It’s been a tough couple of months for investors. Really tough. A 7.5% dip in the Dow Jones Industrial, a 9% retreat in the S&P 500 and a 12% collapse in the Nasdaq is the kind of stock market performance that can make you question why you invest in the first place.

And indeed, all of our analysts are advising sticking to the sidelines at the moment, with Cabot Growth Investor chief analyst Mike Cintolo 90% in cash. At some point, the market will turn around. But things look pretty bleak at the moment.

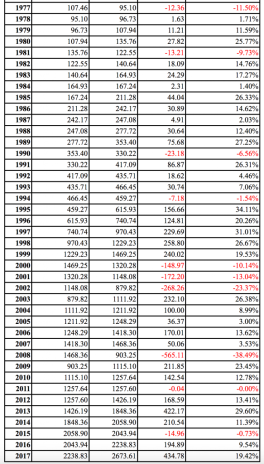

In the very big picture, however, it’s business as usual. As of this writing, the S&P 500 is down about 1% for the year. On the heels of a 9.5% return for large-cap stocks in 2016 and a 19.4% advance in 2017, a stagnant 2018 should have been expected. That’s been the pattern in the stock market for more than 40 years.

[text_ad use_post='129627']

Going back to 1975, only once has the S&P gone longer than three years without hitting the pause button. And the one time it did (1995-1999) was during the dot-com boom, which was quickly followed by a three-year retreat—the only time during the study period that stocks have fallen even two years in a row.

During those 43 years, large-cap stocks have fallen more than 1% in a year only eight times (including the three in a row from 2000 to 2002). However, there have been six other occasions in which they essentially hit the pause button—moving 3% or less in either direction. All but one of those occurrences (in 1978) came after at least two straight “up” years (see table below).

Thus, the 2018 pause is par for the course. Following two straight strong years of stock market performance, chances are it’s a normal consolidation—a chance for share prices and valuations to become more aligned. Granted, the last two months have been way more than consolidation; they’ve been a bona fide stock market crash. Yet, stocks are still down just 1% for the year—with the best month on the calendar for investing still to come.

Who knows what will happen in December? Barring an even deeper collapse or a major rally, both of which I would consider unlikely, 2018 will go down as another pause year for the stock market. You can chalk it up to a variety of factors—Trump turbulence, the trade war with China, rising interest rates, etc. In reality, stocks may have simply been due for a market correction.

And if history is any guide, 2019 will be a much better year for stocks. Think about it: the economy isn’t cratering, it’s thriving, with company profits growing at their fastest rate in years thanks in part to this year’s sizable corporate tax cuts. Unemployment is at a 50-year low. And the reason interest rates are advancing at a fast clip is because the Fed has confidence in America’s economic growth for the first time since the 2008-09 recession.

U.S. companies aren’t struggling. U.S. stocks are.

Don’t expect the poor stock market performance in 2018 to linger into 2019.

[author_ad]