It’s been 10 years since Tesla (TSLA) began manufacturing electric cars, beginning with the Tesla Roadster, which was basically a Lotus “glider” with a battery and motor fitted where the internal combustion engine and transmission would normally be.

Today, the company is the world’s biggest manufacturer of electric vehicles (by revenue), selling the Model S, the Model X and the new Model 3—and there’s a semi truck coming in 2019 as well as an updated Roadster.

But other automotive companies are finally getting serious about electric cars. They’ve seen how well these cars perform—and how much Tesla owners love their cars—and they’re beginning to pour a lot of money into developing electric cars.

[text_ad]

Eventually, some of them may surpass Tesla at its own game—but perhaps not.

And if not, the reasons may include several unique advantages of Tesla that the legacy manufacturers will have trouble matching.

Tesla has no old technology—which means it is unhampered by reluctance to cannibalize existing profitable operations.

Tesla has no old employees—which means all its employees signed up for exactly the challenges they’re facing today.

Tesla has no dealership network—which means its connections to its customers are direct (and there’s no middleman taking a cut of the profits.)

Best of all (in my book), Tesla has one unique advantage that no other manufacturer has been able to duplicate.

Tesla’s Supercharging Network

Over the past five years, Tesla has built a network of 1,139 Supercharging stations around the world, which allow drivers to stop for a quick recharge in the midst of long-distance travel.

All Tesla cars come standard with the ability to use this Supercharger network. Cars ordered before January 15, 2017 get free supercharging for life. Cars ordered after that date get enough electricity to drive roughly 1,000 free miles per year—and pay after that.

Charging at a Supercharger is as easy as plugging in a lamp. Once the plug is inserted, the car talks to the Supercharger and charging starts almost instantly.

Here’s a map of the North American network today, showing the nearly 500 Superchargers (though not showing the seven in Mexico).

Red dots identify operating Superchargers. Orange cones mark sites under construction. And blue dots mark sites that have passed the permitting stage but are not under construction yet. Today, North Dakota is the only state in the lower 48 that has no Superchargers, though by next year, the state could have as many as six. Also empty of Superchargers today are Alaska and Hawaii. (And if you go to the Tesla website, you can see hundreds more dots that have not been permitted—sketching a network that will not only fill in more of the gaps in the U.S. but also stretch across Canada, for example, and into Mexico.

Note: When I drove my Tesla through Iowa, Missouri, Kansas, Oklahoma, Arkansas, Tennessee and Kentucky in 2015, there were no Superchargers on the route, so I had to use slower chargers.

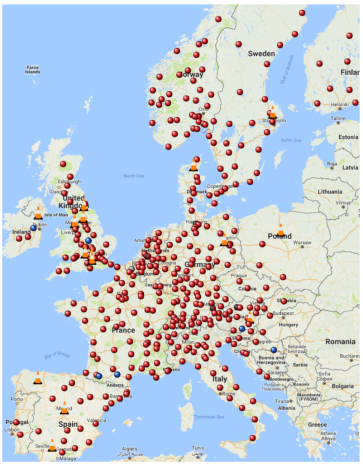

Here’s Europe—though you can’t see the six Superchargers at the top of Norway. (Norway’s tax policy is the most pro-electric car in the world).

As in the U.S., you can see clearly where the customers are found. The first European chargers were installed in Belgium, the Netherlands, Germany and Switzerland, and the network grew from there, radiating out to less prosperous countries like Portugal, Slovakia and Croatia. Eventually Superchargers will cover the continent, extending to Greece, Bulgaria and Romania as well as the Baltic states.

Not shown on this map are the one Supercharging station in Moscow (there are more on the way), four in Jordan and three in the United Arab Emirates.

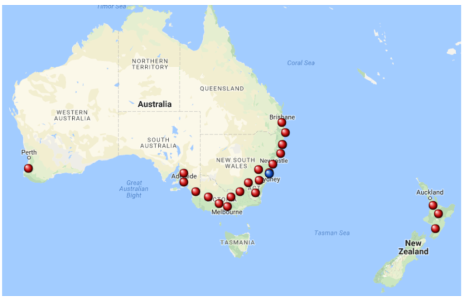

Here’s Australia and New Zealand.

Eventually, you’ll be able to drive across Australia using Superchargers.

Last but not least, here’s China, South Korea and Japan.

I’ve been impressed by the speed of the build-out in China over the past year, and have no doubt it will continue—and that eventually, you’ll be able to drive from Beijing to Paris (a drive first completed by Prince Scipione Borghese in 1907) by recharging at Superchargers all the way!

You can see the source for all these charts here. https://supercharge.info/

But the big question in my mind today is about Tesla’s competitors. Mercedes, BMW, Volkswagen, Ford (F) and General Motors (GM) are all racing to make electric cars now (as are smaller manufacturers and Chinese companies that are not household names).

But none of these companies has a Supercharger network!

Tesla has offered to share its Supercharging network with any of these competitors (for a price) but so far, it has found no takers.

In fact, the only real action has been from Volkswagen (which is working hard to turn over a new leaf after Dieselgate).

Volkswagen’s Charging Network

Volkswagen announced back in April 2017 that it would spend $2 billion over the next 10 years on a U.S. charging network through its new Electrify America open-standard network.

Electrify America installed eight units in the Washington, D.C. area last summer (though they’re not as high-powered as Tesla’s), and eventually they plan to go nationwide, with particularly heavy spending in California.

Electrify America’s Proposed Network

While Tesla’s connection architecture is proprietary (and no other company has chosen to license it), these Electrify America chargers will be compatible with other manufacturers’ standards, and thus be able to serve all electric vehicles—even Teslas—for a price. Volkswagen has already cut a deal with BMW for use of the young network, and it’s very possible that there are more deals on the way.

Blink Network (CCGI)

Outside of the manufacturers, the biggest charging network in the world is operated by Blink Network (previously known as Car Charging Group, Inc). I’ve been a happy customer for years.

Blink has 44,605 charging stations in the U.S., Europe and Australia and it’s also working with Volkswagen and BMW to create a network of faster-charging stations on the East and West coasts of the U.S.

And you can buy the stock—if you dare. Trouble is, the company’s finances have been rather shaky. And its stock has been weak.

To address both conditions, the company effected a 1-for-50 reverse split on August 29, and changed its name from Car Charging Group to Blink. But the decline continued.

Until last week, when the stock suddenly surged higher on big volume, gaining more than 160%!

As I write, there is no news to explain the surge, but I suspect the reason is that fourth-quarter earnings will be rather good—they should be announced soon.

If you like high-risk speculations, you can jump on board here. But if you do, you’re on your own.

If you really like small-cap stocks, a wiser choice would be Tyler Laundon’s Cabot Small-Cap Confidential, which has a diversified portfolio of high-potential stocks with solid finances—and charts that are not at risk of falling back to the ground. As I write, Tyler’s portfolio holds 13 stocks, with an average profit of 39%—and only one small loss. And when you join Tyler’s happy readers, you get updates on what to do every week!

Click here to join.

[author_ad]