The gun industry historically has had significant booms and busts. Currently, the U.S. is experiencing a boom given unprecedented demand for guns and ammo; Smith & Wesson stock is the perfect gun stock to play the boom.

Smith & Wesson (SWBI) is a stalwart name in the firearms industry, delivering firearms and firearm-related products to consumers for over 160 years. The bulk of their revenue is derived from selling long guns and handguns, with additional ancillary revenues coming from their Gemtech Suppressor brand and their Precision Components manufacturing arm. The company does not sell these products directly to consumers, but rather to retailers who eventually sell the products to end users.

Smith & Wesson Stock Follows Predictable Cycle

The last boom occurred leading up to the 2016 U.S. election, when Hillary Clinton was the heavy favorite. Many thought her election would result in increased gun control laws.

[text_ad]

As a result, consumers rushed to their gun stores to stock up on guns and ammo, and Smith & Wesson saw its business and stock price boom.

As we all know, Donald Trump won the 2016 election, and gun sales plummeted. To make matters worse, Smith & Wesson had made several acquisitions in the previously booming market and had taken on debt to do so.

2017, 2018 and 2019 were not kind to Smith & Wesson, as sales declined by 29%, inventory ballooned, and free cash flow declined by 83%.

However, recent events have switched the outlook for the gun and ammo industry from bust to boom in a matter of weeks.

Gun sales started to pick up during the COVID-19 lockdown as individuals feared that law enforcement would not be able to help them or their family in the case of an emergency.

Demand for guns surged even higher following national protests following the killing of George Floyd.

“Almost, you couldn’t even keep up with it. That’s how crazy it was,” said Joe Hawk, owner of Guns & Roses in New Jersey. “After Memorial Day, it spiked again. It just went crazy again.”

One benefit to Smith & Wesson is that its business isn’t necessarily economically sensitive. However, it is closely tied to the economic cycle.

If a Democrat appears likely to win the Presidential election and implement stricter gun control laws in America, consumers rush to buy guns before more regulations come into place. If a Republican is then elected afterwards, much like the result of the 2016 election, sales slow considerably.

Sales ramped higher in both 2012 and 2016. In 2012, President Obama (a Democrat) was re-elected and sales continued to grow. In 2016, President Trump was elected and sales stalled as fewer worried about tighter gun restrictions.

Given that 2020 is a Presidential election year and Joe Biden has a reasonable chance of winning, consumers will likely continue to buy guns leading up to the election.

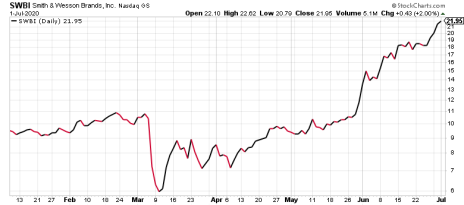

In light of the factors discussed above, SWBI stock has been strong in 2020.

SWBI Still Has Upside

Nonetheless, there still could be significant upside ahead.

First, Smith & Wesson stock, which is a small cap, is trading well below its all-time high of 30.36. Second, the stock’s valuation seems reasonable. It is currently trading at an EV/forward EBITDA multiple of 7.1x and price to forward earnings multiple of 13.7x. While not dirt cheap, this is not prohibitively expensive.

Smith & Wesson stock typically performs well in election years. As such, the stock could be a great trade into the second half of the year.

[author_ad]

*This post has been updated from an original version.