While large caps have hit a bit of a snag the last couple weeks, small-cap stocks keep rolling along. Historically so, in fact. The Russell 2000 is outperforming the S&P 500 by nearly a 4-to-1 ratio through the first seven weeks of 2021 – the widest gap to start the year in more than two decades.

Why are Russell 2000 stocks outperforming to such a large degree? There are several reasons, according to Tyler Laundon, Cabot small-cap investing expert.

“First, small caps underperformed for a while so there’s some catch-up performance happening,” Tyler says. “But the bigger reasons I think are (1) that small caps were/are viewed as being more economically sensitive, so the path out of recession favors them, and (2) the makeup of the (Russell 2000) small-cap index is much more tilted toward cyclicals than the S&P 500, which has become more tilted toward growth/tech.”

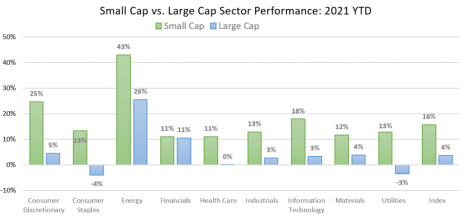

By cyclicals, Tyler is mostly referring to consumer discretionary stocks – airline stocks, restaurant stocks, hotel stocks, etc. In other words, the sectors his hardest by Covid-19 last year. In 2021, the large-cap consumer discretionary sector is up 5%, while small-cap consumer discretionaries are up 25%. It’s the biggest disparity between small and large caps in any of the nine stock market sectors, as the graphic below shows.

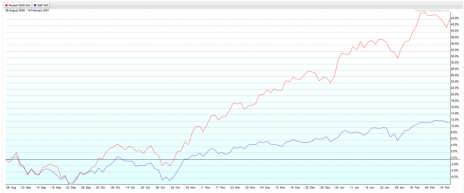

As a whole, Russell 2000 stocks are up 15% year to date, compared to a 4% rise in the S&P 500. The small-cap index has hit new all-time closing highs 10 times already this year. Extending the outperformance back even further, the Russell 2000 has outpaced the S&P by more than 30% in the last six months, as the chart below shows.

Another Reasons Russell 2000 Stocks are Outperforming

Because the vast majority of small companies’ business is done domestically, they’re more tied to the U.S. economy than their large-cap counterparts, whose multinational tentacles are at the mercy of the global economy. So it’s no coincidence that small caps’ run has mostly come since Joe Biden won the presidential election in early November – you can see from the chart that virtually all of their gains in the last six months have come since then (as they have with large caps). Wall Street welcomed the Biden win as being friendly to American small businesses, and the new administration’s bid to push through a $1.9 trillion economic stimulus package has extended that honeymoon phase.

How long might small caps’ honeymoon phase last under the new administration? Difficult to answer. But trends on Wall Street always tend to last longer than anyone expects. And right now the trend in small-cap stocks is decidedly up, but also not as frothy in the long term as the rally in large-cap stocks. For instance, in the two and a half years since stocks first topped in August 2018, large caps are up more than 35%, while small caps haven risen “only” 30%.

Still, the outperformance in 2021 – and really over the last year – is worth the potential short-term downside risk of adding some small caps to your portfolio. If you need help identifying which small-cap stocks to buy, I highly recommend subscribing to Tyler’s Cabot Small-Cap Confidential advisory, where the average return on his 16 current recommendations is 266%.

Now that’s true outperformance!

[author_ad]