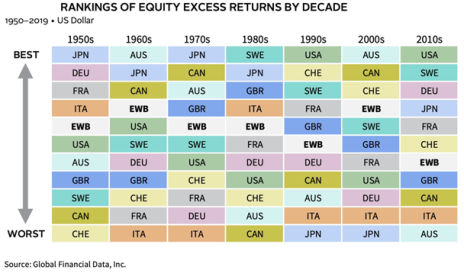

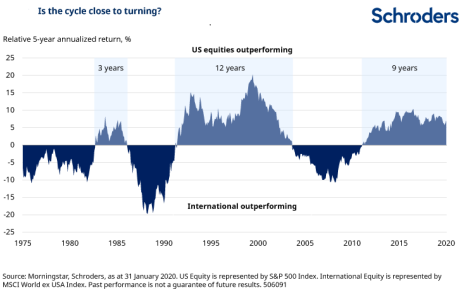

In the last decade, U.S. equity markets have performed incredibly well, outpacing most other global stock markets, as shown in the chart below.

The U.S. could lead the pack again in the decade ahead, but odds are it won’t.

Usually the U.S. goes through periods of ~10 years when it outperforms international markets, and then the cycle turns.

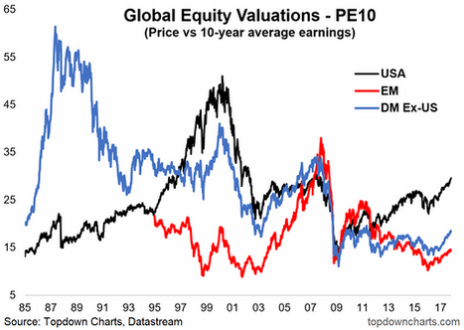

Another factor to consider is valuation. International developed markets and emerging markets look cheap relative to the U.S. on a price-to-earnings basis

While I’m still finding plenty of attractive U.S. micro-cap stocks, I’m finding a ton of good opportunities in Canada.

Today, I will discuss three Canadian stocks to buy. Two will be micro caps and one a large-cap stock.

Let’s start with the large cap.

[text_ad]

Canadian Stock to Buy: Constellation Software (CNSWF)

Constellation Software (CNSWF) is a $26 billion market cap, Ontario-based company that has a cult following.

Want to understand why?

Just take a look at the long-term chart.

Constellation’s business model is to acquire mission critical, high market share, high switching cost, high recurring maintenance fee software platforms across more than 50 industries, typically focused on billing, administrative, and operational systems.

Mark Leonard is the chairman, president, & founder and is an extremely impressive capital allocator. He would likely be featured if William Thorndike ever does another edition of The Outsiders, a book in which eight of the best CEOs of all time are profiled.

While the stock is not dirt cheap, it only trades at 25x free cash flow, which is a bargain considering it has compounded free cash flow at an annual rate of 27% over the past 10 years.

Canadian Stock to Buy: Medexus Pharma (MEDXF)

Medexus Pharma (MEDXF) is a $64 million micro-cap specialty pharma company based in Quebec. Its business model is to acquire and license drugs and therapies that treat auto-immune and pediatric diseases in the U.S. and Canada.

In early 2020, the company made a transformative acquisition of a hemophilia drug called XINITY. Instantly, Medexus was transformed into a very profitable company as it only had to hire a couple individuals in conjunction with the purchase. As a result, its fixed costs were leveraged and margins expanded dramatically.

While the stock has more than doubled since I originally recommended it to my Cabot Micro-Cap Insider subscribers, it is still trading at a dirt cheap valuation: 9x current free cash flow and an EV/Revenue multiple of 1.0x. Pretty cheap for a company that is growing organic sales by more than 20%!

The stock chart looks great, and I think there is significant upside in the months and year ahead.

Canadian Stock to Buy: NamSys (NMYSF)

NamSys (NMYSF) is an $18 million market cap, Ontario-based software-as-a-service company that caters to the cash processing and logistics niche. It has historically grown revenue and earnings at a compound annual growth rate of 20%+. It has a pristine balance sheet with significant cash and no debt, and insiders own over 40% of the company, ensuring high alignment.

Namsys generates revenue from four business lines: Cirreon Smart Safe, Cirreon Banking, Cirreon Cash-in-Transit, and Currency Controller. The vast majority of revenue comes from the U.S. All product lines are software offerings that simplify the management of cash.

Despite strong expected growth going forward, the stock only trades at 19x earnings.

[author_ad]

*This post has been updated from an original version.