’s economic outlook are somewhat reflected by equity prices on the mainland. The Shanghai Composite Index is down over 6% from its February peak, while the iShares China Large-Cap ETF (FXI)—one of my favorite China stock trackers—is down by almost 30% in the last six months.

[text_ad]

Shown here is a comparison of FXI with the copper price (blue line at bottom of graph). As you can see, both the metal and China stocks tend to track each other very closely. There’s no established leadership relationship between the two, though, for sometimes FXI leads copper while at other times copper leads. The important thing to note here is that when both assets are in decline, it suggests that the immediate manufacturing outlook is weak, which doesn’t bode well for copper’s short-term price trend.

What’s more, the slump in copper’s price couldn’t come at a worse time as workers at Chile’s Escondida, the world’s largest copper mine, recently approved a strike after rejecting the final contract offer proposed by mine owner BHP Group (BHP). Other mines that could be affected by the strike include BHP’s Cerro Colorado mine and Codelco’s El Teniente, El Salvador and Hales mines. Collectively, the mines account for over 30% of Chile’s copper production and more than 10% of global copper output.

The strike proposal has created even more uncertainty for the copper mining industry, whose product is in high demand right now on the back of rising infrastructure spending, automotive and electrical/electronic component usage. Metals investors are also concerned by the labor uncertainty, as observers have pointed out.

Bloomberg, for instance, noted that “Worries over global growth amid the pandemic resurgence and reduced stimulus may signal an end to—or at least a pause in—record earnings for copper producers.” Copper workers, however, are more concerned about getting pay raises in the wake of the 140% rally in copper prices from last March until May of this year, feeling neglected after their hard work in keeping operations going during last year’s pandemic.

For some historical perspective, it’s worth noting that Escondida workers staged a 44-day strike in 2017, the longest in the history of Chilean mining. The strike caused $740 million in losses for the company, and while the onset of the strike resulted in a brief rally for copper prices, the rally ultimately failed as prices resumed a downward trend for three months (down 10%) before finally bottoming out and launching a 7-month march higher for a 32% gain.

If history repeats, an extended strike could result in lower copper prices in the short term. However, an extended strike would almost certainly have a salutary effect on intermediate-to-longer-term copper supplies (which are already tight), thus likely paving the way for late-year seasonal strength traditionally seen in the metal.

Additionally, with uncertainty surrounding the upcoming Chile elections and the recent confirmation of Peru’s socialist president Pedro Castillo, Freeport-McMoRan (FCX) and other big producers are putting new copper projects on hold as both countries discuss potential tax increases (including mining tax hikes), while Chile drafts a new constitution. This should also be supportive for red metal prices in the intermediate-term (6-12 months).

What it all Means for Your Portfolio

Now what does all of this mean for equity investors? If you’re a metals or metals stock investor, it means there might be see some additional near-term weakness in the leading copper stocks, including FCX, while the latest developments influencing the copper market mentioned above play out. I think now would be a good time to keep some of your powder dry for when we get a confirmed bottom in the copper price, which should allow us to pick up the shares of some leading producers like FCX, Southern Copper (SCCO) and Teck Resources (TECK) at what are shaping up to be attractive prices.

Sustained weakness in both China’s stock market and the copper price have proven to be fairly reliable leading indicators of future (temporary) weakness in U.S. equities and, in some cases, the U.S. economy. (Most recently, witness the “heads-up” decline in both copper and FXI several weeks prior to last year’s pandemic-driven crash in the U.S.)

Eventually, copper prices will bottom out and will present another excellent buying opportunity for metals traders. And we’re probably not far from a bottom, based on how technically and psychologically “oversold” copper is becoming.

But until the final low is in, equity investors should probably exercise caution by holding off on aggressive stock purchases in China-sensitive sectors while also keep some powder dry due to increased broad market volatility risk.

Do you own any precious metals stocks in your portfolio? Tell us about them in the comments below.

[author_ad]