Business Insider just released a disturbing chart about U.S. household debt. It doesn’t bode well for the state of our economy. But if you’re an investor, at least there’s a way to profit from it—mortgage insurance stocks. In fact, if you invested in one mortgage insurance stock in particular at any point in the last four and a half years, you’d be sitting on a hefty profit right now.

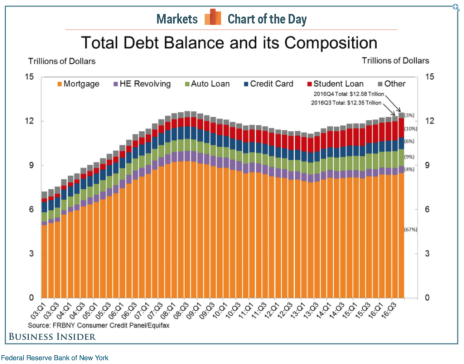

First, to paint the increasingly dire debt picture, here is the Business Insider chart, which came courtesy of the Federal Reserve Bank of New York:

U.S. household debt reached $12.58 trillion in the fourth quarter of 2016, putting it just 0.8% below its Q3 2008 peak. As you can see from the chart, mortgage loans account for about half of that debt, and have been slowly creeping higher since the second quarter of 2013. Fortunately, they’re not skyrocketing the way they were from 2003 until the bottom fell out in 2008, and the quality of those loans is much higher, with 58% of new mortgages approved last year for buyers with credit scores of at least 760, up from 54% in 2015. So, this isn’t the same kind of Wild Wild West-lending that precipitated the subprime mortgage crisis. Student loan debt appears to be the bigger issue.

[text_ad]

But mortgage lending is by far the biggest slice of our debt pie. And with everyone still a little skittish about repeating the sins of the subprime mortgage lending crisis, that puts a premium on mortgage insurance companies. In a nutshell, mortgage insurers protect mortgage investors from credit losses, and makes homeownership more achievable for consumers by offering low down payments. The more loans that are made, the more money mortgage insurance companies make. On the surface, that makes mortgage insurance stocks a good investment right now.

Many mortgage insurers in the U.S. are privately held. The best mortgage insurance stock is one that a friend of mine (and an individual investor, like you) told me about a few years back: MGIC Investment Corporation (MTG). It’s a mortgage insurer with $182 billion primary insurance on roughly one million mortgages in the U.S. and Puerto Rico. He bought shares in early 2013, when the stock was trading at around a dollar. It’s now up to 10, having touched 11 earlier this month. If you were prescient enough to buy MTG back then, you’d be sitting on a return of better than 1,000%.

How has this relatively obscure small-cap stock risen so far, so fast? For starters, sales improved in 2015 and 2016 after years of declines. And after failing to turn a profit for most of its existence, earnings per share have been in the black for three straight years, including $0.86 in EPS last year. Other mortgage insurance stocks like Genworth Financial (GNW), OneMain Holdings (OMF) and NationStar Mortgage Holdings (NSM) have tumbled dramatically in recent years due to either less consistent or nonexistent top- and bottom-line growth. Thus, MTG stands out as the best mortgage insurance stock to buy as a play on escalating mortgage debt.

Even after a 1,000% gain in four years, it’s not too late to add MTG to your portfolio. In fact, it’s still a value stock, trading at less than 10 times forward earnings estimates. Sales and EPS are projected to expand again this year. And the chart looks great.

Since June, the stock has nearly doubled. Its 50-day moving average has been trending upward since September, and the stock hasn’t dipped below that average since a brief pre-election dip in late October and early November. The dip in the last couple of weeks presents an ideal buying opportunity.

My recommendation? Buy MTG with a loose stop below that 50-day moving average.

For more advice on the market’s best performing small-cap stocks, consider taking a subscription to our limited-circulation advisory, Cabot Small-Cap Confidential 2.0. In it, you’ll discover fast-growing stocks that are set to double and triple your investment.

[author_ad]