There’s no denying that 2022 has been a rough year for gold investing. After a promising start to the new year, with gold rising as much as 15% in the first quarter, the yellow metal peaked in March and has spent the last few months in a slump. That said, the million-dollar question is: What will it take for gold to finally turn around?

To answer that question, three basic factors must first be considered: 1) inflation expectations, 2) interest rates and 3) recession risk. (Incidentally, the second and third factors are often so closely related they could almost be combined into one.) Let’s consider each one separately, which will give us an idea of what we can expect from gold for the rest of the year.

[text_ad]

3 Gold Investing Influences

The first consideration is the word on everyone’s lips these days: inflation. With the official U.S. inflation rate currently running at about 8.3% (and by some unofficial measures even higher), many investors are confused as to why gold hasn’t responded more favorably to it. After all, gold’s well-known status as a reliable inflation hedge is one of its biggest attractions, historically.

What’s less known is that it’s not so much the inflation rate as future inflation expectations that drive gold’s price. Markets are forward-looking by nature, and forward-looking investors will naturally gravitate to an investment that will protect them from inflation’s ravages if they see it on the horizon. This market-moving class of investors piled heavily into gold in the spring of 2020 when they realized that the runaway levels of government spending associated with the Covid response would create future inflation.

Gold had another big run toward its all-time high earlier this year when inflation fears reached a peak. But shortly thereafter, forward-looking investors saw that the six-to-12-month inflation outlook would likely be far more benign than the previous two years. This is one explanation for gold’s underperformance since the March top.

Right now, several important measures of inflation are collapsing at historic rates, including the six-month growth rate of the M2 money supply and the U.S. federal budget deficit.

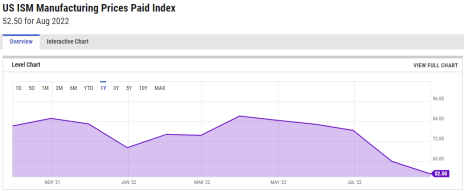

Another sign that inflation has likely peaked was the latest manufacturing survey released by the Institute for Supply Management, which showed that the prices paid index (PPI) has plummeted to levels not seen since the 2020 pandemic. Moreover, the index has fallen 34% in the last five months—the fifth-biggest drop in its 73-year history!

According to market statistician Dean Christians, commodity prices tend to decline in the three-to-six-month period after a significant contraction in the ISM prices paid index, with only the years 1995 and 2006 being exceptions to the rule. With this in mind, it’s little wonder that gold has been under pressure of late.

The second major factor influencing the gold price outlook is interest rates. An environment in which longer-dated U.S. Treasury bond yields and the federal funds interest rate are both rising creates a headwind for gold investing. Rising interest rates mean that non-yielding bullion must compete against assets that are becoming more attractive to yield-oriented investors as rates move higher. And as long as the 10-year Treasury yield index (TNX) continues its upward trend, gold prices will have a hard time turning around.

Not all hope is lost for long-term gold investors, however. Our final consideration for the gold outlook is recession risk which, ironically, tends to increase when interest rates are increasing. This is where gold has the best opportunity to reverse its bear market in the coming months.

In a 2013 report, the U.S. Bureau of Labor Statistics (BLS) acknowledged gold’s tendency to outperform vis-à-vis other major assets during a recession. BLS wrote:

“…gold prices can act as an indicator of the health of the economy. A rise in the price of gold may be a signal that the economy is struggling. As a result, in times of either a crisis or inflation, many investors turn to gold to protect their principal.”

What could cause another recession? One answer was provided by University of Chicago economist Austan Goolsbe, who recently told NPR’s Weekend Edition:

“We’ve had 13 or 14 recessions since World War II, and more than two-thirds of those recessions were caused by the Fed raising the interest rate faster than the economy can handle.”

The Fed/Gold Relationship

If one holds the view that Fed’s continued rate increases are unnecessary—especially given the slowdowns in M2 and the PPI—then the Fed’s aggressive action could weaken the economy to the point of recession. If that happens, gold would almost certainly benefit as Treasury yields would fall, thereby making gold investing more attractive. Moreover, a weaker economy would likely force the Fed to intervene by injecting liquidity into the economy, which would help lower the dollar’s value and thereby increase the gold price (since gold is inversely correlated to the currency).

One of the best indications that the economy is on the brink of recession is the 10-year minus 3-month Treasury yield spread, shown below. Investors should watch this chart closely, for whenever it “inverts” by going negative, a recession has always followed—usually within a few months. (A yield curve inversion implies central bank policy is too restrictive.)

Currently, this indicator is hovering barely above a neutral level of zero. However, if the yield spread falls below zero (as many Fed watchers expect), it will mean it’s time to turn bullish on gold since the metal’s fortunes would almost certainly change for the better in a recessionary environment.

[author_ad]